Report Affirms Strong Q4 Search Growth In 2011, Offers Additional Insights

Marketers have had a couple weeks to digest their fourth quarter numbers and assess their successes and failures from a period that can be a whirlwind, particularly in the retail sector. Now, with Google’s Q4 earnings report and Yahoo’s out, we’re getting a chance to compare our own performance to data put out by some […]

Marketers have had a couple weeks to digest their fourth quarter numbers and assess their successes and failures from a period that can be a whirlwind, particularly in the retail sector. Now, with Google’s Q4 earnings report and Yahoo’s out, we’re getting a chance to compare our own performance to data put out by some of the major agencies and technology platforms.

Earlier this month, we released the RKG Digital Marketing Report with this in mind. Our goal is that it serves as a credible benchmark for advertisers who don’t enjoy the luxury of viewing results across multiple sites with multiple channels each. In our report, we offer our insights and data for paid search, SEO, and Facebook, as well as comparison shopping engines and multi-channel attribution.

We’ve covered the big trends, but we also tried to uncover some subtler ones, a few of which we think you’re unlikely to see anywhere else.

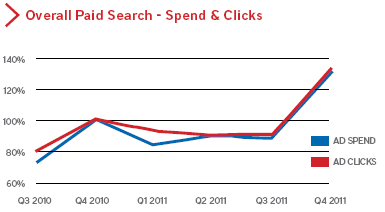

Generally, RKG’s Q4 results are directionally in line with the emerging consensus out there on the higher level metrics. We saw paid search spend growth accelerate in Q4 to a 31% year over year rate, up from 21% in Q3.

Generally, RKG’s Q4 results are directionally in line with the emerging consensus out there on the higher level metrics. We saw paid search spend growth accelerate in Q4 to a 31% year over year rate, up from 21% in Q3.

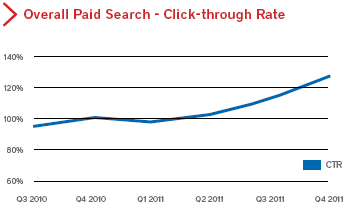

A significant increase in click-through rates was the primary driver, while cost-per-click actually fell 1.4% Y/Y. With revenue per click increasing modestly, our advertisers enjoyed an 8% increase in return on ad spend.

Increased mobile traffic, which has lower click costs, is certainly a contributor here, but we also have to consider what ultimately enables higher CPCs: higher revenues per click. We only see RPC increasing 2.6% Y/Y on Google in Q4 and that serves as a significant constraint on CPC.

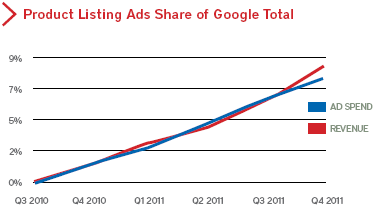

Google’s Product Listing Ads format, which migrated to AdWords and shifted to a CPC model in the Fall of 2010, generated 8% of Google spend for the quarter and, for some advertisers, represented a larger traffic segment than Bing and Yahoo combined.

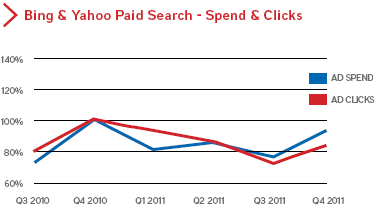

Even though we see Bing and Yahoo making some strides, our figures for them seem to be a little more pessimistic than those we’ve seen elsewhere. In Q4, our combined spend for the two engines was down 6.1% Y/Y, an improvement from an 8.7% Y/Y decline in Q3.

Our revenue per click was roughly 23% higher though, allowing CPCs to rise 12% while our advertisers took home a 10% higher ROAS. Click-through rates did improve on Bing and Yahoo, but not to the same extent as we saw on Google.

At least part of the problem for Bing and Yahoo is a continuing decline in traffic from its search partners. Last fourth quarter, Bing and Yahoo generated over 28% of their traffic from partners, but that has fallen steadily to 21% in Q4 2011. This helps advertiser revenue per click, but if adCenter is unable to deliver much additional ad inventory for subsequently raised bids, we see our ROAS increase, rather than volume.

It’s important to point out that we are now comparing to post-Search Alliance numbers and, given that the Alliance appeared to hurt Yahoo traffic at the time, we would expect a growth rate improvement for that reason alone.

Also, there may be some upside to these numbers as our analysis factored out brand keyword performance to limit the impact of extrinsic variables like offline media buys. Unfortunately for advertisers, we saw brand CPCs soar on Bing and Yahoo.

In the end, we see Google increasing its dominance it paid search, taking nearly 87% of clicks. On the organic side, we see Google with an 84% share, giving us all a couple more reasons to scratch our heads at comScore’s figures. Google is losing some of its advantage in CPCs commanded, but again, mobile is factor here and Bing and Yahoo have almost no mobile share to speak of.

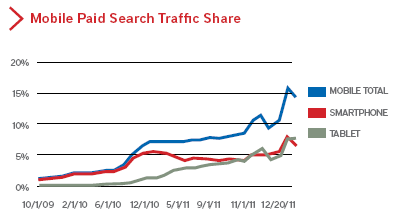

Speaking of mobile, by the end of the quarter we saw traffic from smartphones and tablets generating over 14% of paid clicks, but for the entire quarter, mobile share was just under 10%. This was right in line with our organic search figures which also pegged mobile at 10%.

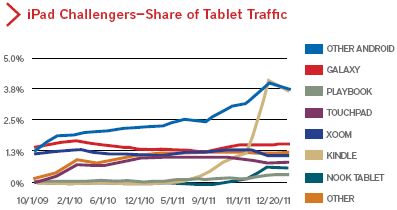

Tablets are the major driver here — even though the “mobile” moniker may be inappropriate for them — and we saw tablets overtake smartphones in December. The iPad remained dominant with a Google-esque 88% share of PPC tablet traffic, but the Kindle Fire was able to carve out a solid niche for itself with nearly 4% of tablet traffic after Christmas.

While Facebook garnered increased attention and budget dollars from marketers, it largely remained a growth opportunity given the sheer scale of its traffic and its grasp on its users’ time online.

For our SEO clients, Facebook generated a little under 4% of referral traffic in Q4. Those running Facebook ads found that they were able to generate an average of 90% of their unique impressions on Facebook from paid activity.

As we move deeper into 2012, the importance of social media, particularly to SEO, looks like it will only grow by leaps and bounds. Google’s Search Plus update may have been as controversial as it was significant, but don’t expect Google to back down on this one, and if they can finally play nice with Facebook and Twitter, things will really get interesting.

On the paid search side, we are seeing the major Q4 trends continuing into the new year with strong spend growth fueled by CTRs giving advertisers a solid return on their investment.

Contributing authors are invited to create content for Search Engine Land and are chosen for their expertise and contribution to the search community. Our contributors work under the oversight of the editorial staff and contributions are checked for quality and relevance to our readers. The opinions they express are their own.

Related stories