Social Deals: Opportunity Cost & Customer Lifetime Value

It’s probably my fault but I receive what seems like 20 emails a days from an endless stream of Groupon emulators, flash sites and discount etailers that have taken my inbox by storm. These sites are saturating the online marketplace with tantalizing deals designed to make even the most staunch consumers (like my wife) … […]

It’s probably my fault but I receive what seems like 20 emails a days from an endless stream of Groupon emulators, flash sites and discount etailers that have taken my inbox by storm. These sites are saturating the online marketplace with tantalizing deals designed to make even the most staunch consumers (like my wife) … well, consume.

It’s inevitable after seeing other businesses participate on Living Social or Google Deals to think about giving it a shot, but before joining the social ad phenomenon, I’d like to offer some insight and analysis behind this new movement.

Like any other business, the Groupons and Gilts of the world have a business model: profit sharing — a 50/50 split with the advertiser to monetize their services. So if you sell $10,000 of goods or services via Groupon, the cost of the ad placement is $5,000.

Given the mainstream acceptance and exposure to “daily deals” and flash sales, consumers expect a bargain and will not purchase a “deal” if it’s not a deal.

So you have to take a few things into account before you can understand the financial impact and potential benefit of a social ad run on your business: cost of placement, actual revenue, margin and opportunity cost.

Let’s looks at some itemized sample data to give the profits and losses some color. Consider a business offering a $100 product for $50 on a flash sale site. Let’s also assume that the cost of production for this product is $25 and the company sells 200 items during the ad run.

- Sales: 200

- Average Order Value: $50

- Revenue: $10,000

- Profit Share: 50% x $10,000 = $5,000

So the advertiser and social ad company each get $5,000 for selling 200 units of the product. But what happens when we include the cost of production on the advertiser side? Remember that the advertiser normally clears a 4:1 profit ($100 MSRP and $25 cost of production):

- Gross Revenue: $5,000

- Cost of Production: $200 x $25 = $5,000

- Net Revenue: $5,000 – $5,000 = $0

The advertiser ends up making no profit. So what’s the opportunity cost of this social ad run?

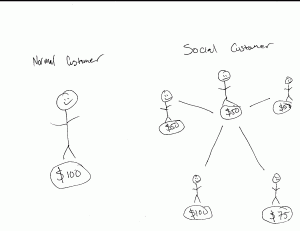

A pessimist looks at this situation and proclaims that the opportunity cost was 100% of the profit margin and the ad run was a failure; but an opportunist recognizes that there are 200 new customers who are trying out this new product and are likely to become repeat customers.

The Holy Grail of web analytics is consumer lifetime value (CLV) — the value of a new customer acquisition via specific marketing channels. For any business, paying nothing for 200 new customers is a heck of a deal, and with a well-managed post-purchase advertising and engagement program, this ad run could turn into a smashing success.

Gilt Gets Customer Lifetime Value

While sitting on a panel at SMX East a few weeks back, I presented a similar case on a men’s clothing company that has run regularly on Gilt for almost a year.

Each Gilt run they execute increases monthly unique new customers by 50%! Despite very low profit margins on the original sale, they set out to drive CLV via brand messaging, incentives and engagement to make this influx of new customers the most profitable and viable customer base in their marketing mix.

What they found is that following up social ad runs with aggressive Facebook advertising and content development, email, retargeting, a loyalty rewards campaign (invite friends to receive store credit) and paid search, they were able to build a streamlined process for new customers to keep the brand top of mind and come back for more.

Breaking down CLV by initial inbound marketing channel, consumers coming from Gilt now boast a 25% higher CLV than any other channel!

The Social Customer

The caveat for all this is quality of product or service. In order for a post-purchase re-engagement program to be successful, the consumers must be very happy with the quality of the product and be willing to engage with the brand in a social setting.

The company I am profiling has been extraordinary in their dedication to Facebook content management and allocation of budget to advertising channels that did not produce returns immediately. But with care and proper management, the program has blossomed into a fantastic success story.

So why do companies use social deals?

Unless there’s a huge markup on the cost of production, social deals yield very little profit. The secret lies behind what happens after the deal is over. If your business is prepared to dedicate marketing resources capable of engaging new customers to interact and repurchase products or services then social ads present fantastic access to new segments of consumers who normally may not engage with your business.

Contributing authors are invited to create content for Search Engine Land and are chosen for their expertise and contribution to the search community. Our contributors work under the oversight of the editorial staff and contributions are checked for quality and relevance to our readers. The opinions they express are their own.

Related stories

New on Search Engine Land