Amid the economic gloom, some hopeful indicators emerge for marketers

Consumer confidence and spending have ticked up as people receive stimulus money and anticipate the lockdowns ending.

The COVID-19 pandemic has taken its toll on consumer and business confidence, with various surveys reflecting pessimism and expectations of a deep and serious recession. Indeed, many economic forecasters and major investment firms project between 15% and 30% unemployment when all the layoffs are through. (At the height of the Great Depression, unemployment was 24.9%.)

But amid the gloom and doom there are several hopeful signs for marketers considering campaign strategies and expenditures that may indicate the economy isn’t as severely damaged or won’t be down as long as many of these grim predictions suggest.

Improving Consumer Sentiment

The HPS-CivicScience Economic Sentiment Index (ESI) tracks consumer sentiment across five economic categories: jobs, economic outlook, willingness to make major purchases, personal finances and new home buying intent. These indicators dropped off a cliff as the lockdowns and shelter-in-place orders took hold in March in many states.

As of the end of last week, four out of five of these indicators started ticking up, as shown in the chart above. In particular, people’s perceptions of the U.S. economic outlook improved significantly. While this may be a function of hopeful thinking about an impending return to normal life — whatever that’s going to mean — it’s potentially significant.

That’s because psychology and confidence play a major role in “personal consumption” (i.e., consumer spending) and consumption drives roughly 70% of U.S. GDP. Other categories, according to the Bureau of Economic Analysis, include business investment (18%), government spending (17%), with trade being a 5% net negative.

A ‘Black-Friday’-Style Spending Burst

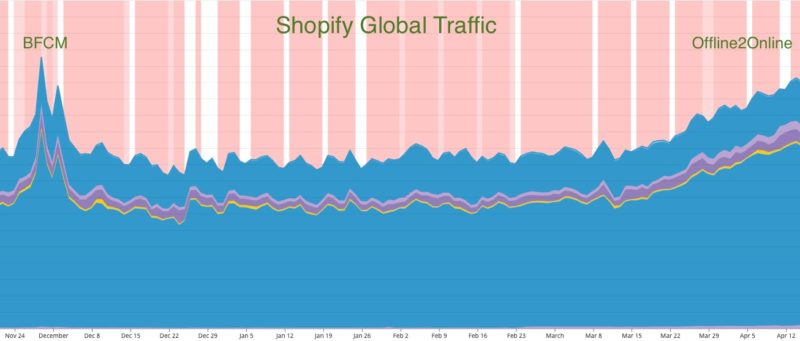

In addition, last week, the first wave of government stimulus checks appears to have triggered meaningful consumer online spending. Shopify CTO Jean-Michel Lemieux tweeted that the company was seeing “Black Friday level traffic every day.” Shopify now has more than 1,000,000 customers in 175 different countries, many of them small businesses.

“Wednesday was one of the best days that we have seen in a while for some brands,” said Kaitlin McGrew, senior SEM manager at PMG Advertising on Friday during a panel discussion of commerce marketers on Live with Search Engine Land. Clients across fashion retail, home organization and skincare categories saw the stimulus bump last week, said McGrew.

Merkle also reported that its paid search data “suggests that many consumers used part of that stimulus money on more discretionary purchases . . . across a variety of industries [we] saw lifts in conversion rate and revenue yesterday, with some retailers reaching levels similar to 2019 Black Friday numbers.”

The agency further explained the spike included apparel, furniture, automotive, footwear, outdoor living, audio equipment and cosmetics. “[A]ll experienced significant day-over-day growth without any change in promotional or advertising strategy. While the amount of growth varied significantly, many clients sampled saw revenue changes between 40% and 100% day over day.”

One question is whether the behavior will last once the immediate cash infusion is gone. But the surge in buying suggests there’s considerable pent-up demand among consumers who’ve been stuck in the house for weeks. Once real-world businesses open up again, they may also experience significant demand — think salons and haircuts.

Increased Marketing Activity

A recent survey of 250 CMOs by John Koetsier (for Singular) found that 73% of respondents were actually increasing their marketing and ad spending.

Here’s where these CMO-respondents said they were focusing their increased activities:

- 28% — more advertising.

- 18% — more content marketing.

- 15% — organic growth.

- 12% — social media marketing.

It’s not entirely clear what “organic growth” means in this context, although I suspect it includes a number of non-paid digital channels and tactics, including SEO. Client retention was also a major focus of these CMOs.

So while a substantial percentage of marketers have seen budget cuts or reallocation (.pdf), there are others adopting a more proactive, even opportunistic approach during this period. Messaging still needs to be appropriate and mindful of the current situation, but many companies see opportunity to position themselves for growth in the next phase, as we emerge from the immediate crisis.

Return of ‘Nonessential’ Products to Amazon

According to the Wall Street Journal and CNBC, Amazon is going to allow third-party sellers on the platform to start shipping nonessential items to its warehouses later this week. While not exactly an economic indicator, this suggests something of a return to a more normal operating procedure for the e-commerce company — and its legions of shoppers.

In mid-March the company stopped the shipment of nonessential items, due to the virus, putting pressure on third-party sellers on the platform. As the restrictions subside, quantities of nonessential products will reportedly still be limited to enable continued prioritization of essential goods. But that should ease over time.

Another positive indicator, it appears that toilet paper shortages are also easing on the site.

Consumer Confidence Is Key

One more debatable, potential signal is the stock market. The market has been incredibly volatile as the parade of job cuts and negative economic news has unfolded. But recently, it has staged a partial recovery.

The market is controlled, as much as anything, by psychology and confidence. Its performance in turn fuels our collective perceptions of economic health. If investors have confidence in future growth, the market generally gains. When the market does well, consumers often gain confidence in the direction of the economy and so on.

Ultimately, however it’s consumer confidence (and consumer spending), more than any other factor, that will determine how soon the recession ends and whether the recovery looks like a “V,” a “U” or an “L.”

Contributing authors are invited to create content for Search Engine Land and are chosen for their expertise and contribution to the search community. Our contributors work under the oversight of the editorial staff and contributions are checked for quality and relevance to our readers. The opinions they express are their own.

Related stories

New on Search Engine Land