Yahoo Q4 Shows Operating Loss; CEO Bartz: ‘This Is Not A Company That Needs To Be Pulled Apart And Left For The Chickens’

Yahoo was widely expected to report lower earnings. But the lower earnings reported beat some financial analysts’ very low expectations. Here are the top-level highlights from the earnings release: Q4 Financial Results Revenues were $1,806 million for the fourth quarter of 2008, a 1 percent decrease compared to $1,832 million for the same period of […]

Greg Sterling on January 27, 2009 at 5:09 pm | Reading time: 4 minutes

Yahoo was widely expected to report lower earnings. But the lower earnings reported beat some financial analysts’ very low expectations. Here are the top-level highlights from the earnings release:

Q4 Financial Results

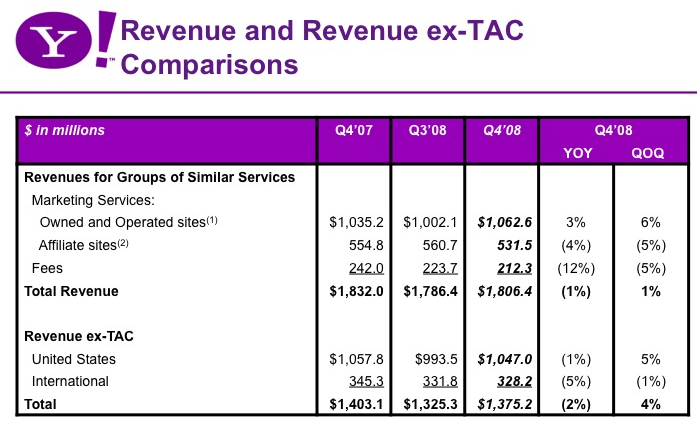

- Revenues were $1,806 million for the fourth quarter of 2008, a 1 percent decrease compared to $1,832 million for the same period of 2007.

- Operating loss for the fourth quarter of 2008 was $278 million compared to operating income of $191 million for the same period of 2007.

- United States segment revenues for the fourth quarter of 2008 were $1,338 million, a 2 percent increase compared to $1,313 million for the same period of 2007.

- International segment revenues for the fourth quarter of 2008 were $468 million, a 10 percent decrease compared to $519 million for the same period of 2007.

Full Year 2008 Financial Results

- Revenues were $7,209 million for 2008, a 3 percent increase compared to $6,969 million for 2007.

- Marketing services revenues were $6,316 million for 2008, a 4 percent increase compared to $6,088 million for 2007.

- Marketing services revenues from Owned and Operated sites were $4,046 million for 2008, a 10 percent increase compared to $3,670 million for 2007.

- Marketing services revenues from Affiliate sites were $2,270 million for 2008, a 6 percent decrease compared to $2,418 million for 2007.

- Fees revenues were $892 million for 2008, a 1 percent increase compared to $881 million for 2007.

- Revenues excluding TAC were $5,399 million for 2008, a 6 percent increase compared to $5,113 million for 2007.

- Operating income for 2008 was $13 million compared to $695 million for 2007.

Here are some slides from the presentation:

Here are notes from the Q&A portion of the call.

CFO Blake Jorgensen:

- Yahoo now has 13,600 employees after the layoffs

- US search market share has “stabilized” according to comScore

- Page views at Yahoo up more than 15 percent in Q4

- Q1 2009 outlook is weak/uncertain. Yahoo has “less visibility” than it did a year ago on the “advertiser pipeline”

- Premium display advertising (class 1) “under pressure;” non-premium (class 2) growing. People moving away from branded advertising in the recession

- With economic uncertainty we will continue to focus on managing costs

CEO Carol Bartz:

- Says “there’s a lot to be excited about.” She reviews and lauds a range of established Yahoo initiatives: YOS, APT, Search innovations like Search Assist and Search Monkey

- Yahoo has the top ranked sites across 11 categories. Users spend more time online at Yahoo than any other site. Inauguration day was biggest Yahoo News day ever.

- I’m excited about the challenge and encouraged by what I’ve seen so far.

- Did I come to Yahoo to sell the company? The Answer is no.

- Am I immediately planning to sell the Search business? I didn’t come here with any preconceived ideas about what to do.

- Search is a very valuable part of our business. Some of the most important search stories at Yahoo are being overlooked.

- Our search share is almost three times the size of the “number three player” (read: Microsoft)

- I’m impressed with the product roadmap for 2009

- Re: “press reports on meeting with Microsoft:” We don’t comment on press reports that “come from nowhere.”

- What I’m most concerned about at Yahoo: This organization is very complex; it’s hard for people to get speedy answers and to make decisions. That’s “fairly easy to fix.”

- Reaching a younger demographic: They do grow up and don’t have all day to throw pictures up on Facebook and chat constantly because they’re “off the dole.”

- Re the Yahoo sales force: I’m very impressed with the sales leaders. The leaders are good. I’m looking forward to having a beer with them; that’s always the best way to get to know them.

- Is everything on the table? It’s my job to create long term shareholder value. Yes, everything’s on the table but this is a fantastic internet property and it doesn’t deserve everyone trying to pick it apart. This is not a company that needs to be pulled apart and left for the chickens. But if there’s something interesting to look at we’ll look at it.

- Re integration of search and display: Search is like a house with different rooms; all of it is part of a complex that allows users to search and us to get money. Some parts of it are easy to break apart and others are not. This is an important asset for the company. It’s important for us to invest in it if we’re going to keep and get the most value for it if we’re going to sell it.

- On the Yahoo brand: Should stand for the best information site on the internet. The problem with some of the many [Yahoo] properties is that they can distract from the core products.

Contributing authors are invited to create content for Search Engine Land and are chosen for their expertise and contribution to the search community. Our contributors work under the oversight of the editorial staff and contributions are checked for quality and relevance to our readers. The opinions they express are their own.

Related stories