Insights from our 2017 holiday retail survey

Retail marketers weighed in on what they did differently this holiday season.

By most accounts, the holiday shopping season was an e-commerce success, with final tallies beating analyst estimates. Earlier this month, we asked e-commerce teams about their holiday marketing strategies — planning, budgeting and expectations — and what they did differently this year from last year.

Nearly 100 respondents shared their feedback. The majority (57 percent) of respondents worked in-house, while 43 percent were at agencies. The client/company size represented skewed to the smaller end, with 60 percent of respondents working with companies with annual revenues below $25 million. Nearly 13 percent represented companies with annual revenues over $500 million.

There were several interesting findings from the survey. Here are some of the highlights from the final results.

Holiday budgets rose across most platforms

Overall, search and social budgets increased this holiday season over the previous year, with 70 percent of respondents saying they increased budgets on both channels. Display retargeting budgets for more than half of respondents (56 percent) also increased year over year. Sixty-five percent used dynamic retargeting ads this holiday season.

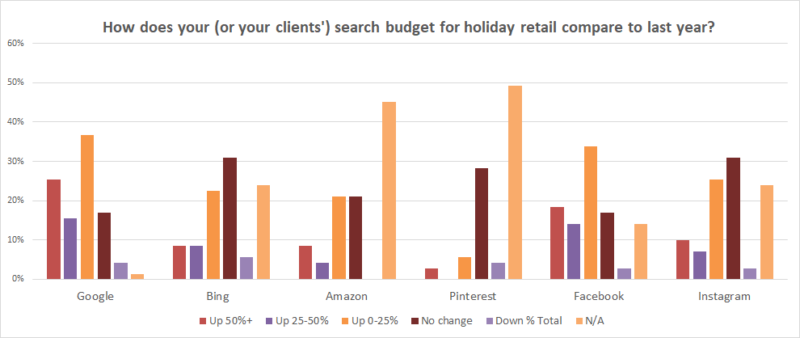

More than three-quarters of respondents said Google budgets rose year over year, with 25 percent saying Google budgets rose by more than 50 percent. Nearly 40 percent increased Bing budgets this holiday season, and 66 percent boosted Facebook ad budgets year over year.

Pinterest advertising remains hard to scale, and that’s reflected here. Just 8 percent of respondents increased their Pinterest ad budgets over last year’s this season, and half aren’t using the platform at all.

Amazon has been rapidly increasing its ad offerings for sellers on the platform. Among respondents, 36.5 percent are selling on Amazon, and of those, 34 percent increased their ad budgets this holiday season.

Holiday planning is primarily a fall sport, but many plan year-round

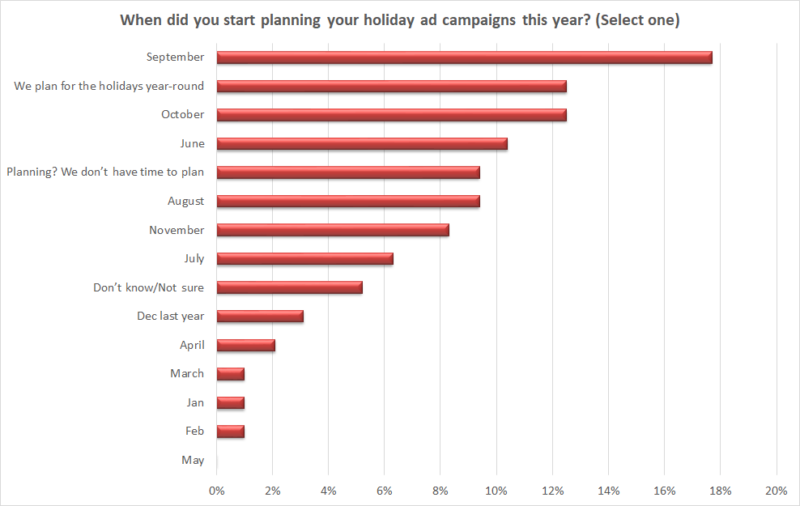

When it comes to planning holiday marketing strategies, September was the most popular month to get cracking, with nearly 18 percent of respondents starting then. Just over 12 percent of respondents said they plan year-round. Just as many said they don’t have time to plan (this gives me anxiety) as those who said they start planning in August.

For 56 percent of respondents, planning started at the same time it did the year before, while 20 percent started planning earlier.

These and many more findings from the survey — challenges, tactical changes and consumer behavior changes, to name a few — were the basis of a lively discussion packed with jewels of insights for retailers in a webinar with Brad Geddes of Adalysis, Elizabeth Marsten of CommerceHub and Aaron Levy of Elite SEM. You can find the webinar, Holiday Retail Search Strategies 2017: What worked, what didn’t, on demand (registration required).

Contributing authors are invited to create content for Search Engine Land and are chosen for their expertise and contribution to the search community. Our contributors work under the oversight of the editorial staff and contributions are checked for quality and relevance to our readers. The opinions they express are their own.

Related stories