RKG: Q1 US Paid Search Up 17 Percent, Fueled By PLAs; Smartphones Drove Just 7 Percent Of Spend

RKG is out with its first quarter Digital Marketing Report today, showing US paid search spend increased 17 percent year-over-year. This echoes positive Q1 global growth trends reported by Covario (25 percent) and IgnitionOne (8 percent). Mobile devices and product listing ads (PLAs) both drove growth. Paid search spend growth slowed slightly after the holiday-fueled […]

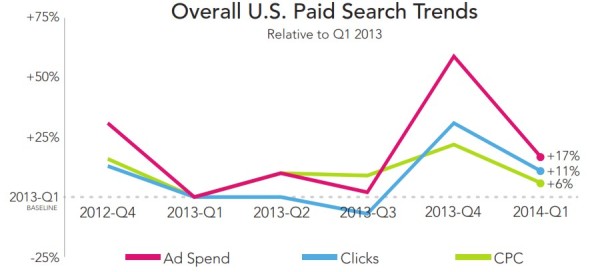

RKG is out with its first quarter Digital Marketing Report today, showing US paid search spend increased 17 percent year-over-year. This echoes positive Q1 global growth trends reported by Covario (25 percent) and IgnitionOne (8 percent). Mobile devices and product listing ads (PLAs) both drove growth.

Paid search spend growth slowed slightly after the holiday-fueled Q4, which saw 19 percent year-over-year growth. Clicks rose 11 percent, while CPCs were up 6 percent compared to the previous year.

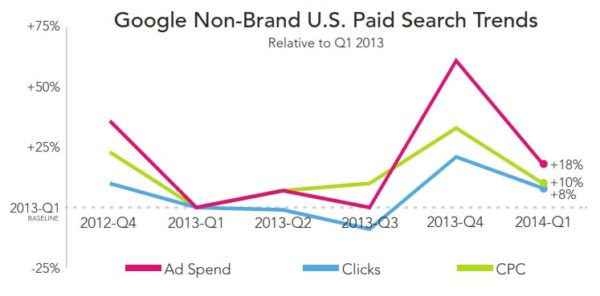

Google’s growth trends reflect those of the overall market, with year-over-year growth slowing slightly from 19 percent in Q4 to 17 percent in Q1. Isolating non-brand Google traffic, ad spend growth was above overall levels at 18 percent, while CPCs increased 10 percent. Non-brand clicks on Google grew more slowly than the overall market, coming in at 8 percent.

Google’s growth trends reflect those of the overall market, with year-over-year growth slowing slightly from 19 percent in Q4 to 17 percent in Q1. Isolating non-brand Google traffic, ad spend growth was above overall levels at 18 percent, while CPCs increased 10 percent. Non-brand clicks on Google grew more slowly than the overall market, coming in at 8 percent.

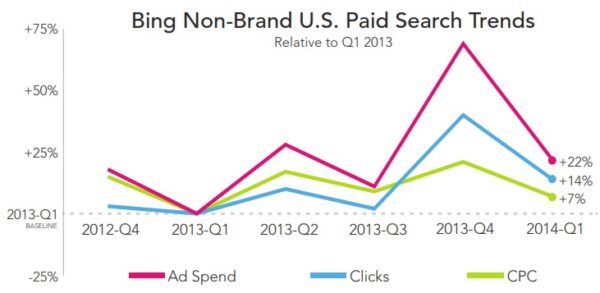

Bing Ads spend growth fell back in line with the industry averages after experiencing large gains throughout 2013 among RKG’s client set. In Q1, ad spend on Bing Ads rose 17 percent, clicks increased 16 percent and CPCs ticked up just 1 percent compared to a year ago. However, Bing Ads brand CPCs continue to be significantly higher than on Google.

Product Ads/Product Listing Ads Importance Keeps Growing

If you’re wondering how significant an impact image-based product ads have made, the chart below says it all. Among RKG’s client set, Bing Product Ads and Google Product Listing Ads continue to drive most of the growth in paid search. Ad spend on these formats rose 69 percent year-over-year. Clicks were up 51 percent. How does that compare to text ad growth? Text ads saw marginal increases with spend rising 6 percent and clicks up just 4 percent.

PLAs generated 29 percent of paid search clicks for retailers in Q1. Looking at non-brand clicks only, that number shoots up to 50 percent. The increase is due in part to Google showing PLAs above the main search results more often, as opposed to in the right rail. PLAs also continue to deliver better ROI (14 percent higher) than non-brand text ads. The median conversion rate was 50 percent higher for PLAs than non-brand text ads. CPCs were 8 percent higher than non-brand text ads.

Still in beta throughout the quarter, Bing Products Ads drove 12 percent of non-brand revenue from Bing Ads for clients in the program. That’s up from 8 percent of non-brand revenue at a lower ROI. Revenue per click (RPC) from Bing Product Ads was 79 percent higher than non-brand text ads in Q1, a huge improvement from an RPC that was 22 percent lower in Q4.

Smartphones Account For Just 7 Percent of Spend

Looking at mobile performance, tablets and smartphones each accounted for 18 percent of paid search clicks. Smartphones gained more share than tablets (6 percent vs. 5 percent respectively) “despite many RKG programs reducing smartphone bids to improve ROI over that time frame.” Smartphone CPCs fell to 35 percent of desktop levels. As a result of those lower CPCs, smartphones drove just 7 percent of ad spend among RKG’s ROI-focused clients. Tablets accounted for 20 percent of ad spend.

RKG reports that smartphone RPC, is making progress, however, rising from 23 percent of desktop in Q1 of last year to 34 percent in Q1 2014.

For a lot more paid search results as well as organic search and social results, the full report is available for download here.

Contributing authors are invited to create content for Search Engine Land and are chosen for their expertise and contribution to the search community. Our contributors work under the oversight of the editorial staff and contributions are checked for quality and relevance to our readers. The opinions they express are their own.

Related stories

New on Search Engine Land