Deal Puts Microsoft Live Search On Dell Computers, Verizon Phones — Will It Help?

Tonight at CES Microsoft CEO Steve Ballmer made several announcements during his keynote address. In addition to a preview of the Windows 7 OS, Ballmer announced high-profile distribution deals for Live Search. We were unable to write about the deals earlier today due to an embargo. However, we covered a Reuters report that was issued […]

Tonight at CES Microsoft CEO Steve Ballmer made several announcements during his keynote address. In addition to a preview of the Windows 7 OS, Ballmer announced high-profile distribution deals for Live Search. We were unable to write about the deals earlier today due to an embargo.

However, we covered a Reuters report that was issued on one of the deals: a five-year search and advertising partnership with Verizon Wirelesss. The other search distribution agreement is a global “default search” deal with Dell. Microsoft has an official blog post here on the news.

Danny earlier put together the following discussion of the various PC partnerships among the leading search providers.

The Dell/PC Deal

The chart below shows the current distribution deals for various search engines, with share figures from Gartner for the third quarter of 2008:

| PC Maker | US Share | Worldwide Share | Search Partner | Deal Signed |

| Dell | 29.5% | 13.6% (2) | Microsoft | Jan. 2009 |

| HP | 25.7% | 18.4% (1) | Microsoft | June 2008 |

| Apple | 9.5% | – | Jan. 2003 | |

| Acer (Gateway, Packard Bell) | 8.9% | 12.5% (3) | Yahoo | Sept. 2006 |

| Toshiba | 5.6% | 4.6% (5) | Jan. 2007 | |

| Lenovo | – | 7.3% (4) | Microsoft | March 2007 |

Dell: Now partnered with Microsoft, which previously had said doing a deal with Dell was too costly. Had partnered with Google in 2006, a deal which produced some controversy because of how Dell pointed people hitting errors to pages dominated with Google ads (see Google & Dell’s Revenue-Generating URL Error Pages Drawing Fire for more). You can see an example of the Google Dell start page here. There’s a good chance existing Dell users will continue to use Google as a start page provider if they’ve customized this page in any way.

HP: Signed a deal with Microsoft last June, but the distribution didn’t begin until this month and is only for North America. HP was previously partnered with Yahoo in North America, in a toolbar deal signed in September 2006. The Yahoo deal to power Yahoo start pages for HP owners in Europe apparently continues.

Apple: Partnered to put Google into the Safari browser way back in 2003, but we’ve found no references to a formal deal being announced (Google sometimes doesn’t announce distribution deals, perhaps to avoid bringing consumer attention to the fact that it buys its way onto desktops). Google also has other deep integration with Apple, such as what our Apple Continues To Integrate Google (& AdSense) Into Software article from last August covers. Google CEO Eric Schmidt, of course, is also part of Apple’s board of directors.

Acer: Apparently remains partnered with Yahoo for global distribution, though a Yahoo Acer start page you used to find here in June 2008 no longer exists. Acer acquired Gateway and Packard Bell in October 2007. Google had a preexisting deal (PDF file) from November 2006 with Packard Bell that seems to continue, with the Google-Packard Bell start page here. Gateway also has a start page here, also through a November 2006 partnership, through it’s not clear if this involved desktop integration.

Lenovo: Partnered with Microsoft in March 2007, which ousted Google as Lenovo’s previous partner. Despite the Microsoft deal being signed in March 2007, Lenovo still cut a deal with Google in August 2007 to use Google as a partner for its Beijing 2008 Olympic Torch Relay project.

Toshiba: Is partnered with Google through a deal that was expanded in January 2007.

The Verizon Deal

Danny and I had a discussion earlier today about which deal was more significant and why. He believed the Dell deal would have greater potential impact and I expressed the view that the Verizon deal was potentially more significant. Regardless, both give Microsoft considerable, additional potential reach — on paper.

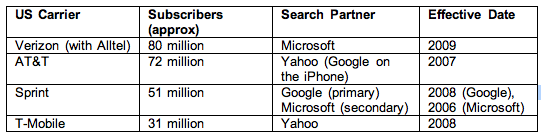

First, here’s a chart parallel to the one above reflecting the current state of deals with US mobile operators and their search vendors:

Given that Verizon is the largest American wireless carrier, following its acquisition of Alltel (valued at $28.1 billion), this distribution deal is a potentially major coup for Microsoft, which trails in mobile search — as it does on the desktop. The following chart reflects mobile search market share (comScore, 8/08) in the US:

The irony or paradox of the Verizon-Microsoft mobile search deal is that smartphones are where most of the mobile search activity is happening today. Yet those are the users that the carriers have the least amount of control over and where the “carrier deck” is either marginal or effectively non-existent. Users may simply open a browser and head to the “mobile internet,” visiting whatever sites and search engines they please.

The Verizon deal is, however, multi-faceted and involves WAP/mobile web search via m.live.com, the Live Search client application, as well as placement of a search box on the carrier deck in many instances. The press release describes it this way:

Depending on which device they use, customers will be able to use voice commands and typed queries and even select to use location-aware searches to receive highly relevant search results, including maps, directions, traffic information, information on local businesses, movie theatres and show times, gas prices and weather. In addition, customers will also get search results that include news and entertainment content such as downloadable full-track songs, videos and games. Verizon Wireless customers will be able to access Microsoft Live Search from a device’s home screen, by downloading an application or through Verizon Wireless’ Mobile Web service.

Much of this describes the content and functionality of the Live Search client, an upgraded version of which was also released this evening. My impression from speaking with Microsoft this morning was that the client would be pre-loaded on Verizon handsets, however it may still need to be downloaded in many instances. Google Maps for Mobile is Google’s competitive offering for smartphones. However, the Microsoft client offers a broader range of content types.

The billion dollar question here is whether the default deal will prompt Verizon users to adopt Live Search — or not. There will undoubtedly be some user adoption; the deal has the potential to boost Microsoft’s market share in mobile, but it’s not yet clear how much. Microsoft asserts that its search product is comparable in quality to Google and that it has a better shot at changing user behavior now than in the past. That may be more true of the Live Search client application than Microsoft’s WAP/mobile web search offering.

Mobile search behavior is relatively new and still evolving. Yet it’s remarkable in some sense (or perhaps not) how mobile search share generally tracks share on the PC.

The greatest benefit of the deal may come in the greater credibility and visibility for Live Search and adCenter among agencies and national advertisers. Suddenly Microsoft has access to a mobile population of roughly 80 million users, with all the corresponding targeting possibilities. The company indicated that it will be working closely with Verizon in a collaborative way on mobile advertising (search and display). There are also indications that Microsoft will get access to Verizon user data, especially highly accurate location information.

Microsoft of course wouldn’t discuss deal terms. When the rumor first surfaced that Microsoft was trying to capture the default Verizon search relationship from Google in November this is what Wall Street Journal said:

Microsoft has gotten the mobile carrier’s attention by offering a sweeter deal to put its search service and related advertising on Verizon phones. Microsoft is also offering more generous revenue sharing and a guarantee of substantially higher payments to Verizon, say people familiar with the matter.

Google has been in discussions for months with Verizon to make its search engine the default on most Verizon phones, according to these people.

Verizon is taking something of a risk with Microsoft, which has fewer advertisers than Google or Yahoo. However the carrier must have felt that the quality of the Microsoft mobile search user experience was competitive or it wouldn’t have made this five-year commitment. Cynics and skeptics might assert that Microsoft probably offered a better revenue sharing deal or more guarantees. However that would be speculation.

Regardless, this is a dramatic and aggressive move by Microsoft that seeks to prevent rival Google from becoming dominant in mobile search at such an early stage in the market’s development. Eventually mobile search will surpass search on the PC; it’s only a matter of time. Consequently now is the time for Microsoft to take such bold action if it hopes to be competitive in mobile search.

There’s more coverage and discussion at Techmeme.

Contributing authors are invited to create content for Search Engine Land and are chosen for their expertise and contribution to the search community. Our contributors work under the oversight of the editorial staff and contributions are checked for quality and relevance to our readers. The opinions they express are their own.

Related stories

New on Search Engine Land