COVID-19 is the asteroid that struck American small business

Billions will be lost to digital marketing if SMBs close their doors.

Small businesses (SMBs) are now in a Darwinian struggle for survival. The fallout from the COVID-19 pandemic is completely disrupting and reconfiguring the market, with some SMBs adapting and others calling it quits. This will have big implications for marketing and advertising as well.

In its Q2 economic report, Yelp paints a picture of increased consumer activity in late May and early June driving the growth of infections in states such as Florida and California. The report also quantifies the number of local businesses that are permanently closing.

According to a separate, June survey of 1,200 SMBs by Small Business for America’s Future, 23% said they considered closing their doors permanently. This data reflects the business owner’s state of mind but not necessarily behavior. Unfortunately, some of the actual numbers are worse.

Fallout for advertising and marketing industry

SMBs in the U.S. collectively spend many billions — more than $100 billion according to Intuit — on marketing and advertising annually. If hundreds of thousands of small businesses disappear that negatively impacts local communities but also affects the larger digital marketing ecosystem.

Absent more government stimulus and loans, the question of SMB survival is one of cash on hand and whether the U.S. can control the pandemic’s spread before the money runs out. The NFIB Research Center found that 78% of SMB-respondents could survive 7 to 12 months or more with existing cash on hand; and 57% could last more than a year, which is positive news. Let’s hope the current crisis doesn’t last more than a year.

Restaurants among the hardest hit

As of July 10, Yelp said there were roughly 133,000 total business closures among those listed on its site, many temporarily and some permanently closed. The company explained that of the roughly 26,000 restaurants on Yelp that had closed since March, 60% were now permanently closed. That’s a shocking figure and seems to support a June prediction from the Independent Restaurant Coalition that, absent strong government funding intervention, 85% of independently owned restaurants could go under.

Bars and retailers are also suffering high casualty levels compared with other categories: 45% of bars and clubs have permanently closed, while 48% of businesses in the retail and shopping category have shuttered, says Yelp.

Professional services and others faring better

Some categories are doing better and suffering lower permanent closure rates, according to Yelp. These include professional services, accountants, web design, graphic design, health services and education-related businesses. This is not to say all is well in these categories, it’s just not as bad as restaurants and retail.

According to a June poll of SMB members of B2B networking site Alignable, 68% of local businesses are now “open” (to varying degrees). Only about 50% of customers had returned at the time of the survey and 48% of employees were back on payroll. Somewhat more upbeat, a July survey from NFIB Research Center found that nearly three-fourths of SMBs reported sales at 51% (or higher) of pre-pandemic levels; 44% said sales were at 75% or better and 11% said they were doing better than before COVID.

Embracing the pivot

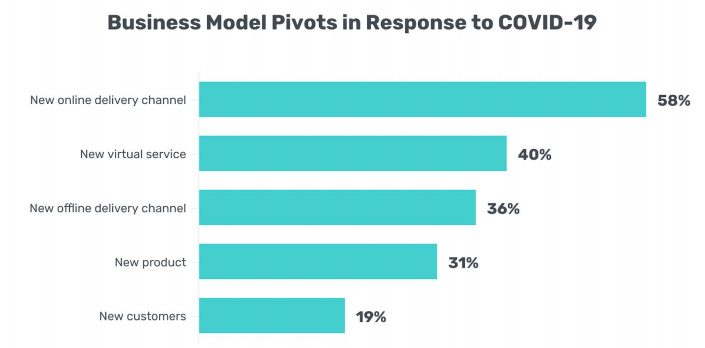

Those SMBs that are surviving or doing relatively well have leaned into the pivot. A GetApp survey of 577 SMBs found that “a whopping 92% of respondents report pivoting in at least one way, while many have pivoted in multiple ways; only eight percent didn’t pivot at all.” The report used the <500 headcount definition of SMB, so undoubtedly there are some larger and more sophisticated companies in the sample.

The most common adaptation was adoption of a new online delivery channel, followed by introduction of new virtual services, then offline delivery services. The overwhelming majority (96%) said they were planning to keep some of these new services and channels when the pandemic is finally over; 43% will maintain all the changes made.

The survey found the biggest SMB challenges in pivoting were: 1) the lack of employees or internal skills to execute, 2) lack of funds and 3) setting up new online delivery channels. But the survey found SMBs that had pivoted were reporting significantly better sales results than those that had not.

Contributing authors are invited to create content for Search Engine Land and are chosen for their expertise and contribution to the search community. Our contributors work under the oversight of the editorial staff and contributions are checked for quality and relevance to our readers. The opinions they express are their own.

Related stories