Online holiday sales could reach $200 billion according to Adobe

Smartphones will drive the majority of online retail traffic and 42% of sales.

Holiday e-commerce spending is poised to exceed $189 billion in the U.S., according to Adobe’s most recent forecast. That represents 33% year-over-year growth. However, online revenues could reach or exceed $200 billion if physical stores remain largely closed due to COVID and if there’s a second stimulus payment to consumers.

Uncertain spending outlook. Consumer confidence declined in October and there are conflicting data about anticipated holiday spending. Some surveys, like that from Feedvisor, assert the majority of U.S. consumers will spend at least as much as they did last year. However, other surveys (e.g., from Suzy) argue only a small percentage of consumers will spend the same or more than they did in 2019. The firm’s most recent shopping survey found that 53% of consumers were uncertain how much they would spend or will spend less; only 13% were confident they would spend more.

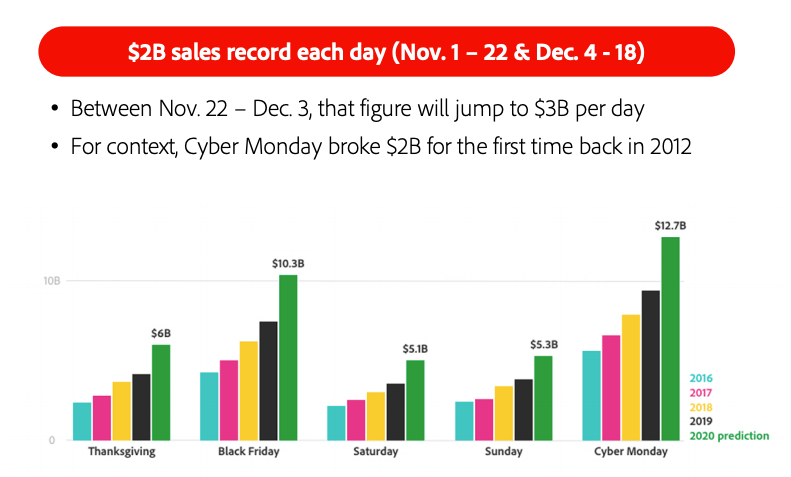

Big gains for Cyberweek. There’s no question, however, that e-commerce will see substantial gains over last year due to new shopping patterns driven largely or entirely by COVID. Adobe expects the traditional Thanksgiving week to see big gains over last year, especially Black Friday and Cyber Monday. But Black Friday will see substantially fewer consumers in stores and less “door busting” because of the pandemic. Most of those specials will move online, fueling more online shopping. Additionally, many malls and retailers, including Walmart, Target, Kohl’s and JCPenney, will close for Thanksgiving day this year.

Cyberweek online shopping predictions

BOPIS bump. Buy online pick up in store (BOPIS) and curbside pick up will also see increases, and could be a lifeline for physical retailers. Adobe says BOPIS will be up 40% over 2019 and that shoppers are “9% more likely to buy at retailers offering BOPIS/curbside pickup on big sale days.” A September consumer survey by Adobe found that “30% of online consumers prefer using BOPIS or curbside over home delivery.”

Smartphones are expected to drive the majority of online retail traffic (60% or more) and 42% of actual sales. Smartphone shopping revenues will see 55% year-over-year growth according to the forecast. This has obvious “best practices” implications for retailers and their mobile shopping experiences.

Smaller retailers will see increased sales. Adobe expects smaller retailers, with $10 to $50 million in revenue, to see higher percentage growth in sales than larger retailers. Its October consumer survey reports that 51% of respondents will shop at local retailers on Small Business Saturday and that 38% of consumers “will make a deliberate effort to shop at smaller retailers throughout the holiday season.” Yet other surveys and data present a less upbeat and more challenging environment for small businesses in the fourth quarter.

Adobe says that average order value will remain flat compared with 2019 but that a large influx of new online shoppers will boost revenues. Adobe reported that during May, online spending from new shoppers outpaced spending by existing, loyal customers two-to-one.

The findings and predictions are based on analysis of retailers using Adobe Analytics and Adobe Commerce Cloud. The company says the data set represents 100 million SKUs, a trillion visits to U.S. retail websites and transaction data from 80 of the top 100 U.S. online retailers. There was also a companion survey of 1,000 U.S. consumers conducted in October.

Why we care. This is a very unpredictable year, with wild card elements such as consumer confidence and the potential return of COVID-19 lockdowns. However, e-commerce growth is a sure thing and multiple surveys have confirmed that holiday shopping is already underway, following Prime Day.

Retailers need to utilize every marketing tool available to gain an advantage this year. That includes Google Shopping/Local Inventory Ads and product feeds, discounts, shipping incentives, BOPIS and curbside pickup. For traditional retailers, Google My Business optimization is critical. Inventory and supply chain management will also be a key to success — making sure that enough product is available to meet demand.

Related:

- Holiday 2020 is do or die for many SMBs

- With an eye toward deal-seekers, Google releases promotions, pricing updates for both advertisers and users this holiday season

- What Prime Day signals for 2020 holiday retail

- Facebook launches new Shopping audiences, Instagram Product Tag ads, tests Shops discounts

Contributing authors are invited to create content for Search Engine Land and are chosen for their expertise and contribution to the search community. Our contributors work under the oversight of the editorial staff and contributions are checked for quality and relevance to our readers. The opinions they express are their own.

Related stories

New on Search Engine Land