Study: 66% Of Consumers Would Recommend A Local Business Based On Special Offers

In March and April, we (BrightLocal) published the findings of Parts 1 and 2 of the Local Consumer Review Survey 2012. The data and charts below are the 3rd and final installment of this survey. About Local Consumer Review Survey 2012 This online survey was conducted between 15th January – 1st March 2012. A set […]

In March and April, we (BrightLocal) published the findings of Parts 1 and 2 of the Local Consumer Review Survey 2012. The data and charts below are the 3rd and final installment of this survey.

About Local Consumer Review Survey 2012

This online survey was conducted between 15th January – 1st March 2012. A set of 18 questions were put to a survey panel of 4,500 local consumers located in US, Canada and UK. We received 2,862 respondents.

This is the 2nd wave of the Local Consumer Review Survey. The 1st wave of this survey was conducted in late 2010/early 2011. We compared results between the two waves (2010-2012) to determine any change in consumer attitudes and behaviour.*

Recap: Part 1 & Part 2 Of Local Consumer Review Survey 2012

Part 1 dealt with the consumption of online reviews and the influence they have on consumer behaviour and purchase of local business services. You can view the key findings and analysis here or read the full set of findings on the BrightLocal.com research portal.

See findings from Local Consumer Survey 2012 – Part 1

Part 2 dealt with Local Business Types, online ‘Reputation’ and building trust through online reviews.

See findings from Local Consumer Survey 2012 – Part 2

In Part 3 of the survey we ask 5 questions relating to consumers propensity to recommend a local business, which channels they actively use and what factors are likely to encourage them to recommend a business to people they know.

5 Questions

- Select the Business Types you have/would recommend to (people you know) if you had a good or bad experience?

- In the last 12 months have you recommended a local business by any of the following methods?

- Which of these factors would make you more likely to recommend a local business to people you know?

- Would you be more likely to recommend a local business if they had a good value offer or discount?

- Would you be more likely to promote a local business if you could benefit personally from doing so?

Q1. Select the business types you have recommend to people you know if you had a good or bad experience? (select as many as you like)

Key Findings:

- 65% of people have recommened a Restaurant or Cafe

- 49% have recommended a Doctor / Dentist

- 43% have recommended a Hotel, B&B or Guest House

Analysis

Consumers ar prepared to recommend any local business they use as long the experience warrents it. Some business types are more likely to be shared than others due to their nature – i.e. people got to restaurants every week and so there are more experiences to share; doctors and dentists provide such a critical and personal service that people don’t want to pick one at random from yellow pages so ask their friends for recommendations etc…

Even at the business types at the right hand end of the chart have high relative scores. About 16% have recommended their Yoga Class/ Alternative Therapy, but what percentage of the poulation actually uses these services? I would guess that 16% was a very high relative score for this particular sector.

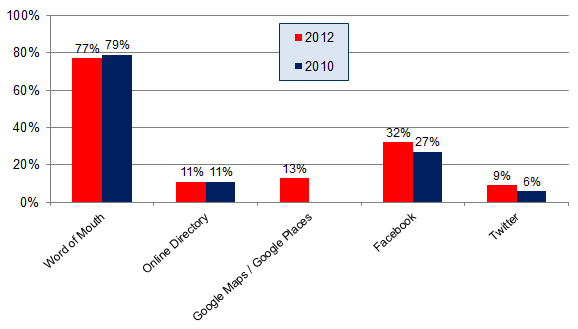

Q2. In the last 12 months, have you recommended a local business to people you know by any of the following methods?

Key Findings

- The number of people sharing advice via WoM has dropped from 79% to 77%

- 32% of people now make recommendations via Facebook – up 5% on 2010

- 13% of people share recommendations/reviews on Google Maps/Google Places

- Only 9% of people share recommendations on Twitter

Analysis

Word of Mouth (WoM) still dominates other channels but Facebook is really growing as a force for sharing experiences and recommendations of local businesses.

While WoM remains very high, it’s increasingly apparent that people are using a wider range of channels to share their experiences. The average ‘channels per respondent’ figure rose from 1.23 (2010) to 1.42 (2012)

We added in Google Places/Google Maps as a distinct option in this year’s survey (to make it distinct from ‘other directories’) which accounts for some, not all, of the increase.

As the 3rd most used channel, Google Places outperforms twitter by nearly 50%. Given the wider popularity and daily use of Twitter this is surprising; however Google Places is only about ‘Local’ and this focus means it’s a more regularly used channel than Twitter for sharing ‘local experiences’.

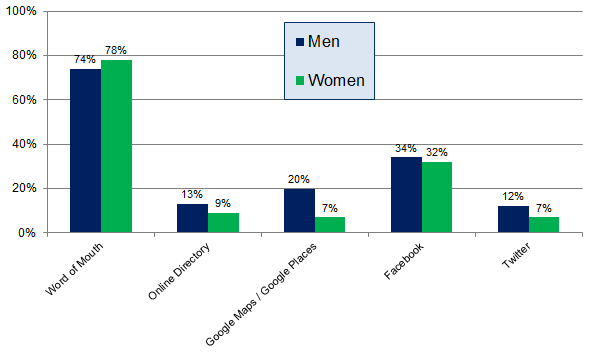

Chart: Men vs Women

Key Findings:

- Men use more channels to share their experiences than women – avg. channels per user = Men 1.53 vs. Women 1.33.

- 20% of Men share via Google Places vs. 7% of Women.

- 78% of women share via WoM vs. 74% of Men.

Analysis

Men appear to be embracing other communication channels more than women to share their experiences. Interestingly 20% of men have used Google Places to recommend a local business – nearly 3x more than women.

Q3. Which of these factors would make you more likely to recommend a local business to people you know?

Key Findings:

- 65% of respondents said that they would recommend a business which provides Professional & Reliable service (vs. 60% in 2010).

- 45% said they would recommend a business which provides Good Value service.

- 45% said they would recommend a business which was Friendly & Welcoming.

- Just 16% would recommend a business because they were asked to do so.

Chart: Men vs. Women

Key Findings:

- Women are more inclined to recommend a business than men, and for a variety of reasons.

- For Men, Professional & Reliable service is the most significant factor by some way (65% vs. 39% for cheap pricing).

- 46% of Women are more likely to recommend a business is they have a special offer vs. just 27% of Men.

Q4. Would you be more likely to recommend a local business to people you know if they had a good value offer or discount?

Key Findings:

- 66% of people would recommend a business (which has a special offer) – vs. 52% from 2010

- 96% of people would consider recommending a business – vs. 89% in 2010

- Only 4% of people said ‘No’ they would not recommend a business

Analysis

It appears that consumers are increasingly swayed by special offers and promotions – maybe a sign of the tough economic times. In 2012, we see a significant jump in consumers’ propensity to recommend a business which has a good value special offer.

Local business owners should use special offers intelligently to keep existing customers returning and also as a tool to generate recommendations and ‘talkability’ about their service.

Chart: Men vs. Women

Key Findings:

- 98% of Men would recommend a business which has a good special offer vs. 93% of Women

Analysis

Both sexes are keen on special offers but Men have greater propensity to tell their friends & colleagues about it (brag about it even?!)

Q5. Would you be more likely to promote a local business to people you know if you could benefit personally from doing so?

Key Findings:

- 35% of consumers would recommend a business if they benefited from it – vs 41% in 2010.

- 40% of consumers might recommend a business if they benefited from it – vs 27% in 2010.

Analysis

The 2012 results show that more consumers are open to the idea of promoting a business if they could benefit directly. However, respondents were less keen to provide a definite answer with 49% saying ‘Maybe’ or ‘Unlikely’.

It’s obvious that the nature and scale of the incentive plays a significant part in whether a consumer does or does not promote a business. If a local business owner is able to calculate the value of a new customer and a cost per lead they would be willing to pay, then this provides a budget level for incentivising existing customers.

Being ‘generous’ with this incentive could create a powerful new acquisition tool for their business.

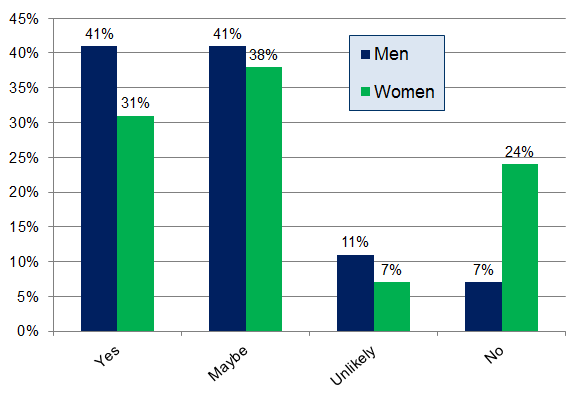

Chart: Men vs. Women

Key Findings:

- 41% of men would recommend a business if they could benefit directly vs. 31% of women.

- 24% of women would definitely not recommend a business vs. just 7% of men.

Analysis

Again, men are more inclined to recommend a business and the potential to benefit personally amplifies this. Local business owners should actively promote their offers to all customers but extra attention/focus on their male customers may see a greater return on effort.

Smart business owners will create offers which appeal to the different sexes, and they may have to provide greater value to their female customers in order to spark them into recommending their business.

- 24% of women would definitely not recommend a business vs. just 7% of men.

Local Consumer Review Survey 2012 – White Paper

We (BrightLocal) will be publishing the full set of findings from the Local Consumer Review Survey as a white paper. This will include the full set of findings from Parts 1,2 and 3 plus additional charts for Age Group comparison and Gender comparisons. These charts will be available for the 3rd party use (online and offline).

If you would like to receive the White Paper when it’s ready then please register your interest here.

Contributing authors are invited to create content for Search Engine Land and are chosen for their expertise and contribution to the search community. Our contributors work under the oversight of the editorial staff and contributions are checked for quality and relevance to our readers. The opinions they express are their own.

Related stories

New on Search Engine Land