Using Data To Better Understand Tablet Consumer Behavior

The emergence of the tablet PC as a legitimate device for online activities beyond media consumption has turned the eyes of marketers and analysts towards understanding how tablet user behavior differs from that of traditional desktop and mobile. There are certain things which simply cannot be done on a mobile device – but the gap […]

The emergence of the tablet PC as a legitimate device for online activities beyond media consumption has turned the eyes of marketers and analysts towards understanding how tablet user behavior differs from that of traditional desktop and mobile.

There are certain things which simply cannot be done on a mobile device – but the gap is quickly closing and tablets are at the center of attention as consumers are embracing mobile tablet PCs as their primary computing devices.

With “more normal” sized screens, tablets don’t have the same issues with site formatting that high-end mobile devices have long suffered from. As a result, we would expect users to have an easier time engaging with a website via a tablet.

In terms of market share, tablet PCs are being gobbled up by consumers (shipments are up 42% Q/Q and 210% Y/Y) so it’s about time you and your business take a serious look at how tablet users are engaging with your site and develop a strategy for reaching tablet users with your marketing program.

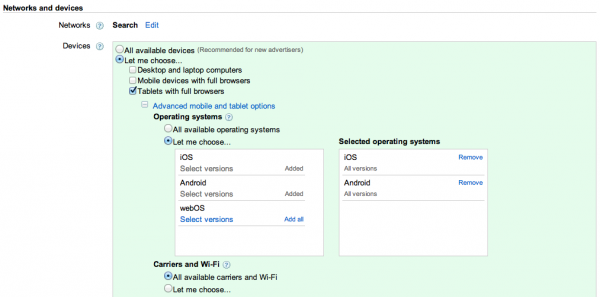

Fortunately, recent targeting modifications in AdWords allow marketers to isolate tablet traffic and even target ads by operating system. It’s only a matter of time for other marketing channels to step up their game and provide the same level of targeting. (Hello Facebook – maybe this is why they’re bringing ads to mobile operating systems…)

With the ability to parse data comes an opportunity for a test. Tagging URLs by device (I usually append the device to the campaign name and populate it into the utm_campaign parameter in GA) makes for a clean data set to determine the differences in user behaviors by device.

Comparing Desktop, Mobile & Tablet Performance

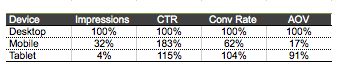

Below, I’ve normalized some key performance indicators for mobile and tablets relative to desktop. The terms being analyzed are generic category terms for an online-only service provider.

It’s worth noting that the company has a mobile and desktop version of the site but does not have a tablet specific site or app. Sniffer scripts are used to automatically send mobile users to the mobile site. Tablet users are sent to the desktop version of the site.

Albeit simple, the data set is quite revealing.

The most significant variance by device comes from impression volume. There just isn’t as much volume on tablets relative to mobile searches and more significantly desktop searches.

Even though relative click-through rates for mobile are higher than tablet users, tablet users show more intent to engage at a deeper level convert ata significantly higher rate than both mobile and desktop. Even more interesting is that the average order value for tablet users more closely resembles desktop than mobile search.

This is probably the most insightful metric on the table as it identifies the inherently unique, and impulsive, nature of mobile search behavior relative to desktop and tablet. Maybe mobile behaviors are different due to browser security concerns and the fear of credit card security (maybe forthcoming technologies like Google Wallet will fundamentally change conversion rates on mobile devices).

With such a massive discrepancy in average order value, it’s worth considering making a unique, cheaper, offering for mobile visitors to your site in an attempt to get them to stick around, engage, and convert.

Look At User Engagement By Device In Your Analytics

Diving deeper into the post-click analytics, we can better observe what happens between the click and conversion via on site metrics such as pageviews per visit and bounce rate:

With respect to PPV and Bounce Rate, once again, mobile shows poor performance relative to desktops with tablets in the middle, skewing closer to desktop behavior. Mobile users are less likely to stick on a site, moving faster and bouncing immediately more often than not, whereas users are more willing to engage with and seek out interesting content on a larger format device.

However, Time on Site shows some very interesting behavior – when a mobile or tablet user is engaged with a site, they spend far more time going through it.

There are many possible explanations for the dramatic variance in time on site, but I believe it comes down to when users are engaging on a given device. Tablets and mobile devices are more commonly associated with recreation while a desktop / laptop is more associated with work.

Personally, I use my computer for work, tablet for play, and when I’m commuting I use my phone. During a commute or while I’m sitting at home on the couch, I’m far more likely to spend a few extra minutes fumbling through a site.

If I’m surfing during the day, I’m usually pretty efficient with my time and less likely to spend too much time on a given site (except Search Engine Land, of course); and while I’m not a massive sample size, I don’t think it’s a far cry from the norm.

Conclusion

The numbers indicate that tablets do bridge the gap between desktop and mobile behavior patterns. Similar to mobile, tablet users search for a purpose and are more likely to click through an ad.

But unlike mobile, tablet users are not necessarily mobile and are more likely to engage with a site after clicking, displaying stronger engagement metrics and overall conversion behavior closer to desktop users.

Depending on your site’s method of monetization, the value of a click on a tablet may outweigh the value of a click form any other device.

Contributing authors are invited to create content for Search Engine Land and are chosen for their expertise and contribution to the search community. Our contributors work under the oversight of the editorial staff and contributions are checked for quality and relevance to our readers. The opinions they express are their own.

Related stories

New on Search Engine Land