What’s going on with Google brand CPC?

Brands may be at Google’s mercy when it comes to the price of branded traffic, but Columnist Andy Taylor outlines steps they can take to reduce their CPC pain.

In Q1 and Q2 of 2017, Merkle (my employer) reported on a positive trend for advertisers that showed a decline in brand cost per click (CPC) year over year. The CPC of brand terms is often determined by Google’s algorithm as opposed to the competitive landscape, so brands are often left to Google’s mercy in determining the price paid for this traffic.

In Q1 and Q2 of 2017, Merkle (my employer) reported on a positive trend for advertisers that showed a decline in brand cost per click (CPC) year over year. The CPC of brand terms is often determined by Google’s algorithm as opposed to the competitive landscape, so brands are often left to Google’s mercy in determining the price paid for this traffic.

In the case of the mid-2017 decline, it seems advertisers were benefiting from Google’s May ad rank change, which appeared to reduce first-page and top-of-page minimum bids in the search results. However, despite a continued decline in minimum bid estimates, brand CPC rebounded sharply in Q4.

What gives?

Brand CPC up massively in Q4

Looking at the data featured in the Merkle Q4 digital marketing report, we find brand CPC went from a 13 percent year-over-year decline in Q3 to a 23 percent increase in Q4, by far the largest increase of the past seven quarters:

The data shows the decline in cost per click seems to line up chronologically with Google’s May ad rank update, which appeared to send brand first and top-of-page minimum bid estimates down while sending non-brand estimates up.

These trends continued through the end of 2017, with non-brand continuing on an upward trajectory and brand continuing downward:

Non-brand CPC growth continued to accelerate through the end of the year in concert with the increase in minimum bid estimates, so why did brand CPC experience such a sharp reversal? If Google took corrective action to adjust the price paid for brand cost per click, it would not be the first time.

Google’s history of algorithm adjustments as corrections

Travel back with me to the year 2011. At the beginning of the year, advertisers started seeing brand CPCs fall precipitously, finally bottoming out in 2012 around 30 percent to 40 percent lower than the historical average.

Throughout the period of decline, Google released a number of ad extensions, notably Enhanced Sitelinks in February 2012, which gave ads in top positions increased prominence in the search results. These new bells and whistles naturally increased CTR, resulting in better quality assessments for keywords in top positions, particularly brand keywords.

When CPCs started increasing again in the back half of 2012, Google gave advertisers the explanation it was simply a correction for what had been the unintended consequences of rolling out extensions without properly adjusting expected CTR for those ads that feature them.

Could a similar correction be in the works, with Google trying to mitigate the loss in CPC that seemed to accompany its May ad rank change? It’s certainly possible.

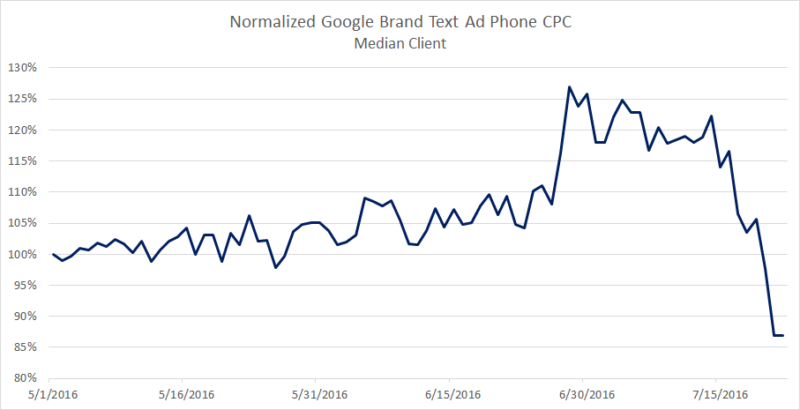

A more recent correction happened in the opposite direction after a June 2016 shift sent phone brand CPC soaring. Within days of a Merkle blog highlighting the increase, phone brand CPCs quickly declined to even lower levels than prior to the increase, as shown here:

Google has at times rolled out changes impacting brand CPC in unintended ways, both upward and downward, and has made moves following those shifts to correct course. It sure seems like the rapid increase in brand CPC during the final quarter of 2017 might have been a similar correction.

Conclusion

In Q4 2017, year-over-year CPC growth accelerated across the board, including brand and non-brand campaigns, shopping, text ads, desktop and mobile. In the case of brand keywords, this marks a significant reversal of the brand CPC declines observed in Q3.

As mentioned at the beginning of this post, brands are largely at the mercy of Google’s algorithm in terms of the price of branded traffic, but advertisers can take some steps toward minimizing the potential for increased cost per click.

Testing reductions in bids for brand keywords to assess the impact on traffic can give a clearer picture how high bids need to be in order to land top spots for most searches. Additionally, taking into account the amount of organic traffic coming from branded keywords at different bid levels can give a fuller picture of how many visits and orders brands might give up at various bid levels.

In the big scheme of things, most brands will continue to pay to ensure ads are featured in position one for as many brand searches as possible. This allows advertisers to control messaging, play defense against competitors and minimize the potential for lost traffic from users looking for brand names.

Will brand CPCs continue to climb alongside non-brand? The first couple of weeks in 2018 seem to indicate it’s likely. However, Google tends to change course frequently, so it’s possible that will happen yet again.

Contributing authors are invited to create content for Search Engine Land and are chosen for their expertise and contribution to the search community. Our contributors work under the oversight of the editorial staff and contributions are checked for quality and relevance to our readers. The opinions they express are their own.

Related stories

New on Search Engine Land