Survey: Android Most Desired OS By Non-iPhone Users

GetJar released data from a “global survey” about mobile apps and user behavior that offers positive news for the Android platform, which reportedly beats the iPhone in terms of “next phone” purchase demand by more than 2 to 1. The survey was sent to 25 million users in 190 countries. However there were only 2,500 […]

GetJar released data from a “global survey” about mobile apps and user behavior that offers positive news for the Android platform, which reportedly beats the iPhone in terms of “next phone” purchase demand by more than 2 to 1. The survey was sent to 25 million users in 190 countries. However there were only 2,500 completed responses across multiple continents.

The big finding is that “a whopping 40% of consumers across our survey suggested their next handset would be an Android phone vs only 17.9% going for iPhone. Less then 9% responded they would stick to what they have and alarmingly, only 8.2% envisioned a Blackberry as their next device.”

These findings clearly show the momentum Android has developed on a global basis. However when more closely examined the results are not as dramatic as the GetJar headline suggests.

According to the companion report released by GetJar, device ownership of respondents was as follows:

- Symbian: 31.7 percent

- Java (feature phones): 23.1 percent

- Android: 18.2 percent

- Other: 27 percent

The “other” category is not broken out. (I created it by implication, only the first three OSs are mentioned.) In “Americas and Europe” Android owners represented 34.9 percent and 31.8 percent of respondents respectively.

There’s no discussion or mention of how many iPhone users were in the sample. Because most iPhone users don’t use GetJar, though it has some iPhone apps, Apple iOS users are effectively not represented in the survey results.

Most of the survey respondents are probably looking to upgrade from low-end Symbian phones or feature phones or are Android loyalists. I would also guess that price is a factor here and Android offers a wide range of increasingly inexpensive smartphone options vs. the iPhone.

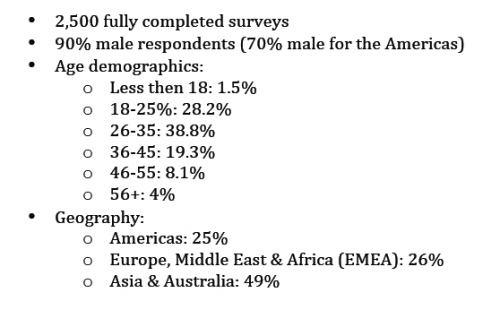

Here’s the geographic and demographic breakdown of the respondent sample:

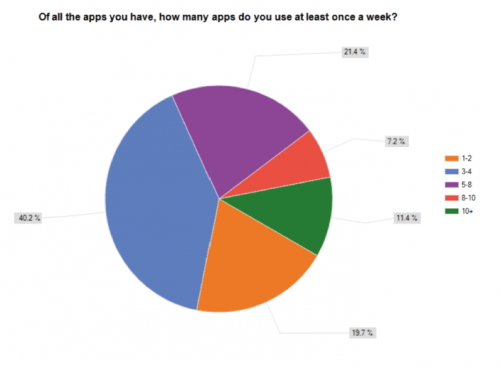

Most survey respondents said they used between 3 and 8 apps at least once a week.

Across all regions respondents “spent nearly 34% of their time using apps for 1 or more hours with the majority (31%) spending 10 – 30 minutes using apps” on a daily basis. By comparison the largest group of respondents (29 percent) said they watched between 1 and 2 hours of TV per day (clearly not the Americans).

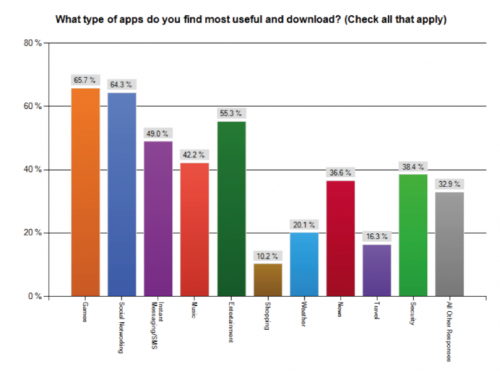

Here’s the breakdown of the most popular apps categories (Games, Social Networking) according to the survey. However there were significant regional differences.

Here’s the US-specific version of the chart:

App usage was somewhat concentrated on the weekends, but still heavy throughout the week according to the survey findings. Evening was the peak time for American app usage, while Europeans were more inclined to use apps late at night.

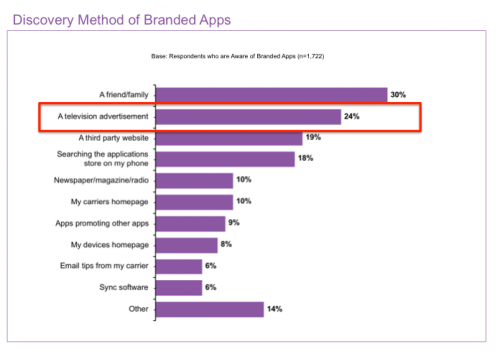

Most app discovery (53 percent) was from “online” vs. other sources (e.g., TV). This stands in marked contrast to Yahoo’s data about app discovery (pictured below):

More findings from the survey:

- 58 percent of respondents use mobile apps more than once a day.

- Almost 80 percent of respondents said “the quality of the brand’s app makes the brand more trustworthy. Furthermore, 72 percent of those surveyed said they were more likely to engage with a brand if they had a good app.”

- 73 percent of respondents said they have downloaded an app with advertising in it, and almost 60 percent said they’d do it again. Almost one in four made a purchase after having clicked on a mobile ad.

- 25 percent discovered the apps they were looking for using actual app stores. Nearly 50 percent had actually discovered apps while browsing online and nearly 17 percent had discovered apps through friends or social media.

The big, “meta” takeaways are the following:

- Android has big momentum globally

- Apps are important and used with increasing frequency

- There are some best practices around app UI/UX and app discovery

- Mobile is a marketing medium that must be addressed by advertisers (or you’re missing a growing audience).

Contributing authors are invited to create content for Search Engine Land and are chosen for their expertise and contribution to the search community. Our contributors work under the oversight of the editorial staff and contributions are checked for quality and relevance to our readers. The opinions they express are their own.

Related stories

New on Search Engine Land