Less than essential: Why smart speakers are like smartwatches, not smartphones

The devices have reached 50% of US homes, but fallen flat as a channel

Are smart speakers more like smartphones or smartwatches? Almost 85% of U.S. adults own a smartphone, while only about 16% of Americans own a smartwatch. In more ways than one the better analogy for smart speakers is the smartwatch.

Even though there are now approximately 126 million smart speakers in 60 million U.S. households, according to the latest Smart Audio Report from NPR and Edison Research, these devices have not turned into the compelling marketing or commerce channel that many (including me) had envisioned when Amazon released its first Echo in November 2014.

Nearly six years later, the user experience and technology have not fundamentally evolved. Two obvious exceptions are the availability of screens and back-end leaps in natural language processing and machine understanding. But those improvements have not brought about transformative changes in usage or performance. And the advent of voice apps/skills/actions have not added significant utility or enjoyment.

Falling short of their potential as a channel

This is not to say smart speakers are a disappointment. They’re remarkable multi-function units controlled by voice and and powered by a massively sophisticated cloud infrastructure. They can deliver all kinds of valuable information and content on demand. They can also control numerous smart home functions. But it does not appear they will realize their potential as a commerce channel or as a marketing platform — at least not in the foreseeable future.

If there was a time for people to really engage with these devices it’s now during the stay at-home lockdowns. Think about how video calling/conferencing has taken off. Indeed, the NPR research finds people are using their smart speakers more frequently and consuming more content via these devices. However, the use cases are largely unchanged and the growth is incremental. This has not been the breakthrough moment it might have been.

Most common smart speaker use cases

The top actions — play music, get the weather, general knowledge question answering, set timers and news or radio listening — are consistent with how people have been using these devices for several years. Younger users (18 – 34) are listening to more news on smart speakers since the beginning of the outbreak, however.

There have been glimpses of search and commerce potential in the past. In the 2017 survey 57% of respondents said they had purchased something using a smart speaker. Those results have not really been replicated since. However, the current survey did find that 18% of smart speaker owners had ordered food and 31% had used a smart speaker or smart display to conduct a local search, while 32% say they had made a phone call.

Unfortunately, we don’t know a great deal more about the nature of these behaviors, their frequency or user satisfaction levels.

Hitting an adoption wall

In January of 2019, NPR estimated there were roughly 118 million smart speakers in U.S. homes. The figure today is 126 million according to the most recent report. That’s less than 10% growth, compared with nearly 80% growth from 2018 to 2019.

The lower-end smart speakers from Google and Amazon are frequently sold for $29 or bundled for free into other product promotions. Accordingly, cost has not been a barrier to adoption. And the bulk of sales have been of the lower cost Google Home Mini and Amazon Echo Dot devices.

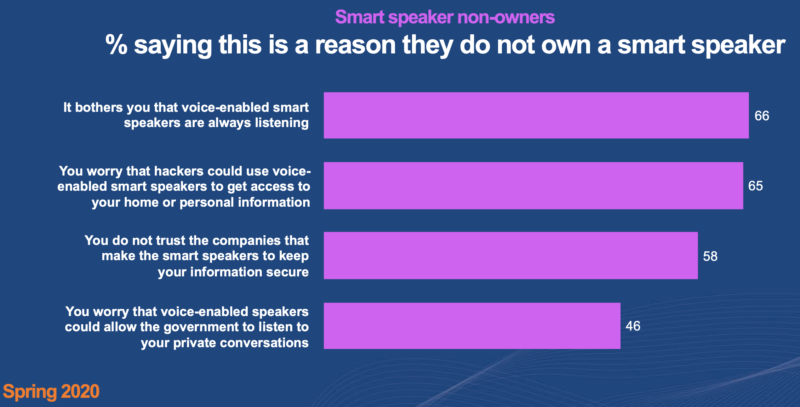

Why people don’t own a smart speaker

There are roughly 124 million households in the U.S., which then suggests 50% penetration and implies significant “headroom” for smart speakers and displays. But while smartphones are perceived as essential, demand for smart speakers is softer — like smartwatches. And some of the past, negative publicity around smart-speaker eavesdropping and rising, general awareness of privacy and technology may blunt or significantly slow further adoption.

The current NPR survey found that distrust of tech companies, eavesdropping and hacking were concerns and purchase barriers for roughly two-thirds of those surveyed who didn’t own a smart speaker or display.

COVID-driven innovation required

In 2017, 42% of NPR survey respondents called their smart speakers “essential to daily life” and there have been favorable satisfaction ratings since that time. The potential remains for commerce and marketing. But despite a few high-profile announcements, brands, retailers and publishers have not been very innovative or creative in the use of these devices, notwithstanding more than 80,000 Alexa skills, which most people don’t use.

The COVID crisis offers a new and more urgent opportunity to experiment and innovate. Retail, restaurants and hotel environments, for example, will require associates to minimize close interaction and offer contactless payments, as well as other “vicarious” or virtual services (e.g., concierge). Smart speakers (and smart displays) were tailor made for this moment. I’m hopeful that someone will seize it and create applications that are truly ingenious and useful — for marketers and consumers alike.

Contributing authors are invited to create content for Search Engine Land and are chosen for their expertise and contribution to the search community. Our contributors work under the oversight of the editorial staff and contributions are checked for quality and relevance to our readers. The opinions they express are their own.

Related stories

New on Search Engine Land