Measuring The Offline Value Of Paid Search Clicks During The Holidays & Beyond

Google's "In-Store Transactions" metric is handy for calculating offline conversions attributed to paid clicks, but it doesn't tell the whole story. For paid search marketers tasked with attribution modeling, columnist Andy Taylor takes a look at how various factors can impact offline conversions.

The task of attributing offline orders to online clicks and ad views has long been a challenge for advertisers seeking to measure the full impact of their digital investments, including paid search spend.

While holdout tests can help to give brands an idea of the lift paid ads produce in brick-and-mortar sales and other channels’ performance, such tests can often be expensive to run, and multiple tests may be required in order to acquire significant results you can rely on.

Thus, Google’s in-store conversion tracking is becoming a popular way for advertisers to track in-store purchases to consumers who interacted with a paid search or display ad online.

When Google first officially confirmed they were testing in-store transaction tracking in 2014, we were happy that they cited my company, Merkle|RKG, as a very early tester of the product. Since then, we’ve learned a lot more, and we’ve found that these conversions offer fresh insight for many in determining the true impact of their paid search spend.

However, offline tracking also comes with new challenges to address in order to make the resulting conclusions and optimizations as effective as possible. This is particularly true during the holiday season, when investments and potential sales are both at their highest for many retailers.

Offline Impact Of Paid Search Ads

Taking a look at offline conversion data across the Merkle|RKG advertisers that opted into tracking these purchases, we find that adding offline conversions tracked to online paid search clicks produces a 16 percent lift in total paid search conversions during the peak of the holiday season.

However, that figure only represents directly tracked conversions and was not adjusted to account for the fact that many purchases cannot be associated with a shopper’s online behavior and whether they clicked an ad or not.

To understand, let’s consider how we are able to tie offline orders to online clicks, and the limits of the most common approaches.

Tracked Vs. Untracked Offline Converters

In order to track users from online ad clicks to in-store purchases, you can imagine that Google and others that are attempting to do this would need to be able to make a couple of connections:

- The device used for a paid search click must be tied to an anonymized purchaser profile.

- The in-store purchase must be made using traceable tender, meaning a method of payment which can be tied to the user online. If a user who clicked on a paid search ad uses cash, that purchase would not be tied to the anonymized purchaser profile, and paid search offline tracking would be blind to the order.

From our experience, between about 10 percent and 30 percent of offline orders match both of these criteria.

Assuming the sample of users who are able to be tracked were a good representation of the entire population of users who clicked on paid search ads, this would mean that the offline conversions tracked should be multiplied by a factor between 3.3 and 10 in order to estimate the total number of offline transactions with ties to a paid search click.

However, that’s not necessarily a good assumption, as the users tracked likely share attributes which make their offline value different from those who aren’t able to be tracked.

For example, those users who are able to be tracked from online to offline have likely made purchases online before, in order for it to be possible to tie their purchasing methods to their devices. Users who aren’t tracked are more likely never to have made online purchases, which may make them even more valuable in terms of offline value, as they make their purchases exclusively in stores.

Countless other factors can push and pull the data in this way or that, making extrapolating the offline conversions we can track a more complex process than simply assuming matched customers reflect all customers.

That does not mean that the data is unusable, but rather that advertisers need to be intelligent in their analysis of the offline orders tracked to online clicks and in the optimizations they implement as a result.

This is particularly true during the holiday season, when simply applying 10x multipliers to offline conversions may result in some very large bid increases that don’t necessarily reflect the value driven by paid search ads.

There are also still some very valuable insights to be had, even from the raw data.

Trends Throughout The Holiday Season

As mentioned earlier, across our advertisers we see about a 16 percent overall lift in paid search conversions from adding in offline transactions. However, the magnitude of the lift can vary significantly when comparing in-holiday to out-of-holiday time periods, as well as at a daily level within the holiday shopping season.

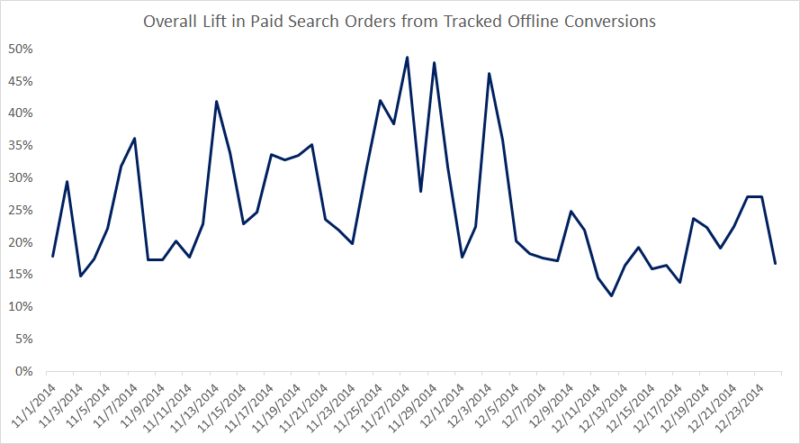

For example, here’s the overall lift for one advertiser from the beginning of November through Christmas Eve.

There are a couple of things to note about this data.

One is that while there is a lot of fluctuation in the percentage lift from day to day, we see a much lower lift following the first week of December.

This trending mirrors official retail sales data from the US Bureau of the Census, which shows that e-commerce sales as a percentage of total sales consistently peak during Q4.

Thus, while sales are up sharply both online and off, the offline lift we’re describing declines in percentage terms.

Another key observation is that the lift picks up in the days just before Christmas relative to the days in the middle of December. This is likely caused by shipping cutoffs forcing shoppers to head to a store in order to make sure they will have their gifts for Christmas Day and/or to avoid paying pricier last-minute expedited shipping costs.

These shifts in the offline impact can have big implications for paid search bidding optimizations and should be studied before and during the holiday season to produce the best results.

But of course, looking at offline conversions in aggregate doesn’t tell us the whole story.

Brand Vs. Non-Brand Impact

Some of those offline conversions are driven by branded keywords, which primarily capture demand created by marketing channels other than paid search. Since all of the advertisers we studied have brick-and-mortar stores across the country, we would expect some of that brand traffic to be the product of users searching specifically for store locations.

Looking at brand campaigns vs non-brand campaigns, we find offline conversions produce a 19 percent lift in paid search orders for brand keywords and a 12 percent lift for non-brand.

This isn’t quite as big a difference as some might expect, but SERP features such as the local pack, which provides store locations along with a map directly on the results page, may keep searchers from clicking through to a site if they are indeed searching for a brand name just to find nearby locations.

Non-brand searches are less likely to produce local packs unless there is local intent in the query, such as including “near me.”

Differences in the relative volume of offline to online orders can also exist between other segments of keywords. For example, if a brand sells mattresses and bedding, keywords for mattresses likely produce a much greater number of offline conversions for every online conversion than do keywords for duvets, which are more easily and readily purchased online.

Offline Impact By Device Type

The common wisdom is that mobile users are more likely to be drawn to a brick-and-mortar store by their search, because they are more likely to be “on-the-go” at the time of their query.

We do see this for some advertisers in the offline conversion data. For example, during last year’s holiday season, one retailer saw a 19 percent lift in conversions for desktop computers when adding in tracked offline conversions but a 32 percent lift for phones.

However, another retailer saw a 23 percent lift on desktop but a 20 percent lift on phones during the same time period.

The lower lift on phones for the second advertiser is likely a result of the match rate of users to their offline purchases being lower on mobile devices, as users are generally less likely to have made a purchase on their mobile devices.

Since part of this type of tracking process requires that the device on which a user clicks an ad be tied to a purchasing method for the user, this means mobile ad clicks are less likely to be tied to users who might head into a store.

Thus, while the raw numbers can help craft some of the story, the issue of tracked vs. untracked users still flares up in different ways for different advertisers.

Conclusion

If you have a brick-and-mortar presence and aren’t already tracking offline conversions through Google’s system, you should ask your reps about getting into the program. These conversions can give you valuable insights into the offline impact of your online ads and help to shape your holiday bidding optimizations.

However, it’s important to understand the current limitations of this tracking in order to make informed optimizations. Aside from extrapolations, there is also the question of what share of offline conversions tied to paid search clicks are actually incrementally driven by those paid search clicks.

For example, if a customer with a loyalty or credit card through a particular brand clicks on a non-brand paid search ad for that brand and later purchases something in-store, did the paid ad really drive that purchase? Or was it a happenstance touch for a customer who already had an offline relationship with the brand?

These are tough questions that require critical thinking and analysis to answer.

While digital is growing fast, the fact that only 7.6 percent of retail sales occurred online during the 2014 holiday season shows how important other channels remain.

Marketers should take advantage of any methods that allow advertisers to understand the digital spillover to those other channels, such as Google’s offline conversion tracking, in order to better inform online advertising investment.

Contributing authors are invited to create content for Search Engine Land and are chosen for their expertise and contribution to the search community. Our contributors work under the oversight of the editorial staff and contributions are checked for quality and relevance to our readers. The opinions they express are their own.

Related stories

New on Search Engine Land