Advanced Google Shopping: Is price a proxy for Quality Score in product ads?

Columnist Andreas Reiffen shares insights about price sensitivity and user behavior in Google Shopping, based on an analysis of 15,000 conversions across the German, UK and US markets.

In June, I spoke as part of the “Mad Scientists of Paid Search” panel session at SMX Advanced in Seattle. During the session, I presented Crealytics’ latest research on Google Shopping. The presentation included some findings relating to user behavior within the channel and uncovered how much product price really impacts performance.

We’ve had a lot of questions as to how we came to those numbers, so I would like to share some answers with you now.

Consumers don’t buy what they search for

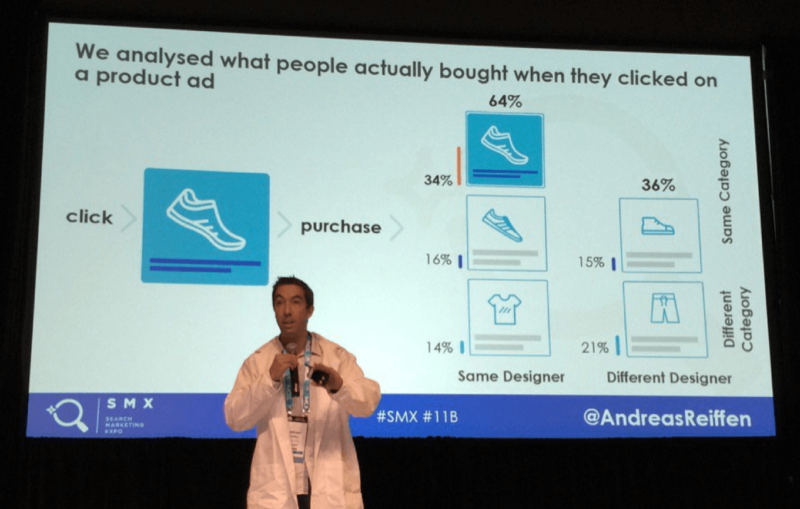

For a deeper insight into what is actually going on in Google Shopping, we analyzed a data set of more than 15,000 Google Shopping conversions across the German, UK and US markets covering several international retailers from the fashion, sports, outdoor and luxury sectors. We looked at search queries, clicked product ads and products purchased.

Surprisingly, the vast proportion of consumers don’t buy the products they search for (and click on). Analysis of the data found that only 34 percent of products purchased via Google Shopping match the product ad that was clicked on. We could also see that 30 percent of users bought a product by the same designer, but from a different product category, and 36 percent of users bought a product from a completely different designer.

What does this mean for advertisers? Understanding the link between what was clicked and what was bought becomes very important. This way, advertisers will be able to raise bids on the ads that actually lead to sales of the products they want to push. (You can read more about this topic here.)

Product pricing is key to success in Google Shopping

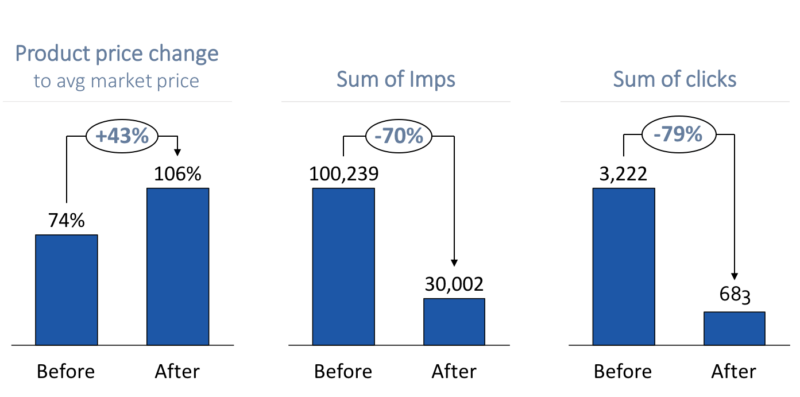

One element I spoke about that got people talking was what impact price changes have on Google Shopping performance. We used our client data to investigate this — it included 700 products with over 100,000 impressions. All products saw a price increase by 43 percent, on average.

The effect on traffic was dramatic — while bids stayed the same, impressions went down by 70 percent. If we wanted to maintain the same traffic volume, we would need to raise bids drastically. It’s clear that Google is penalizing increases in selling price, and so we have found that product pricing is key to success in Google Shopping.

The chart below shows the average data across all of the products analyzed (up to 2,000 products per price segment, based on >5 million impressions).

Our research also found that products that are cheaper than the market average tend to generate the lion’s share of traffic in any given product feed. The chart below shows that the impressions and clicks generated by the “cheap products” were far higher than those generated by the expensive products.

We might expect cheaper products to generate a higher click-through rate, explaining a higher traffic share, but the difference in impressions is clear proof that the Google Shopping algorithm favors products with lower prices and therefore serves those product ads for a higher number of relevant searches.

Many marketers believe that Google Shopping is a great way to cover the long tail of all products. But further analysis of our data highlighted the importance of key products, with only 10 percent of all products being responsible for 60 percent of traffic. We found that a small number of products drive the majority of sales.

From an even larger analysis (3,900 products and five million impressions), we found that the cheaper products in the sample generated 4.3 million impressions, against only 1.8 million impressions on expensive products. As a result, of course, the number of clicks shows a similar outcome.

In addition to this, we found that it was the products that were cheaper in relation to their competitors that were converting significantly better than the expensive ones.

Bidding and pricing are a double-edged sword

It’s only when you look at both bidding and pricing together that you get the full picture on how to utilize Google Shopping to your advantage, as they both work by a very similar mechanism:

- High bids will generate many impressions, but they decrease your ROI through higher CPOs.

- Low prices will generate many impressions, but they decrease your ROI through lower margins.

Bidding may be the key element of Google Shopping, but ultimately, pricing is the dominating influencer. Google will not even allow you to participate if they think your prices aren’t competitive.

So for advertisers in this environment, how do you reach your goal, a high ROI and a healthy traffic volume? Two strategies are possible:

- Have unique, exclusive products without competition, ones that users love. In other words, build a strong brand. Pure resellers will have a hard time competing.

- Selectively use lower-priced products as entry points to gain traffic, and upsell high-margin products to shoppers on your own website.

Advertisers: Use price to your advantage

The combination of our learnings on price sensitivity and user behavior opens up some very interesting possibilities and the potential for highly advanced strategies to be implemented within the Google Shopping channel.

Here are three key considerations:

- Price is a key influencing factor which advertisers need to get right in order to succeed. You cannot fix sub-optimal pricing with bidding strategies!

- Selling everything at a cheaper prices implies a race to the bottom in the long run. However, as we now know that people don’t buy what they click on, smart advertisers will sell only a few select products within a certain range of an assortment at a very low price, using these products as entry points for traffic from Google in order to upsell and cross-sell other higher-margin products.

- Google Shopping could act as an instrument to test price elasticity in order to better identify the ideal price of products. It has to be proven, however, that price elasticity in Shopping is a good proxy for other channels.

By analyzing all the of data available, advertisers will be able to manipulate bids and product prices to generate the maximum value for their business. These findings could even suggest that eventually, bidding and pricing could be merged into one big retail optimization platform, allowing retailers to gain the very best value by optimizing advertising and inventory simultaneously.

Take a look at the full presentation below.

Contributing authors are invited to create content for Search Engine Land and are chosen for their expertise and contribution to the search community. Our contributors work under the oversight of the editorial staff and contributions are checked for quality and relevance to our readers. The opinions they express are their own.

Related stories