Study: Year-Over-Year, Search Spend Rose 17% In Q1

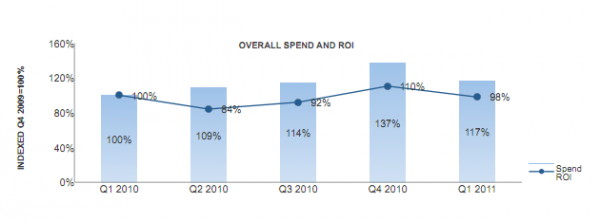

U.S. search spending was up 17% in the first quarter of 2011 as compared to the same period in 2010, according to analysis of client activity by search marketing agency Efficient Frontier. The agency attributes the growth primarily to a strong quarter in the retail and finance sectors. Click volume and impressions were up year-over-year, […]

U.S. search spending was up 17% in the first quarter of 2011 as compared to the same period in 2010, according to analysis of client activity by search marketing agency Efficient Frontier. The agency attributes the growth primarily to a strong quarter in the retail and finance sectors.

Click volume and impressions were up year-over-year, according to Efficient Frontier’s analysis, but return-on-investment remained steady.

The retail sector saw an especially robust quarter, as impressions in the category grew by 30% year-over-year, showing a higher consumer interest, perhaps fueled by an increase in optimism about the economy. Search marketers took advantage of the interest, spending 22% more in Q1 than it did during the same quarter in 2010.

In the financial sector, impression volume remained steady — the same number of searches occurred for financial products in Q1 as in the previous year — but click-through volume increased 22% year-over-year. This would seem to indicate that more people were actually shopping for products this year, rather than simply seeking information.

Automotive also saw an increase in spend (18%) on increased cost-per-click and consumer demand. The travel sector was the only one measured by Efficient Frontier saw spend decrease year-over-year — it went down 13% and cost-per-click was flat.

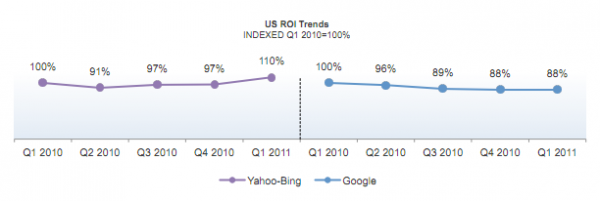

Interestingly, the agency’s research found that return-on-investment (ROI) on Bing is currently 12% higher than on Google. Bing’s ROI has increased 10% year-over-year, while Google’s has decreased 12%. Though revenue-per-click is higher on Google, cost-per-click is also significantly higher on Google, making Bing a good deal for advertisers. Still, Google continues to have the dominant market share position in SEM spend and clicks. Efficient Frontier predicts that the Bing-Yahoo! ROI will drop when the distribution network is expanded.

Both the United Kingdom and Japan saw increases in search spend in Q1 year-over-year. In the UK, spend rose 9%, while in Japan, spend grew 13%. The majority of the period measured occurred prior to the earthquake and tsunami disasters in Japan in March.

Efficient Frontier expects search engine marketing to continue to grow in the U.S. — 15% for the full year 2011 as compared to 2010. In the UK, the company expects to see 10% growth for the year.

Related stories

New on Search Engine Land