SMBs bullish on virtual assistants, think Alexa has biggest marketing potential

Don't focus on the specific numbers, the interesting thing is the sentiment.

Small businesses haven’t yet invested much in voice search or optimization for virtual assistants, but they’re bullish on voice as a marketing channel. That’s according to new research from Uberall (reg. req’d).

Majority think ‘voice marketing’ is valuable. The survey of 300 U.S. small businesses asked whether “interactive voice marketing” was valuable for them. About 23 percent said it wasn’t valuable or weren’t sure. The remainder (77 percent) said that it was valuable to varying degrees, with about half saying it was “somewhat” or “very” valuable.

This is all about perception, because most respondents probably don’t have a good sense of what “voice marketing” is. In all likelihood, they’re responding to widespread consumer adoption of smart speakers and the publicity surrounding voice assistants on smartphones.

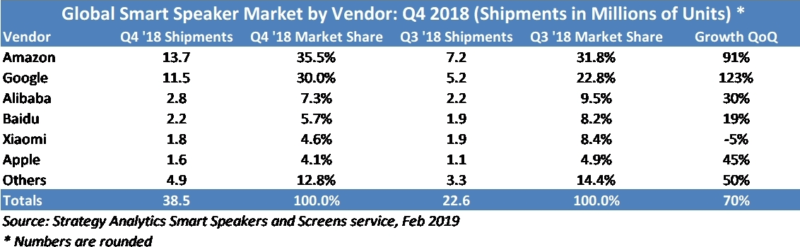

86 million units sold in 2018. According to recent data from Strategy Analytics, which tracks device shipments, global smart speaker and smart display shipments grew 95 percent to nearly 39 million units globally in Q4 2018. The firm estimates that 2018 shipments of smart speakers and displays reached 86 million worldwide.

Fourth quarter data shows Amazon with a 35 percent market share but Google close behind with 30 percent. Google’s growth is also outpacing Alexa’s. Apple’s HomePod saw 45 percent growth but has only a 4.1 percent market share. Though the chart doesn’t reflect this, Amazon is still the dominant smart speaker provider in the market by a significant margin.

That dominance may partly explain why the SMB survey respondents said that Alexa had the greatest “marketing potential.” Nearly half (48 percent) choose Alexa in response to the question, “Which voice assistant do you think has the most potential for marketing?” Google Assistant was second with 29 percent, Siri followed with 17 percent. This directly corresponds to the smart speaker hierarchy in the market.

Budgeting for voice. Asked about budgets for “voice channels,” most SMBs said they weren’t investing or their budgets were staying the same. About 35 percent of respondents said their budgets were slightly increasing (26 percent) or significantly increasing (9 percent).

I don’t think these numbers accurately reflect reality. Right now, budgeting for voice channels is really about optimizing content for SEO and snippets. So unless these survey respondents translated the question into that context it’s not clear what they were referring to.

The survey also explored who would create content for voice channels. The largest group (44 percent) said they would outsource to an agency (multiple types were mentioned), while 40 percent said they wanted to control it in-house. The remaining options were “I’m not sure” and “publisher partners.”

Why you should care. The specific numbers in the survey don’t really matter at this point. What matters is the interest level among small business, who typically lag in marketing sophistication and technology adoption. For example, it took many years and lots of channel partners before paid search was widely adopted by SMBs. Thus it’s noteworthy that there’s such high awareness of voice assistants as a potential marketing channel, as well as potential pent-up demand.

Contributing authors are invited to create content for Search Engine Land and are chosen for their expertise and contribution to the search community. Our contributors work under the oversight of the editorial staff and contributions are checked for quality and relevance to our readers. The opinions they express are their own.

Related stories

New on Search Engine Land