Why Your Mobile & Geo Modifiers For Paid Search Aren’t Getting The Job Done

Columnist Andy Taylor of RKG shares enlightening data on mobile PPC performance by age and location.

Mobile and location bid adjustments are both hugely important functions of Enhanced Campaigns, allowing advertisers to adjust bids for phones and locations at scale within Google campaigns.

However, location and phone impacts on performance are not independent of one another, and dissecting phone performance by geography uncovers some interesting trends for advertisers to consider in their management of these modifiers.

Paid Search Usage By State

The map below depicts the share of paid search traffic coming from phones for each state in the U.S. in Q4 2014, according to Merkle|RKG data. Across all states, phone share of paid traffic stood at 23%, with Mississippi showing the highest share at 29% and Vermont the lowest figure at just 12%.

It’s no coincidence that Mississippi is also the state with the lowest median income, as lower income users are more likely to use phones as their primary device for accessing the internet.

This is at least partially the result of how expensive it is to set up and maintain internet in home, considering the cost of a router, modem, a device with which to access the internet, and the monthly bill for internet service. With many cell phone providers offering free devices upon signing a long-term contract, phones are often the cheapest means for regular internet access.

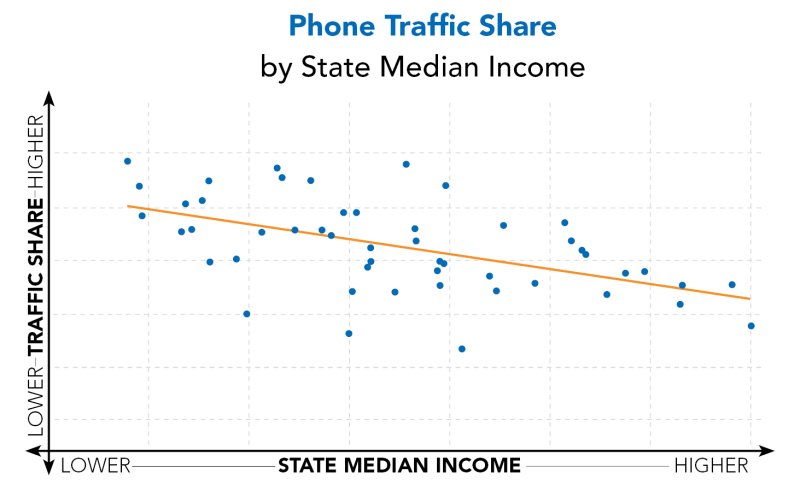

When we plot the share of traffic coming from phones against each state’s median income, we see that a negative correlation between income and phone share of traffic does exist.

However, income isn’t the only factor at play in how much of region’s traffic is coming from phones.

Younger People Use Phones More

Younger generations who grew up with phones capable of browsing the web are much more comfortable using this functionality. The youngest age brackets have both the highest rate of owning a smartphone as well as the highest rate of accessing the internet via phone.

Thus, when we plot out the share of paid search traffic coming from phones against state median age, we see a negative correlation similar to that for income.

Of course, age and income aren’t independent of one another, since younger users also have less earning power. Thus, those adults who are most comfortable using smartphones are also those with the least amount of disposable income with which to pay for alternative methods of accessing the internet.

So what does all this mean for the value of smartphone traffic?

Phone Traffic from Younger, Lower Income Users Worth More, Relatively

Plotting revenue per click (RPC) across all device types against the median income of each state results in a chart that looks about how you might expect – higher income states generally provide a greater revenue per click to advertisers than lower income states.

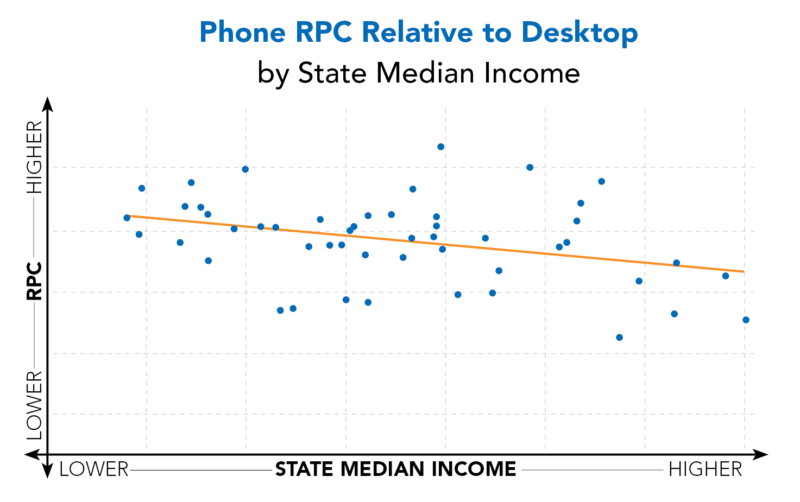

However, when we look at phone revenue per click relative to desktop and tablet, an interesting trend emerges: the gap in value per click is smaller in lower income states.

Plotting relative revenue per click against state age again shows a similar negative correlation.

This makes a lot of sense. Younger, poorer users are less likely to own alternative devices with which to convert, limiting the possibility of cross-device conversions. They’re also less likely to own a vehicle to use for heading to a brick-and-mortar location for offline interactions.

Thus, more of the value that phone traffic provides to advertisers in younger and lower income areas is found in the directly measured revenue per click, whereas older and more affluent regions offer greater possibility of cross-device and in-store interactions.

And again, younger users are more comfortable using phones for internet access, so the prospect of searching and completing orders entirely on a phone is less daunting.

Thus advertisers, especially those whose businesses serve primarily younger or lower income customers, may be able to drive more out of their smartphone traffic in younger and lower income areas.

However, evidence suggests that the difference in value is already having at least some impact on cost-per-click (CPC), even without advertiser action.

Relative CPC Differences Already Exist

As noted in an RKG blog post a few months ago, average cost-per-click is already greater in higher income areas, where overall conversion rate across all device types is greater, without advertiser bid adjustments.

My findings suggested that these differences were not the result of optimizations made by competitors or click-through rate (CTR) differences pulling more advertisers into auctions in higher income areas, and may instead be caused by Google itself impacting the price paid for traffic based on location.

Taking a look a smartphone cost-per-click relative to desktop by state, we see that smartphone clicks are indeed more expensive relative to desktop in lower income states, where the gap in click value is smaller.

As mentioned in my previous post on the topic, it’s not totally clear how Google would be impacting the price paid based on the value of the clicks. It may be a result of the bid floor for placement in promoted positions at the top of the SERP being manipulated based on the expected value of the auction.

However, while phone CPC moves in the same direction as value, this doesn’t result in a uniform return on ad spend across states prior to advertiser bid adjustments. Thus, advertisers do stand to make gains from setting different mobile bid adjustments for different geographies.

But…

The Problem For Advertisers

Advertisers have two levers: one for device and one for geography. The problem is that the data suggests that phone traffic performs relatively well in geographies that perform relatively poorly.

Let’s consider a hypothetical example that illustrates the problem:

- To start, let’s assume that we know that a desktop click is worth $1 to us nationwide for a keyword in a particular ad group, while a phone click is worth $0.50. If that’s all we knew, we would set the Enhanced Campaigns mobile modifier to -50% nationwide and call it a day.

- Digging deeper though, we find that a desktop click is worth $1.50 to us in Virginia, so we would want to add a 50% geographic modifier increase in that state. This would increase our base desktop bid of $1 to $1.50. The mobile modifier of -50% would then set our phone bid at $0.75.

- However, digging deeper still, we find that a phone click from Virginia is not actually 50% less valuable than a desktop click, but rather 75% less valuable. Unfortunately, we cannot set a mobile modifier specifically for Virginia without creating a new campaign specifically targeting Virginia.

In short, the gap between the value of a desktop click and a phone click can vary greatly from location to location, so without the ability to combine geographic and mobile modifiers, advertisers will either have less than ideal mobile bids or they will need to create a convoluted and cumbersome campaign structure.

Conclusion

As RKG co-founder George Michie argued in an SEL column in 2013, sophisticated advertisers would prefer to set bids for combinations of variables, since performance indicators like location and device aren’t always independent of one another.

In the current state of Enhanced Campaigns, however, advertisers will have to decide if the opportunity for greater optimization is significant enough to warrant campaign duplication.

And, of course, keep digging to find areas of opportunity like this one. Broader economic themes impact paid search performance in ways both simple and complex, and it’s up to campaign managers to uncover what the effects and possibilities are for building as successful a program as possible.

Contributing authors are invited to create content for Search Engine Land and are chosen for their expertise and contribution to the search community. Our contributors work under the oversight of the editorial staff and contributions are checked for quality and relevance to our readers. The opinions they express are their own.

Related stories

New on Search Engine Land