The 4 Cs Driving Mobile Search, Shopping & Buying

Mobile is driving the evolution of shopping behaviors. Contributor John Cosley explores how marketers can meet consumer needs and win customers.

According to comScore, smartphone penetration has reached 72% of mobile market penetration.

Mobile devices have become an inseparable part of our everyday shopping lives — whether looking at reviews, checking a price or better understanding product features.

Like a snowball rolling down a hill, mobile commerce (m-commerce) will only gain momentum, both through device adoption and the services that retailers and technology makers put behind m-commerce.

At Bing Ads, we see the evolution to m-commerce balancing on four key elements:

- Control. Mobile gives users more control over what they buy, the price they pay and where they buy it.

- Convenience. Consumers use smartphones to conduct shopping-related activities in the comfort of their homes, at work and everywhere in between.

- Conversion. 70% of Bing mobile users convert within five hours of their mobile search. PC users take weeks to convert. (Based on Bing internal data. Conversions include calls, store visits and purchases across screens.)

- Commerce. eMarketer projects that mobile will make up 19% of retail e-commerce sales in 2014 — and it is expected to grow as we see more innovations and maturity around mobile payments.

Let’s dive into each of these a little deeper to understand how it’s driving the new mobile shopper.

1. Control

According to Nielsen’s Digital Consumer study, more than 4 in 5 smartphone and tablet owners are using a mobile device for shopping activities. Twenty-six percent of smartphone users plus thirty-five percent of tablet users do more shopping because of mobile devices.

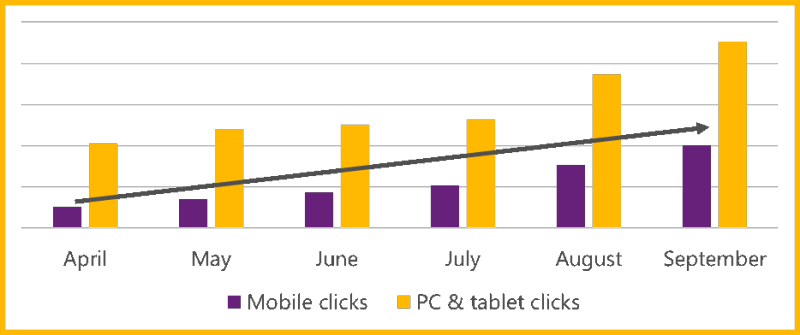

Across the Yahoo-Bing Network, we’ve seen similar trends in mobile user engagement. For example, for clothing and shoes (a sub vertical within retail), impressions and clicks on smartphones are growing at a faster pace than on other devices.

Exhibit 1, Clothing and Shoes in Retail, Yahoo Bing Network mobile impressions, Apr – Sept 2014

Mobile clicks for clothing and shoes accounted for 31% of total clicks across all devices, growing from 20% since April. For additional insights on other retail sub verticals, visit our Mobile Retail Narrative on Slideshare.

Exhibit 2, Clothing and Shoes in Retail, Yahoo Bing Network clicks, Apr – Sept 2014

2. Convenience

Consumers use smartphones to conduct a variety of shopping activities such as researching before purchase, finding store locations and checking a price while in store.

When asked, “Where are you located when you use a smartphone to access shopping-elated information?,” 84% of consumers said At Home, 51% In Store, and 36% said Getting Somewhere.

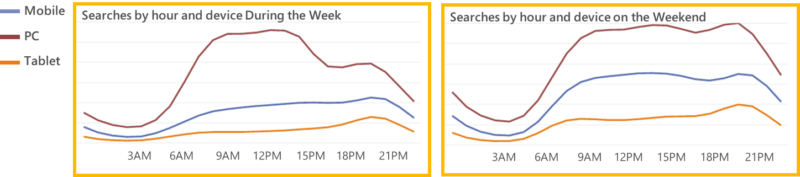

Our research into the timing of device use for retail-minded consumers shows that convenience drives device use.

As consumers leave work during the week, their search behavior shifts to mobile devices peaking around 8:00 p.m.. Query volume remains high throughout the day on weekends, also peaking around 8:00 p.m.

As a result, we encourage advertisers to optimize mobile budget for after work-hours during the week to maximize reach, and spread budget more evenly on the weekends.

Exhibit 3, Yahoo and Bing Network, June 2013 – June 2014

3. Conversion

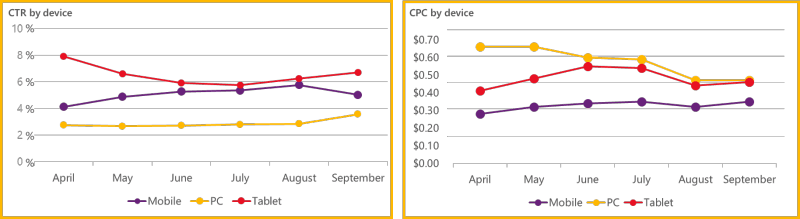

Continuing with the earlier example on Clothing and Shoes, Exhibit 3 shows that click-through rate (CTR) on smartphones is comparable if not higher than other devices, yet the cost-per-click (CPC) is 40-50% less compared to PCs and tablets.

Mobile CPC is on the rise because many advertisers are starting to understand the value of mobile and have opted in, but the cost-saving is still there.

Exhibit 4, Clothing and Shoes in Retail, Yahoo Bing Network CTR and CPC, Apr – Sept 2014

Advertisers say they use basket transactions to measure mobile PPC success, and we think it’s time for a huge shift in thinking about mobile conversion measurement. This is because mobile conversions don’t usually happen within the mobile phone – they happen in a store or restaurant or via phone call.

Because mobile search is oftentimes local search, people find what they’re looking for and go to their destination to spend money. Offline attribution is in its infancy, but advertisers can still track mobile ad effectiveness with discount codes tracked to specific ads, and with call tracking.

4. Commerce

Is your site mobile-optimized? A recent Forrester survey with 70 large to medium size retailers pointed out that mobile was the top priority for retailers in 2014.

Website redesign to optimize for small screens was among the top investments. It’s been proven that mobile-optimized retail sites drive higher conversion, and we see it every day in Bing Ads.

Based on a study of 53 retail sites and 180 million shopping sessions by Internet Retailer in October 2014, conversion rate for smartphone shoppers on mobile-optimized sites is 160% higher than the rate on non-optimized sites.

Average order value on smartphones on mobile optimized sites is 102% of the average order value for shoppers on PCs of those same retailers’ desktop sites. That number drops to 70% on non-mobile optimized sites.

Advertisers simply cannot ignore mobile any longer as it’s a significant driver in consumers’ search behavior.

I will close by sharing a quote from Prat Vemana, VP of e-commerce and product management of Staples, who said it well:

[blockquote]It’s all about providing the convenience of being able to shop and pick up products when they want, where they want. Mobile is at the nucleus of this change.[/blockquote]

Contributing authors are invited to create content for Search Engine Land and are chosen for their expertise and contribution to the search community. Our contributors work under the oversight of the editorial staff and contributions are checked for quality and relevance to our readers. The opinions they express are their own.

Related stories

New on Search Engine Land