Are The Analysts Wrong About Google’s Undervalued Stock?

Writers and analysts who keep an eye on the value of certain stocks, have been writing all year about the curious phenomenon of Google’s stock price. They generally say something along the lines of, “If you compare Google’s cash generation capabilities, why is it valued so much less than Apple?” or similar statements. Is it […]

Writers and analysts who keep an eye on the value of certain stocks, have been writing all year about the curious phenomenon of Google’s stock price. They generally say something along the lines of, “If you compare Google’s cash generation capabilities, why is it valued so much less than Apple?” or similar statements.

Is it true that Google is undervalued or, in fact, might the lower than expected stock price be due to none other than Google itself?

If you read this column regularly, you’ll know that generally, as Google releases its performance figures each quarter, I like to break them out and have a look at trends and performance as they relate to the international scene.

So, What Is Happening To The Value Of Clicks?

In the last couple of quarters, the discussion has revolved around the increasing number of clicks versus the value they generate for the company. Google has been protesting to the Street, that they don’t really understand technology and how it works. They’ve also been releasing some data related to mobile and how they’re impacting their click values.

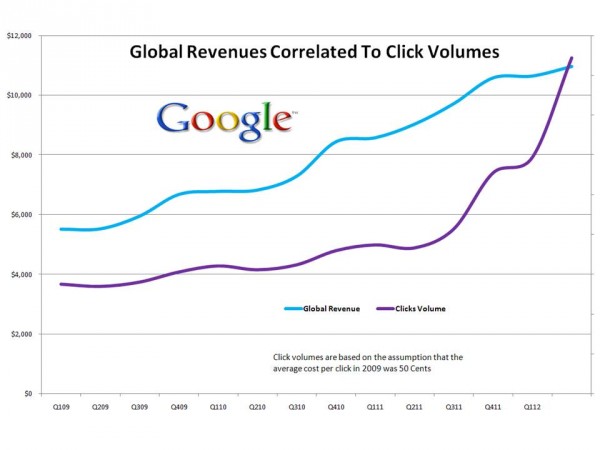

So, check out the chart below for the kind of information the analysts are considering:

Since Q1 2009, Click Values Have Dropped 28 Per Cent

It’s a pretty frightening picture which shows that, indeed, the value of clicks (based on Google’s own figures) has declined by some 28% since early 2009. The counter argument, of course, is that “Clicks don’t correlate to cost, so they don’t have a direct bearing on the financial performance of Google.” Really? Is that actually so?

Is It Truly Mobile Which Is Having The Impact?

Surely, clicks do directly reflect the cost of both promoting the search engine to advertisers and the market as well as the data center investments required around the world to deliver that quickly and easily to every single user — including those who are accessing the data by mobile.

Growth Rates In Headcount & Sales And Marketing Spend Increase Again

The above chart shows the cost of running Google from a sales and marketing as well as from a headcount perspective. If the cost of clicks was inconsequential, then Google would not need to be investing in additional headcount or advertising its own products — but they are.

As you can see from the chart above, these cost increases fluctuate wildly from quarter to quarter, but what is clear is that there is an overall strong momentum towards extra cost – and that’s before the impact of Motorola becomes apparent (bearing in mind that Motorola arrives at Google losing money).

Monetizing Google — Are We Really Back To That?

As you see below, if creating and delivering clicks reflects Google’s cost base, then costs relative to Global revenues are increasing at an astonishing rate.

We’re back to a scenario where Google has to start thinking, “How am I going to monetize this technology?” which would be the kind of thinking normally associated with a start-up. Google a start-up? However, this is likely the reason Google found it necessary to start charging for product search insertion.

Global Revenues Correlated To Click Volumes

Google’s significant investment in advertising its own products and recruiting its own people around the world used to be something which could be readily justified by the upswing in Google’s global presence. Even that is no longer true with international growth rates descending quite dramatically to reach the same levels as those in the US.

International Stabilises But Growth Rates Declining

Now you could argue that this is to do with growth declining globally and you can say that growth will one day return. But that of itself is a new phenomenon and would mean that Google was in a mature market, not one with lots of exponential growth ahead.

If mobile that’s hot — well, Google isn’t yet extracting values from mobile marketing which can return it to its upward exponential trajectory.

Contributing authors are invited to create content for Search Engine Land and are chosen for their expertise and contribution to the search community. Our contributors work under the oversight of the editorial staff and contributions are checked for quality and relevance to our readers. The opinions they express are their own.

Related stories