E-commerce explodes: 45% growth in Q2

While many retailers flounder, some omnichannel merchants are killing it online.

Years of economic growth have been wiped out by COVID-19. However, the story for e-commerce has been the opposite: an acceleration of growth that otherwise might have taken years.

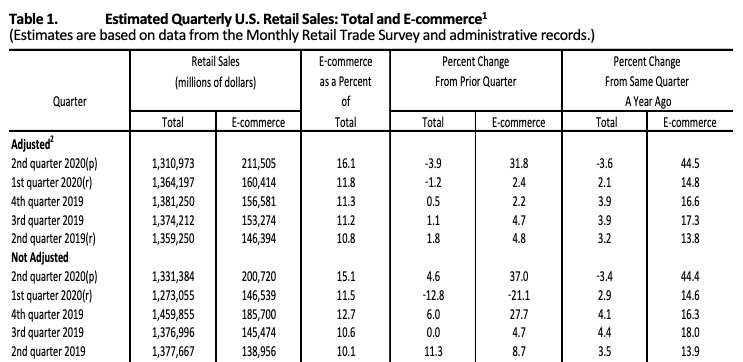

Approaching 20% of retail. The U.S. Commerce Department reported new retail sales data (.pdf) earlier this week. It shows a huge spike in second-quarter e-commerce spending as a percentage of total retail, growing from 11.8% in Q1 to 16.1% in Q2.

Some analysts and outlets exclude categories such as restaurants, bars, automobile dealers and gas stations to tell a stronger growth story. Using that formula, which is a bit of a cheat, e-commerce is now closer to 21%.

To put all that into larger context, July retail sales data showed growth of 1.2%. That followed a 7.5% increase in June on the heels of an 18.2% jump in May. So, as retail sales have slowed, e-commerce has gained momentum.

Years of growth in a quarter. For years e-commerce hovered just under 10% of total U.S. retail sales — leading to the familiar conference refrain: “90% of retail sales still happen in stores.” While it remains to be seen what happens when the pandemic fully subsides (whenever that may be), there’s no question that e-commerce is exploding and higher levels of online spending are here to stay.

Year over year (YoY) online shopping growth in Q1 was 14.8% and 2.4% sequentially. But in Q2 (April–June), when most state lockdowns were fully in place, e-commerce surged 44.5%, while quarterly growth was 31.8%. These are huge numbers, fueled in large part by consumer necessity.

Triumph of the big boxes. The U.S. retail economy is in a state of very uneven recovery, if we can even call it that. There are regional differences and variable outcomes by retailer, with many in bankruptcy. Others, such as Walmart, Home Depot and Target, are booming.

Walmart’s second-quarter earnings, for example, beat expectations. The company posted 97% YoY e-commerce sales growth. That followed 71% growth in Q1. It introduced curbside pickup during the quarter.

Target’s numbers were even better. The company reported Q2 results today, including:

- 195% YoY e-commerce sales growth

- 10 million new online shoppers in the first half of 2020

- 700% growth in curbside pickup

The O2O hybrid model. E-commerce and “local” shopping are not mutually exclusive, which has been the way they were discussed in the past. That thinking is reflected in the historical separation of e-commerce and store operations teams. And while that may have made sense in the beginning, it no longer does.

The reason that Walmart, Home Depot and Target, among a handful of others, are having so much e-commerce success is precisely because of their stores and same day “delivery” capability. They’re combining the convenience of e-commerce with the immediacy of stores. Stores give people confidence to buy online, knowing that they can return products locally. Brand trust is also a factor.

Why we care. It remains to be seen whether consumers will return to stores in large numbers for holiday 2020 shopping. But, it’s clear that Q4 will be another huge quarter for online commerce. Retailers and brands should be preparing now and operating under the assumption that people will go online first before they visit stores.

To that end, marketers need to build content and landing pages (with product inventory, if possible) that help them gain exposure in search results for non-branded product/service/menu queries. They also need to build out and optimize GMB profiles and local-social pages as well.

Related: Majority of chains call local-digital marketing an ‘untapped opportunity’

Contributing authors are invited to create content for Search Engine Land and are chosen for their expertise and contribution to the search community. Our contributors work under the oversight of the editorial staff and contributions are checked for quality and relevance to our readers. The opinions they express are their own.

Related stories

New on Search Engine Land