Google Q1 Revenues $8.58 Billion, Some Investors Unhappy

Google had a strong Q1 with $8.58 billion in gross revenue. Net revenue was $6.54 billion. Both figures were somewhat better than some expected, although many are calling them “mixed.” Growth was 27 percent year over year. Expenses and costs were higher and some investors are expressing disappointment; Google shares are down almost 5 percent […]

Google had a strong Q1 with $8.58 billion in gross revenue. Net revenue was $6.54 billion. Both figures were somewhat better than some expected, although many are calling them “mixed.” Growth was 27 percent year over year. Expenses and costs were higher and some investors are expressing disappointment; Google shares are down almost 5 percent in after-hours trading.

Here are some highlights from from the release:

- Revenues – Google reported revenues of $8.58 billion in the first quarter of 2011, representing a 27% increase over first quarter 2010 revenues of $6.77 billion. Google-owned sites were responsible for 69 percent of total revenues, a 32 percent increase over first quarter 2010 revenues of $4.44 billion.

- Google’s AdSense programs were responsible for $2.43 billion, or 28 percent of total revenues.

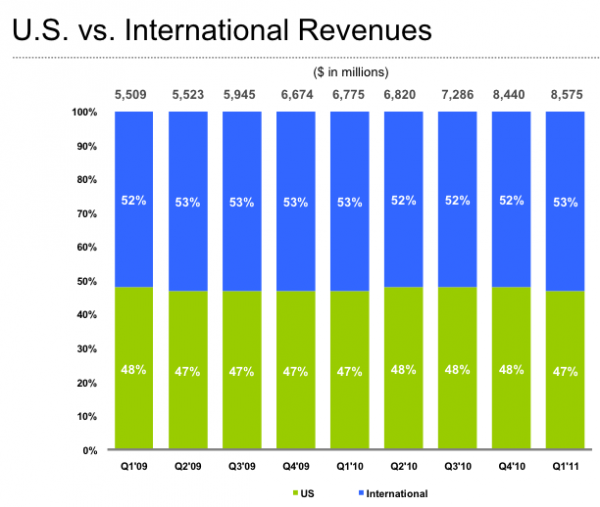

- Markets outside the US generated $4.57 billion, representing 53% of total revenues, which is basically flat YoY. Revenues from the UK were $969 million or 11 percent of Q1 revenues, down slightly from a year ago.

- Paid Clicks – grew approximately 18 percent YoY and 4 percent vs. Q4 2010.

- Cost-Per-Click – grew about 8 percent vs. Q1 2010 but only 1 percent vs. Q4 2010.

- TAC – Traffic Acquisition Costs increased to just over $2 billion and were 25 percent of ad revenues in Q1. Most of this is AdSense.

Earnings call:

The call and earnings release are beset by technical problems: Google has gone back to Windows Media and Real Player for the webcast, abandoning the superior YouTube experience. In addition, earnings slides are not downloading. I’ve joined the call late because of these technical problems.

Google CFO Patrick Pichette is leading the call. Larry Page isn’t there (he was apparently at the very beginning, which I missed.) Pichette is joined by Product SVP Susan Wojcicki and Commerce & Local head Jeff Huber, as well as head of sales Nikesh Arora. (Their “performance” strikes me as less polished than when Schmidt and Rosenberg were on previous calls.)

As mentioned, I missed the beginning but there appears to have been little or no discussion of privacy and the FTC privacy settlement regarding Buzz. I’m sure the ITA acquisition was mentioned but no one seems to be talking about it during Q&A.

In general, financial analyst questions seem to be more skeptical than normal. Many of them are focused on increasing costs and employee-related expenses as well as questions surrounding growth opportunities.

Jeff Huber said in response to a question about Google’s access to social data that they are important to Google but only a portion of all 200+ signals that Google is using in search.

Pichette is straining somewhat to convince analysts that Google is going to control expenses. He’s also emphasizing that Google is growing and has lots of growth ahead.

Pichette addressed a question about employee bonuses being tied to success in social. He said it reflected that Google was making social a priority but wouldn’t comment beyond that.

Huber declined to quantify the value of a mobile user but reiterated that mobile was a significant priority for Google. He cited a range of mobile ad formats as evidence of potential for the market. Huber added that there are 350,000 Android activations per day on a global basis.

There’s lots more coverage of the earnings announcement and the call on Techmeme.

Contributing authors are invited to create content for Search Engine Land and are chosen for their expertise and contribution to the search community. Our contributors work under the oversight of the editorial staff and contributions are checked for quality and relevance to our readers. The opinions they express are their own.

Related stories

New on Search Engine Land