Opinions expressed in this article are those of the sponsor. Search Engine Land neither confirms nor disputes any of the conclusions presented below.

How to prepare your e-commerce ad strategy for an uncertain Q4

What your eCommerce ad strategy should look like for Q4 based on COVID-19’s impact in the first half of 2020 and predictions for the quarter.

This year has been one of the most uncertain and capricious years ever for eCommerce. As businesses look to recover from the early effects of COVID-19, eCommerce advertisers must ask, “what happens next?”

While signs point to a slow recovery of jobs and purchasing in Q4, there is also a chance the U.S. will see another shutdown later this year impacting the economy and eCommerce in a similar way to March and April. On top of this, Prime Day has likely moved from Q3 to Q4, creating unprecedented crossover with the holiday buying season.

What does all of this mean for your eCommerce ad strategy? First, let’s look at how COVID-19 has shaped the industry so far this year and what changes we still expect to see.

Changes in the first half of 2020

In Pacvue’s Q2 2020 CPC Report, cost-per-click on Amazon for both Sponsored Product ads and Sponsored Brand ads saw a significant decrease in April and May. Since then, average CPC has rebounded to nearly pre-COVID-19 levels. Except for a peak in March, conversion rates also saw a downward trend in Q2.

There were a number of causes for the significant changes to eCommerce ad spend and consumer behavior.

The biggest cause, which continues to affect advertisers, are category-level changes in consumer buying behavior. Online sales for sports and outdoors, kitchen, and especially groceries all saw increases as lockdowns and work-from-home policies led to consumers staying home to cook and exercise. Meanwhile, the work-from-home trend has caused a big hit to the apparel and beauty industry as less people are spending on new clothes and cosmetics when they aren’t going out.

Shipping delays and inventory issues also caused challenges for advertisers. Conversion rates were affected when consumers clicked through an ad only to abandon the item when they found it out-of-stock or with a significant shipping time.

eCommerce predictions for Q4

Many new buying trends are expected to stick around through the end of the year. This is especially true for online grocery shopping, which has seen a massive boom this year. Of those who have yet to buy groceries online, 41% say they plan to do so in the next 6 months. However, now that the initial panic buying has subsided, there shouldn’t be as many shipping delay and out-of-stock issues as we saw in Q2.

The biggest wild card to look out for in the remainder of 2020 is Amazon Prime Day. Brands have come to depend on Prime Day in early Q3, coupled with a strong Q4, to hit their yearly sales targets. Pushing Prime Day back into Q4 will almost certainly cannibalize sales from November and December. Additionally, this could have serious implications on which products brands can run as deals, given Amazon’s traditional requirements that the advertised deal price must be the lowest price in a certain number of trailing days.

While Prime Day could negatively affect Cyber Monday and the holiday shopping season, this will likely be a massive holiday season for eCommerce. With many retailers closed on Thanksgiving and consumers less motivated to shop in-store, much of the holiday weekend spending could move to Cyber Monday and extend through December. In fact, Barron’s predicts an 80% increase in eCommerce holiday spending in 2020 compared to 2019.

While the Prime Day move is a given, the most uncertain and difficult to plan for changes will be the future effects of COVID-19. eCommerce advertisers should prepare their strategies for a continued economic recovery or another complete lockdown.

Q4 eCommerce ad strategies

Despite these uncertainties, there are a number of strategies eCommerce advertisers can employ to maximize sales through Q3 and Q4. Here are a few of the most important considerations as you prepare your ad strategies for the rest of 2020:

1. Invest when and where demand surges

Some brands may feel they should hold their ad budget until Q4, while others feel they should invest heavily now because Q4 is so unpredictable. Instead, invest when and where consumer demand is surging; in short, invest now.

Pacvue’s report found that brand average daily spend in Q2 was higher than during Q4 2019. Spending rose 14% from Q1 and showed a 23% increase from Q2 2019.

If eCommerce is going to continue spiking during months that aren’t traditionally as important as Q4, i.e. March and April, then brands should capitalize on those opportunities. This is especially important if brands’ competitors are also active in the space, since they risk getting left behind and losing share if they don’t pivot quickly during times of change.

2. Prioritize share of voice in Q3

Without Prime Day in Q3, the best thing brands can do now is invest in building the relevancy and sales of their entire catalog, not just their hero products or those that were planned to be on promotion during Prime Day. Building this relevancy takes time, and brands need to be doing the work now if they want to be in a position for success during Q4. This includes both paid search on Amazon and other marketplaces, as well as display media campaigns, such as Amazon DSP, in order to reach new-to-brand consumers and retarget loyal customers.

Advertisers should make sure that they have solid paid search and display strategies in place now and shouldn’t wait until Q4 to launch, so they can gain learnings of how to optimize and maximize efficiency, as well as build their campaigns’ relevance scores.

This will be especially important for the eCommerce grocery industry seeing a significant expansion. The online grocery marketplaces seeing the biggest growth are Walmart and Instacart, with Instacart growing to 25,000 stores offering service to 85% of U.S. households. The remainder of 2020 will be crucial for brands to win Share of Voice in these marketplaces and start building a customer base. Grocery advertisers should adopt an “always-on” strategy by cross-promoting products on both similar and complementary keywords.

For industries that aren’t seeing growth, such as apparel, Q3 is the time to employ defensive advertising strategies to maintain customer loyalty. Brands that cut back on ad spend and fail to bid on their brand name and target their own products risk competitors bidding on those terms and stealing customers. Brand-level campaigns, such as Sponsored Brand ads on Amazon, are a good way to own those terms and maintain Share of Voice. This allows you to promote secondary products and adapt to changing consumer demand.

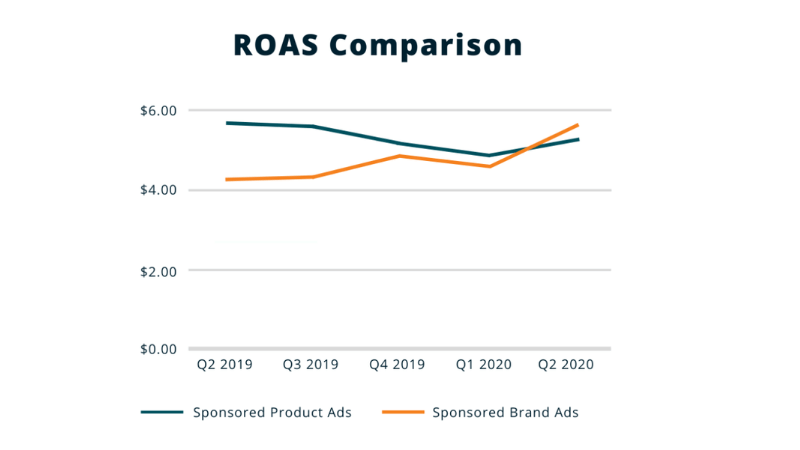

In fact, Q2 saw Return on Ad Spend (ROAS) for Sponsored Brand ads surpass ROAS for Sponsored Product ads for the first time. ROAS for Sponsored Brand ads saw 22% growth from Q1.

3. Prepare for a mega-holiday season online

For brands that saw a negative impact on sales in H1 2020, the online holiday season will be more important than ever. This year is anticipated to be the largest online shopping season we have ever seen. Barron’s expects $51.1 billion in online sales during this period, up from only $28.4 billion in 2019.

Apparel and Beauty were both down significantly during the beginning of COVID-19, as most people were stuck at home and not purchasing these items. This holiday season should be used as an opportunity to capitalize on consumers buying more items they anticipate will be of use in 2021. This could see these lagging industries improve.

For all industries, expect Cyber Monday to see much higher volume than ever before. Businesses that dealt with out-of-stock issues in March and April should plan ahead to ensure they have enough inventory. Online retailers may also see much higher than average returns as consumers traditionally shopping for apparel or gift items in-store move to more online shopping.

It is nearly impossible to predict what the rest of 2020 will look like. While eCommerce advertisers may need to deal with uncertain times in Q4, it is clear that the industry as a whole is seeing massive growth this year. As more consumers shift buying behavior online and Q4 sees a hopeful resurgence in shopping, devoting ad spend to eCommerce is more important than ever.

For more information on how COVID-19 affected Q2 eCommerce advertising strategies, read Pacvue’s full report: “Q2 2020 CPC Report: Amazon Ad Growth Through an Uncertain Market.”

Related stories

New on Search Engine Land