Bing-Yahoo Paid Search Share Rises For Two Consecutive Quarters [IgnitionOne]

With robust consumer holiday shopping, US paid search closed out 2014 with 11 percent growth year-over-year in Q4 ad spend, bouncing back from sluggish growth of just 2.1 percent in Q3 2014. The data, which comes from IgnitionOne’s quarterly report, shows that the growth surge was driven by increased spend on the Yahoo Bing Network […]

With robust consumer holiday shopping, US paid search closed out 2014 with 11 percent growth year-over-year in Q4 ad spend, bouncing back from sluggish growth of just 2.1 percent in Q3 2014. The data, which comes from IgnitionOne’s quarterly report, shows that the growth surge was driven by increased spend on the Yahoo Bing Network which saw strong spend share gains for the second straight quarter.

Advertisers increased spending by 31 percent year-over-year on the Yahoo Bing Network (through the Bing Ads platform). Spending on Google AdWords rose by just 5 percent.

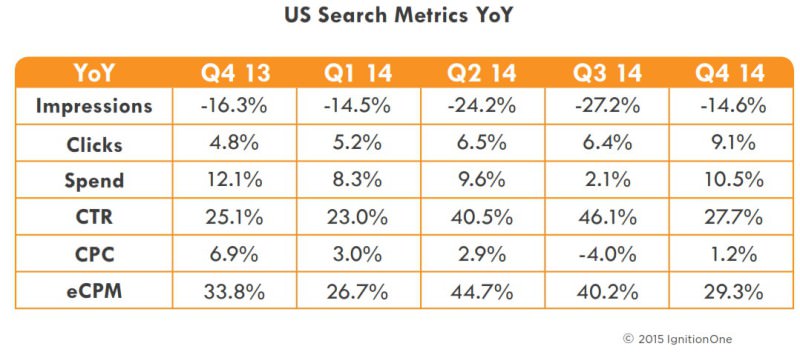

Impressions Only Metric To Dip Overall In Q4

Off by 14.6 overall, Google impressions fell 25 percent while Bing Ads impressions rose by 22 percent year-over-year. The impression drop on Google was in part due to changes within Google’s partner network and IgnitionOne advertisers increasingly pulling out of search partners, says the company.

Click volume and click-through rates continued to rise, however. Clicks rose 9 percent overall, with Google clicks up 3 percent. Click-through rates were up 28 percent overall, with Google up 37 percent and Bing up 6 percent compared to the previous year.

Costs-per-click (CPC) were up 1.2 percent, and effective CPM rose 29 percent. IgnitionOne says the spend increase on Google can be attributed to three primary factors: 1. As advertisers continue to pull out of the Google search partners network, average CPCs will rise., 2. Mobile CPCs continue to grow at faster rates than desktop year-over-year, 3. The removal of “close variants” targeting for exact match also drove CPCs higher.

Here’s a snapshot of what the metrics through IgnitionOne have looked like over the past year.

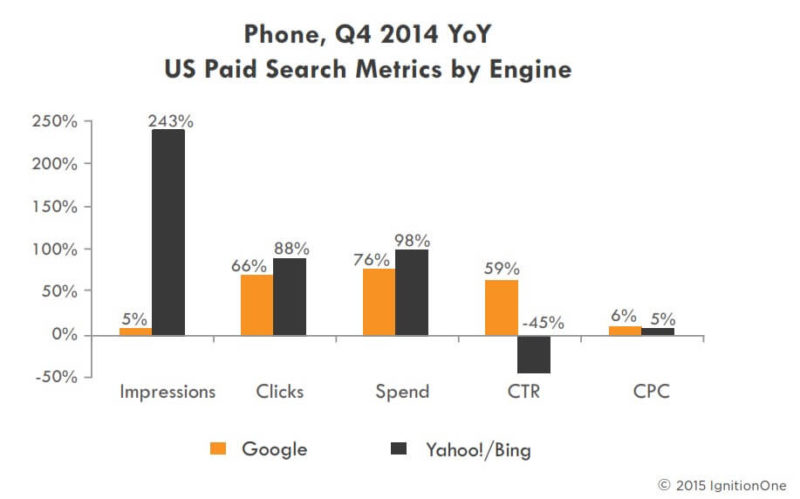

Mobile Spend Rose 78 Percent YoY

Mobile Spend Rose 78 Percent YoY

In line with reports from Kenshoo and Marin, no surprise, IgnitionOne also saw big jumps in mobile. Spend on mobile phones increased by 78 percent year-over-year. Tablets saw an increase of 37 percent and desktops rose 11 percent. Smartphone impressions rose 27 percent while desktop impressions fell 13 percent compared to the previous year. Spurred by a strong Thanksgiving weekend, clicks on mobile jumped 69 percent. Tablet clicks rose 37 percent and desktop again lagged with an increase of 16 percent.

Though working from a much smaller base, Bing Ads saw substantial mobile growth. Smartphone impressions jumped 243 percent year-over-year on Bing Ads. Google’s smartphone impressions rose 20 percent. IginitionOne attributes the big leap on Bing Ads to the adoption of enhanced campaigns.

Overall, smartphone CPCs rose 5 percent and tablet CPCs remained flat year-over-year. Spending was split nearly evenly with smartphones accounting for 49.7 percent of spend and tablet taking 50.3 percent.

Google Spend Share Declines For Second Quarter

Q4 marks the second consecutive decline in spend share for Google and a 25.8 percent increase in market share for Bing Ads. Google, of course, still dominates with 73.7 percent of total ad spend and Bing Ads getting the remaining 26.3 percent. Still, IgnitionOne says the firm hasn’t seen a two-quarter gain of this magnitude since the Yahoo and Microsoft Search Alliance began. The closest thing to it was in Q4 2007 to Q1 2008 when Yahoo/Bing grew 20 percent.

IgnitionOne lists recent changes in default search engines (Firefox to Yahoo, being the most significant) and CPC declines year-over-year on Google compared to CPC increases on Bing Ads as primary causes for the shift in spend share.

Contributing authors are invited to create content for Search Engine Land and are chosen for their expertise and contribution to the search community. Our contributors work under the oversight of the editorial staff and contributions are checked for quality and relevance to our readers. Search Engine Land is owned by Semrush. Contributor was not asked to make any direct or indirect mentions of Semrush. The opinions they express are their own.