Understanding How Your Brand Drives Google Shopping Campaign Traffic

Separating brand from non-brand traffic is not as straightforward in Google Shopping as it is for standard AdWords text ads, but columnist Mark Ballard has a solution.

In my experience, most retailers see segmenting brand and non-brand traffic as a necessity of running a paid search program; however, the rise of Google Shopping Campaigns and the Product Listing Ad (PLA) format has muddied the waters on these efforts.

Searches on a retailer’s own brand name tend to perform very differently from generic searches or searches that include product manufacturer names. Brand search is often purely navigational in nature or reflective of brand equity that has been generated through other channels.

While brand search can produce incremental paid search revenue, it is helpful to assess its performance in that context and separately from non-brand search.

Because text ads are based on an advertiser’s chosen keywords, it is relatively straightforward to channel searches on the advertiser’s brand name to one set of ads and non-brand searches to another.

PLAs, on the other hand, are feed-based and advertisers cannot simply tell Google, “If you see my brand name in a user’s query, run these PLAs. If not, run these.”

The good news is that advertisers can segment brand and non-brand PLA traffic with a little bit of effort, some negative keywords, and by making use of the campaign prioritization options introduced with Shopping Campaigns last year.

We’ll walk through that process below and also examine how important branded queries are to PLAs in general and compared to text ads.

Segmenting Brand From Non-Brand PLAs

Confining brand queries to one set of PLAs and non-brand queries to another, to track, analyze and bid them separately, involves three basic components:

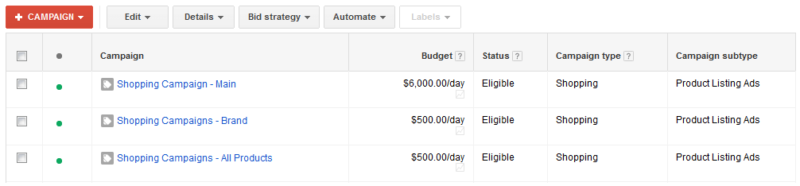

- Creating at least two separate Google Shopping Campaigns

- Applying brand terms as negative keywords to one set of Shopping Campaigns

- Setting the campaign priority higher for the campaign with the brand term negatives

In creating a Google Shopping Campaign designated for brand traffic, an advertiser may choose to duplicate the potentially complex targeting structure of their main Shopping Campaign or they could simply target All Products (more on this question below).

Applying brand terms as negatives to the Shopping Campaign designated for non-brand PLA traffic should be a familiar process for any experienced, paid-search advertiser.

One special consideration for adding brand terms as negatives is that it may be particularly important to include misspellings, which are common for brand searches, but still behave and should be weighed differently than non-brand searches.

Also, retailers with relatively generic-sounding brand names face the additional challenge of determining where the line is between brand and non-brand, but they likely will have faced this issue before in creating text ad keywords or negatives.

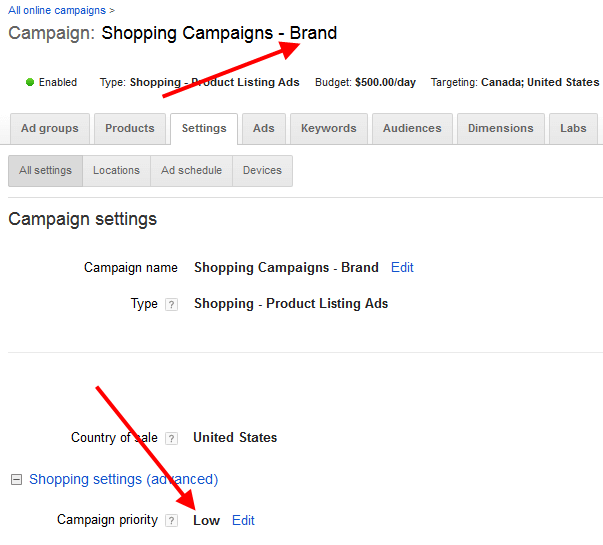

The final major component of segmenting brand and non-brand PLA traffic is to adjust the campaign priority settings to make the brand campaign a lower priority than the non-brand campaign.

Campaign priority was a new feature for PLAs when Shopping Campaigns were introduced, and importantly, it does not affect how Google determines the relevancy of a product for a particular query. Instead, it tells Google which campaign to serve a relevant product from if it is eligible to serve from multiple campaigns.

By making the non-brand campaign a higher priority than the brand campaign, non-brand queries should trigger the non-brand campaign products, even if the same product exists in the brand campaign at a higher bid.

I used the word “should” above rather than “will” because if there is greater product coverage in the brand campaign than the non-brand campaign, advertisers may find some spillover of non-brand traffic into their brand campaigns.

This scenario could happen if the brand campaign is set to target All Products for the sake of simplicity, while the non-brand campaign excludes some products that perform poorly when not triggered by a brand query.

However, by staying on top of Google search term reports and adding negatives for any slippery non-brand queries that find their way to triggering brand PLAs, paid search advertisers can effectively put a stop to this behavior.

On the other side of things, brand negatives work as advertised and are effective at keeping brand queries from triggering PLAs from our designated non-brand PLA campaigns.

How Big Is Brand For PLAs? It’s Not Just The Clicks That Count

How important it might be to segment brand from non-brand PLA traffic will vary from retailer to retailer, but most will likely find that brand searches are far less likely to trigger PLAs than text ads.

At my company, Merkle | RKG, we find that about 6% of PLA clicks are produced by brand queries for a set of large, well-known retailers. For text ads, brand share of traffic tends to run between five and ten times higher.

This makes sense when you consider that the most common brand searches are navigational queries that include only the name of the retailer (‘amazon’) or even their web address (‘amazon.com’). These types of queries are unlikely to trigger PLAs.

At the same time, average click-through rates for PLAs are roughly twice as high as those for text ads for non-brand queries. So, even when PLAs aren’t completely pushing text ads off the page, they have been taking a larger and larger share of non-brand clicks over time.

Although brand is a relatively small contributor to PLA click volume, its relatively strong click-through and conversion rates can have much larger impacts on how an advertiser perceives those particular metrics. If brand and non-brand are grouped together, this could lead to overspending on the non-brand traffic.

It is well worth the trouble of pulling a search term report to see how big brand traffic is when it comes to driving PLA traffic and conversions for your program.

What Else Can We Use This Approach For?

The whole notion that we would set a campaign we expect to perform better than others at a lower priority may sound counterintuitive, but it’s just a function of the lack of keyword targeting in Shopping Campaigns, and we have to think a bit backwards when we are using negative rather than regular keywords to segment our ads.

This way of thinking, however, opens up some additional possibilities for controlling and, more importantly, growing our PLA programs. Many retailers will find that the use of their brand name in queries that trigger PLAs is trivial, but few will find that the specificity of the query is irrelevant or that it makes no difference whether the query includes the manufacturer brand name.

Accounting for other search query characteristics like these would follow a similar logic and process as segmenting brand and non-brand. The key is to give higher priority to the campaigns designated for capturing poorer performing queries, thus, the ones that will have lower bids, and apply negatives appropriately for the query elements we are looking to funnel to other campaigns. We can then bid the campaigns we designate for better performing queries higher and capture more of only the best traffic.

With PLAs accounting for over half of non-brand Google search ad volume for retailers, according to the RKG Digital Marketing Report, sophisticated advertisers cannot view Shopping Campaigns as a set and forget program.

As with keyword-driven text ads, the quality of our PLA analysis, and ultimately, performance, depends on smart segmentation and ongoing active management that seeks to uncover new growth opportunities.

Contributing authors are invited to create content for Search Engine Land and are chosen for their expertise and contribution to the search community. Our contributors work under the oversight of the editorial staff and contributions are checked for quality and relevance to our readers. The opinions they express are their own.

Related stories

New on Search Engine Land