Marriage Equality, Healthcare & Low Unemployment: How Search Marketers Can Make A Difference This Tax Season

Tax marketers, pay attention! Columnist Purna Virji discusses some developments that may impact your search campaigns this year.

As the marketing world recovers from the Hunger Games-eque madness that was the holiday retail season, we know this rest period is but temporary. The next melee for paid search marketing is now upon us, in the form of tax season.

Many businesses that specialize in taxes or services that support tax filing have a similar marketing calendar to retail, in that most of the annual income happens over a span of three months. This puts a lot of pressure on a $9.3 billion industry to get it right.

This year, more than many recent years, current events are shaping new tax requirements, giving marketers an opportunity to highlight specific areas of assistance.

For example, with the passage of the Marriage Equality Act, many same-sex couples will be filing jointly for the first time. This is in addition to the over 2 million couples that already tie the knot in the US each year. Could you be the one to answer their questions when they do a search about this?

Let’s take a closer look at the events shaping the tax season this year.

1. Affordable Care Act

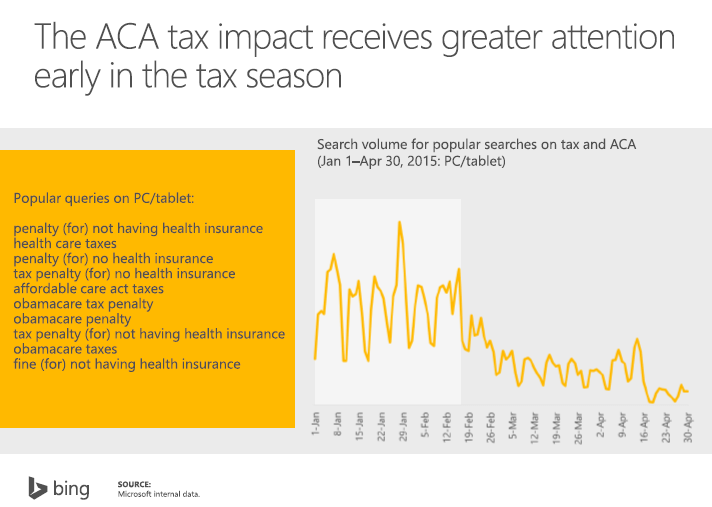

Healthcare coverage is now part of your tax return. Per the IRS, approximately one in five taxpayers last tax season reported that they did not have qualifying health coverage all year.

Twelve million filers claimed a healthcare coverage exemption, and over three million filed Form 8962 to get a premium tax credit. The tax penalty for not having health insurance will more than triple for 2015, making this tax season significant for many filers.

What this means for tax marketers

Zero in on terms and write ads which target keywords these filers will be searching on, such as:

- Obamacare tax requirements.

- Affordable Care tax info.

- Forms for ACA tax credit.

2. Marriage Equality Act

Anticipate newly married couples having questions about the tax benefits available to them. According to Accounting Today, members of a married couple can make unlimited gifts to their spouses without gift taxes, can inherit a spouse’s property without paying estate taxes and a surviving spouse can roll over their spouse’s IRA.

What this means for tax marketers

Capture curious filers with keywords targeting their needs, including:

- Marriage Equality tax questions.

- Married filing jointly.

- Tax benefits for married couples.

3. Low Unemployment Means Many New Filers This Year

The unemployment rate remains low across the US. The US economy is estimated to have added 2.3 million jobs in 2015 alone. More jobs and fewer unemployment checks will lead to many more people filing taxes this year than in the past (Unemployment benefits are considered taxable income, but many don’t file taxes). Many filers will be first-timers, with questions they need answered.

What this means for tax marketers

- If you have a local office or multiple offices, add location and phone numbers to your ads (in paid search ad extensions to your paid search ads to support easy access).

- Sympathize with the overwhelming feeling that new tax filers may feel, and create messaging that reassures.

- Bing (my employer) research shows that many sitelink terms are under-used but have high ad quality (meaning that they draw a lot of clicks).

- For example, “Tax Calculator” is one that’s particularly neglected by advertisers but would provide a big benefit to new tax filers. This is aligned with Bing’s search trend performance analysis, which found that “tax calculator” and other variations of the term were among the most popular search terms.

- Test ad copy that’s proven itself; in Bing’s research, they noted the top performing copy combinations across devices.

In Summary

Profound changes across our country are being realized in the most concrete way on our tax forms, and the opportunity to help confused tax filers is bigger than ever. Tax marketers should be prepared for the first big surge of tax searches in early January, as shown in the Bing Ads Tax Insights presentation.

If you’re a tax season marketer, what changes are you anticipating for this year?

Contributing authors are invited to create content for Search Engine Land and are chosen for their expertise and contribution to the search community. Our contributors work under the oversight of the editorial staff and contributions are checked for quality and relevance to our readers. The opinions they express are their own.

Related stories