Enhanced Campaigns Barely Impact CPCs, But Bing Ads Gains Share In Q2 [RKG Report]

Google AdWords enhanced campaigns have had negligible influence on general Google trends so far, according to RKG’s Q2 Digital Marketing Report. However, Bing Ads continues to draw market share in clicks and ad spend. According to RKG’s tracking, Google AdWords has lost spend share for six straight quarters. RKG saw a 58% increase in spending […]

Google AdWords enhanced campaigns have had negligible influence on general Google trends so far, according to RKG’s Q2 Digital Marketing Report. However, Bing Ads continues to draw market share in clicks and ad spend. According to RKG’s tracking, Google AdWords has lost spend share for six straight quarters.

RKG saw a 58% increase in spending growth YOY on Bing Ads in Q2. CPCs rose 12%, but RKG reports most of the spend increase was driven by 41% click growth. Non-brand activity from Bing Ads rose even more sharply. Spending rose nearly 70 percent YOY as clicks rose 49 percent. Non-brand CPCs rose 14%, and traffic quality improved to keep ROI flat YOY.

RKG saw a 58% increase in spending growth YOY on Bing Ads in Q2. CPCs rose 12%, but RKG reports most of the spend increase was driven by 41% click growth. Non-brand activity from Bing Ads rose even more sharply. Spending rose nearly 70 percent YOY as clicks rose 49 percent. Non-brand CPCs rose 14%, and traffic quality improved to keep ROI flat YOY.

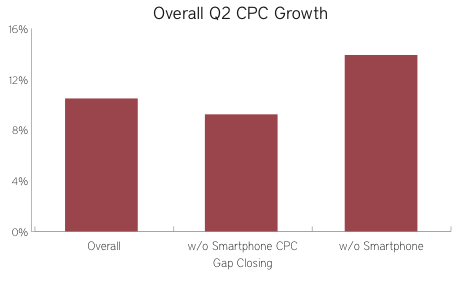

In analyzing enhanced campaigns’ impact on CPC trends, RKG saw the CPC gap between smartphones and computers close at a faster pace in the last two months, but RKG surmises that as advertisers optimize their campaigns, the gap closing could slow again. RKG concludes that rising smartphone CPCs have contributed only slightly to the CPC rise seen over the past few quarters. After removing smartphones from the equation, RKG says, CPCs still would have increased 9 percent, versus 10 percent overall.

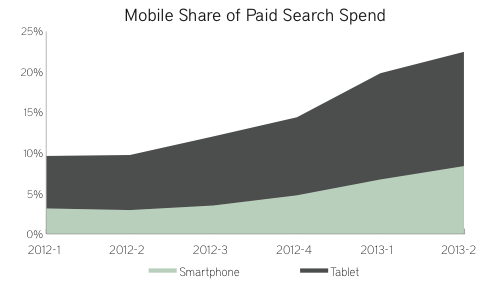

Both ad platforms saw mobile click share grow — mobile click share was 28 percent overall, and accounted for 22 percent of paid search spend.

Yet Google’s mobile share still beats Bing Ads by a wide margin. Google generated 31 percent of paid clicks from tablets and smartphones (up from 27 percent in Q1), while Bing Ads generated just 19 percent of clicks from mobile (up from 16 percent). RKG says its organic data points to a mobile traffic lag on Bing compared to Google and Yahoo.

Overall smartphone spend shot up 261 percent on 178 percent more clicks. Tablet spend rose 165 percent on 115 percent more clicks. Desktop/laptop clicks fell 7 percent, yet spend rose 5 percent YOY due to higher CPCs.

Tablet CPCs surpassed those of desktop by 1 percent. Smartphone CPCs continued to depress the overall market at just 60 percent of desktop/laptop.

Contributing authors are invited to create content for Search Engine Land and are chosen for their expertise and contribution to the search community. Our contributors work under the oversight of the editorial staff and contributions are checked for quality and relevance to our readers. The opinions they express are their own.

Related stories

New on Search Engine Land