What would it take for new search engines to succeed?

Neeva and You.com seek to pick up segments of users overlooked by Google, and with shifting user preferences and increased governmental scrutiny, there might be an opportunity.

For over half of its 22-year history, Google has been the most prevalent search engine in the United States. Over that term, its perception has gone from quintessential Silicon Valley startup and underdog to the gatekeeper of the internet, presiding over algorithms that have massive business implications and developing a reputation for expanding its business into different sectors in the name of providing a better experience to its users.

More recently, increased scrutiny over its business practices has led government regulators to crack down on perceived improprieties and some users have shown a slight sway towards a more privacy-oriented search experience. Pushback has also come from other search engines, such as DuckDuckGo and Ecosia, which have been vocal critics of how Google is presenting search engine alternatives to Android users in the EU.

The groundswell of resistance to the market leader may create the right circumstances for alternative search engines to assert themselves. Founded by former Google ad boss Sridhar Ramaswamy, Neeva was announced in June, and You.com was announced this month by former Salesforce Chief Scientist Richard Socher. While taking a significant slice of search market share away from Google might be part of their overall goal, and what many marketers would like to see, success as a new search engine is contingent upon many factors and may come in a more modest form.

Regulators want to see more competition in search

Over the last few years, Google has been facing increased scrutiny over alleged anticompetitive practices both in the US and abroad. In 2018, it was penalized €4.3 billion (roughly $5 billion), the largest antitrust fine ever imposed by the European Commission (EC) — that’s on top of the €2.4 billion ($2.7 billion) fine it levied on Google the year before for favoring its own content in search results.

Last year, 48 state attorneys general joined in an antitrust investigation of the company. On the federal level, the Department of Justice filed an antitrust suit against Google in October, alleging that it uses contracts and its market power to neutralize rivals.

If Google is found to have engaged in anticompetitive tactics, the question then turns to remedies. A report issued by the House Judiciary Subcommittee on Antitrust recommended a number of potential remedies, including “structural separation” to restore competition, but Google is projecting confidence and may take the fight to court.

If that happens, it could be two years before an initial judgment, and even then, the company may pursue an appeal. However, with scrutiny over the company’s dominant position coming to a head, potential competitors have been gradually coming out of the thicket and attempting to distinguish themselves from the market leader.

RELATED: Does the Google antitrust case make an Apple search engine more likely?

Can anyone actually go head-to-head with Google?

As Google exists today, creating a search engine that could meaningfully compete with it would necessitate “[Building] a product that shows results at least as relevant, useful, fast, and cognitively low-load as Google themselves, then build a brand that at least tens to hundreds of millions of people rapidly trust and prefer to Google,” according to Rand Fishkin, CEO and co-founder of SparkToro, adding that the latter half is a more realistic possibility due to Google’s “continuing tack away from ‘beloved startup’ and toward ‘evil empire’ over the last ~8 years.”

“To be honest, I don’t see how that will happen,” Eric Enge, principal at Perficient, told Search Engine Land, “Quality of search results has a lot to do with the data you have access to, and [the search engine] with the most data wins — I don’t see how anyone can catch Google in that regard.”

Fishkin shared a similar sentiment: “I don’t think, realistically, anyone can build a search engine close to Google’s quality without their years of data on what people searched for, clicked, and found valuable vs. not (via measuring things like bounces-back-to-the-SERPs, query modifications, regularly choosing result #8 over #1, etc). That’s Google’s real secret sauce — the ace no one can touch. Tragically, I don’t think many folks in search (including these two new companies [Neeva and You.com]) realize how impossible a hurdle that is to overcome.”

While the bar is high, these two potential rivals presumably believe there are areas of opportunity that Google has yet to claim, and have been able to attract investment towards that cause. As of June, 2020, Neeva had already raised $37.5 million and employed 25 individuals, and You.com is being backed by Salesforce CEO Marc Benioff and venture capitalist Jim Breyer. Funding, however, is unlikely to level the playing field — even with Microsoft’s massive resources, Bing has largely been unable to sway users or digital marketers away from Google.

Catching Google does not need to be the goal

Instead of building a search engine that could take Google head on, “the objective could be to build a strong cadre of users interested in building out their ‘own corner of the web,’” Enge said with regards to Neeva, adding that this strategy would not require billions of users to be a successful business.

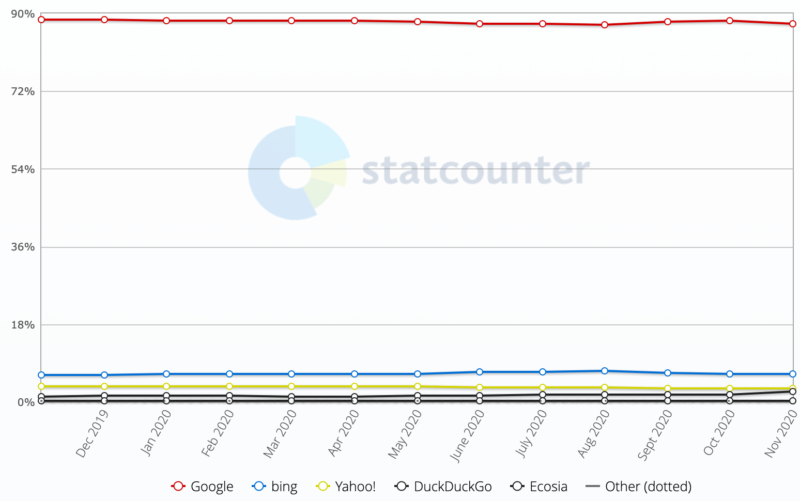

DuckDuckGo employs a similar strategy to differentiate itself from others and appeal to privacy-minded users. In November 2020, the number of queries DuckDuckGo handles per month increased to an all-time high of nearly 2.4 billion. Nevertheless, it still only accounts for 2.3% search market share in the US, compared to Google’s 87.7%.

Neeva’s subscription-based service, which will reportedly cost less than $10 per month when it launches, seeks to deliver a personalized yet ad-free experience. And, it may not have as many technological hurdles to overcome as it will leverage existing content and data sources, including Bing search results, Apple Maps, and weather.com. This may help Neeva save on its development budget coming out of the gate, and if it’s able to attract enough subscribers, the company aims to lower its monthly fee, which may make it a more attractive alternative for new users.

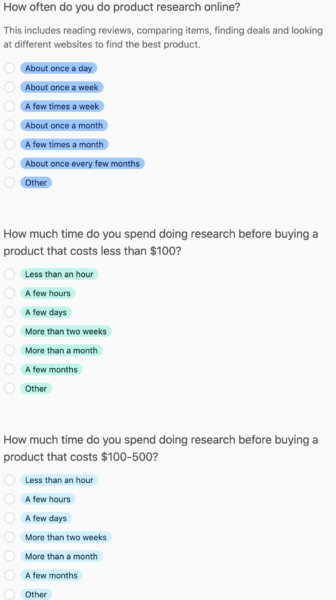

Although exact details haven’t been announced, the You.com website makes multiple references to helping users with their online purchasing decisions. The company’s early access survey also asks numerous questions related to e-commerce.

If You.com wants to be a player in the e-commerce space, it may also have to compete with Amazon. If it decides to challenge Amazon directly, then “the biggest challenges … are scale of operators, especially on the shipping+delivery side, then the two-sided marketplace-building challenge of growing potential customers and stores/sellers, and finally, luring enough investment to withstand the sustained price wars Amazon’s willing to engage in,” Fishkin said.

“So many people are wired to start their shopping with Amazon that it seems highly improbable that anyone will accomplish that,” said Enge, caveating that You.com could still build a strong user base through its differentiating features, such as a custom You.com URL with the user’s name to facilitate sharing.

Distinguishing itself in the e-commerce sector may be a more realistic path, as companies such as Etsy, eBay, Shopify and, to some extent, Google Shopping have been able to carve out their own niches in the space. “A site like You.com, if they do integrate in some level of e-commerce, only need to start producing millions of dollars of revenue to be off to a great start,” Enge reiterated, “While this is still a non-trivial accomplishment, it’s a lot simpler than trying to unseat Amazon.”

What success might look like for new search engines

The long-term viability of potential Google or Amazon competitors will partially depend on their ability to attract an initial audience, which is difficult to forecast at this point since neither Neeva or You.com have released more details or an expected launch date.

“In my opinion, no,” Fishkin said when asked about whether he thinks Neeva or You.com’s differentiating business models and features are enough to attract new users during their launch period. “If I were in their shoes, I’m not sure I’d announce my ‘secret sauce’ way of competing against the tech monopolies until after I launched — so hopefully they’ve got more up their sleeves,” he said.

A component of the “secret sauce” may hinge on identifying users who have needs that Google isn’t currently addressing. “These users will likely still use Google quite a bit, but they might use Neeva or You.com for specific scenarios,” Enge said, “If these companies can maintain this level of focus they could have a chance of success.”

If these companies take traditional venture capital, success may look more familiar: “Becoming a unicorn with $1B+ returned in shareholder value,” Fishkin said, adding, “That could be through an acquisition, of course, but hopefully some of these folks would aim to actually compete long-term against Google.”

The potential impact on Google

The existence of more viable competitors provides marketers and users with more options, but it may also, to some extent, influence Google’s strategy. That may force Google to respond by catering more to the preferences of users and search professionals, which might improve the landscape for everyone.

“Certain specific innovations might spark new innovations, or adoption by, Google,” Enge said, noting that even a large degree of success for potential rivals would still represent small numbers for Google, and that the impact is unlikely to be evident in the near term.

“Google’s never had a real competitor before, but when they had a perceived one (in Facebook), they took some fairly clumsy steps,” Fishkin said, referring to the company’s now-defunct social networking platform Google Plus, “So maybe we could hope that would happen again and give rise to an actual market for search instead of just a monopoly.”

Contributing authors are invited to create content for Search Engine Land and are chosen for their expertise and contribution to the search community. Our contributors work under the oversight of the editorial staff and contributions are checked for quality and relevance to our readers. Search Engine Land is owned by Semrush. Contributor was not asked to make any direct or indirect mentions of Semrush. The opinions they express are their own.