Google Q3: $7.29 Billion, Display And Mobile Showing “Momentum”

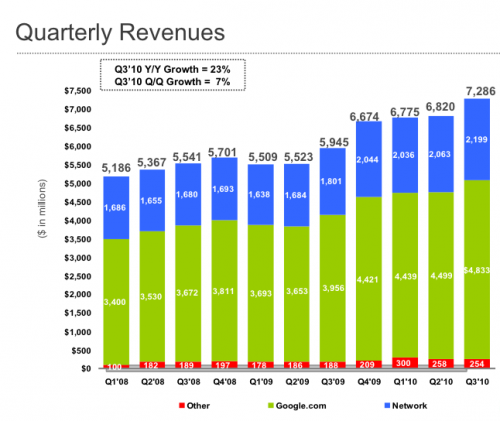

Google said it earned $7.29 billion in Q3 2010, an increase of 23% compared to the same period in 2009. Quarterly growth was 7%. Although these numbers aren’t broken out (update: see below), the Eric Schmidt quote included in the press release highlighted display and mobile as having “significant momentum.” Here’s the quote: “Google had […]

Google said it earned $7.29 billion in Q3 2010, an increase of 23% compared to the same period in 2009. Quarterly growth was 7%. Although these numbers aren’t broken out (update: see below), the Eric Schmidt quote included in the press release highlighted display and mobile as having “significant momentum.”

Here’s the quote:

“Google had an excellent quarter,” said Eric Schmidt, CEO of Google. “Our core business grew very well, and our newer businesses — particularly display and mobile — continued to show significant momentum. Going forward, we remain committed to aggressive investment in both our people and our products as we pursue an innovation agenda.”

And now more detail (verbatim) from the release with a few of the earnings presentation slides thrown in to visually spice it up:

- Revenues – Google reported revenues of $7.29 billion in the third quarter of 2010, representing a 23% increase over third quarter 2009 revenues of $5.94 billion.

- Google Sites Revenues – Google-owned sites generated revenues of $4.83 billion, or 67% of total revenues, in the third quarter of 2010. This represents a 22% increase over third quarter 2009 revenues of $3.96 billion.

- Google Network Revenues – Google’s partner sites generated revenues, through AdSense programs, of $2.20 billion, or 30% of total revenues, in the third quarter of 2010. This represents a 22% increase from third quarter 2009 network revenues of $1.80 billion.

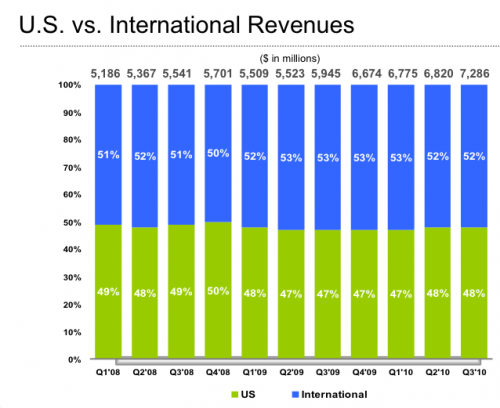

- International Revenues – Revenues from outside of the United States totaled $3.77 billion, representing 52% of total revenues in the third quarter of 2010, compared to 52% in the second quarter of 2010 and 53% in the third quarter of 2009 . . .

- Paid Clicks – Aggregate paid clicks, which include clicks related to ads served on Google sites and the sites of our AdSense partners, increased approximately 16% over the third quarter of 2009 and increased approximately 4% over the second quarter of 2010.

- Cost-Per-Click – Average cost-per-click, which includes clicks related to ads served on Google sites and the sites of our AdSense partners, increased approximately 3% over the third quarter of 2009 and increased approximately 2% over the second quarter of 2010.

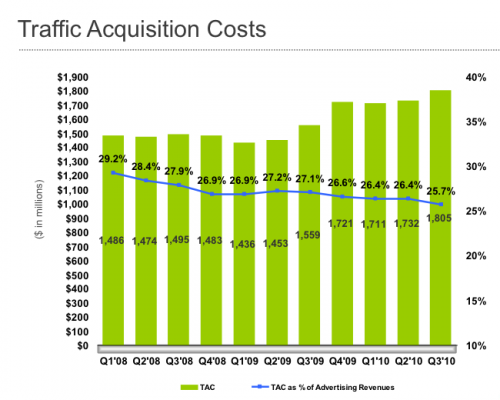

- TAC – Traffic Acquisition Costs, the portion of revenues shared with Google’s partners, increased to $1.81 billion in the third quarter of 2010, compared to TAC of $1.56 billion in the third quarter of 2009. TAC as a percentage of advertising revenues was 26% in the third quarter of 2010, compared to 27% in the third quarter of 2009. The majority of TAC is related to amounts ultimately paid to our AdSense partners, which totaled $1.52 billion in the third quarter of 2010. TAC also includes amounts ultimately paid to certain distribution partners and others who direct traffic to our website, which totaled $285 million in the third quarter of 2010.

Other interesting details:

- Cash – As of September 30, 2010, cash, cash equivalents, and marketable securities were $33.4 billion.

- Headcount – On a worldwide basis, Google employed 23,331 full-time employees as of September 30, 2010, up from 21,805 full-time employees as of June 30, 2010.

If Google has a bang-up Q4 it could approach $30 billion in total revenue for 2010.

Update: Google’s Jonathan Rosenberg disclosed the following revenue numbers:

$2.5 billion in display (non-text) and $1 billion in mobile ad revenues. Google’s CFO said there was some small overlap in these numbers (i.e., AdMob).

Contributing authors are invited to create content for Search Engine Land and are chosen for their expertise and contribution to the search community. Our contributors work under the oversight of the editorial staff and contributions are checked for quality and relevance to our readers. The opinions they express are their own.

Related stories

New on Search Engine Land