First-page minimum bids continue to rise in wake of Google desktop SERP changes

Columnist Andy Taylor discusses AdWords bidding trends following Google's move to eliminate right-rail ads and show four top-of-page ads for some queries.

We’re just about a month out from Google’s sweeping changes to desktop SERPs, in which text ads were removed entirely from the right-hand rail and the number of text ads appearing above organic results increasingly grew to four, where there used to be three.

As we reported a couple of weeks ago, the overall impact of the change hasn’t been dramatic, with at most minimal shifts in CPCs and traffic.

Two observations included in our previous analysis were:

- Rising first-page minimum bids for non-brand text ads, as the total available ad inventory decreased from a maximum of 11 text ads per page to seven.

- Decreasing top-of-page minimum bids for non-brand text ads, as the total available ad inventory above organic results increased from three to four for some searches.

In the days since, we’ve seen first-page minimums continue to steadily increase, while top-of-page minimums appear to be back on the rise.

While it’s too soon to attribute these changes precisely to causes, these are the symptoms we would expect if advertisers did get more aggressive with paid search bids as a result of the changes.

Note: All data sourced from samples of Merkle advertisers, which range from medium to enterprise-level businesses.

First-page minimum bids headed up and to the right

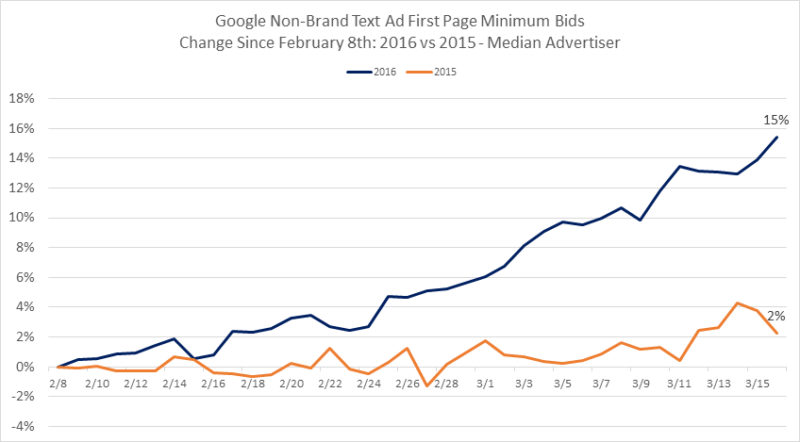

Looking at the median change from February 8 through March 16 for a sample of advertisers year over year, we find that first-page minimum bids continue to increase steadily since the removal of right rail text ads.

Looking at the first-page minimum change for 2015 over the same time frame, we find that there was a slight bump in first page minimum bids in mid-March last year.

However, using last year’s data as a gauge for the seasonality of these minimums for the sample studied, it appears most of the increases observed in 2016 seem tied to the desktop SERP changes, as opposed to seasonal increases.

Now, it’s very possible it’s just taking some time for these minimum bid estimates to get fully updated on Google’s end in light of the new auction limits and that there haven’t been any real changes in competition since the updates.

However, it’s also possible that at least some advertisers are upping bids in an attempt to get ads that fell off of the first page of results with the changes to begin showing on the first page again. Google makes this simple with their automated bid adjustments, which can push keyword bids up to the first page minimum. Thus, these steady increases could be linked to more aggressive competition arising out of the changes.

Not everyone could possibly be bidding to the first page all the time, though, or we would see constantly increasing minimums. If advertisers did start upping bids to remain on the first page in the wake of the SERP updates, bids are likely to plateau at some point as advertisers reach the absolute upper limits of how much they’re willing to pay for traffic.

Top-of-page minimum bids headed back up

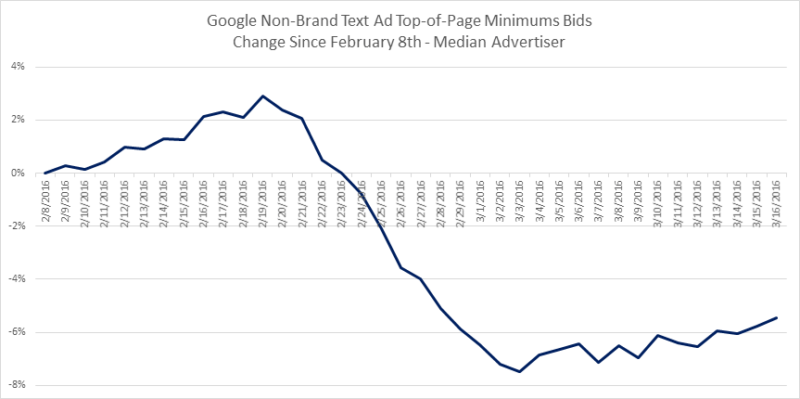

As mentioned earlier, top-of-page minimums declined after the SERP changes, as there are now more available ad slots at the top of the page, and these estimates continued to decline for about two weeks.

However, during the first week of March, top-of-page minimum bids began creeping back up and are still steadily climbing.

Again, because these estimates are provided by Google and may take time to fully update, and search behavior is ever-changing, this recent increase may not speak to the level of competition.

However, combined with the fact that first page minimum bids continue to rise, it also seems possible that advertisers are adjusting bids to get ads to show above the organic results.

Even though bottom ads have maintained most of the click share that went to ads on the side/bottom prior to the updates, top ads have still gained traffic share, which we’ll discuss in more detail later.

Therefore, advertisers may be bidding to the top of the page in order to garner more clicks, and this could in turn increase top of page bid estimates for advertisers.

CPCs up only slightly since updates

Looking at daily year-over-year CPC increases aligned for day of week, we see some slight acceleration in CPC increases over the past two weeks. However, the acceleration is slight enough to be reasonably tied to simple seasonality as a cause.

Many predicted that desktop CPCs would rise in the wake of Google’s updates, but a couple of factors likely play into why there hasn’t been a clear-cut increase.

Factors working against CPC increases

1. Google’s requirements to show on the first page and top of page only affect the CPC for some clicks

The role of first-page and top-of-page minimums in the auction is complicated and took me about 10 minutes of fast-paced speaking to explain at last year’s SMX Advanced. In short, however, there are minimum ad ranks required for advertisers to show above the organic results, as well as minimums for an advertiser to show at all. These ad ranks translate to minimum CPCs required for each advertiser to reach the first page of the results and to get to the top of the page.

First-page and top-of-page minimum CPCs might be a pure result of the level of competition. This means that the first page minimum is the bid required to beat out the ad rank of the last advertiser that’s getting featured on the first page, and the top of page minimum is the bid required to beat out the last advertiser being shown above the organic results.

However, for some auctions, these minimum CPCs are required to meet Google’s minimum ad rank, as opposed to beating out competitors, as Google itself requires minimum ad ranks for ads to show at the top of the results or to be featured on the first page at all. This ensures the quality of the ads that are presented to users.

Google’s documentation puts it like this:

The minimum Ad Rank required to appear above search results is generally greater than the minimum Ad Rank to appear below search results. As a result, the cost-per-click (CPC) when you appear above search results could be higher than the CPC if you appear below search results, even if no other advertisers are immediately below you.

For auctions where first page and top of page minimum CPCs are decided by Google’s minimum ad rank, as opposed to the ad rank of the next highest competition, the changes to the desktop SERP impact the CPCs for ads shown in the last position above the organic results and the last ad featured on the first page.

However, for auctions where these CPC floors don’t come into play for the price paid, these changes would not have had an impact on the CPC for the ads shown in those positions.

All of this is to say that the desktop SERP changes very likely directly impacted the price paid for traffic for some keywords that got moved just above the organic results or found themselves in the last ad spot on the page.

However, most clicks are not impacted by minimum bids, particularly first page minimum bids, since most traffic goes to ads farther up the page.

2. Bottom ads are picking up a lot more traffic than most expected

To be honest, when I first heard that side ads were being removed completely and that there would just be more ads at the top and bottom of the page, my first reaction was that pretty much all paid search traffic would go to ads featured at the top of the page.

The likelihood of users scrolling past all of the top of page ads and organic listings to then find a relevant ad at the bottom of the page just seemed unlikely.

This would have driven up CPCs if it were indeed the case that only ads in position 4 or higher got any real traffic.

And yet, it appears that bottom ads are doing pretty well for themselves. Looking at the share of Google.com non-brand text ad traffic by the location on the page, we find that while top ad click share increased about 10 percentage points to ~80 percent with the updates, bottom ads also picked up about 10 percentage points of share to ~20 percent.

This is helping to keep CPCs stable, as traffic hasn’t shifted entirely to the top position ads, which have higher CPCs tied to them.

Conclusion

As mentioned, there haven’t been huge shifts in CPC in aggregate just yet, but you can see from the way first page and top of page bid minimums are moving that the auction has indeed changed as a result of Google’s updates.

It’s still very early to assess the impact from these changes (particularly considering these updates occurred towards the end of what is considered a down period for many retailers after the holidays), and we may yet see more evidence of impacts in the weeks to come or further rollout of serving four text ads from Google’s end. Frankly, it’s too early to call the ballgame.

We’re particularly interested to see if four text ads get served above the organic results more often come the holiday shopping season this Q4. Only time will tell.

Contributing authors are invited to create content for Search Engine Land and are chosen for their expertise and contribution to the search community. Our contributors work under the oversight of the editorial staff and contributions are checked for quality and relevance to our readers. The opinions they express are their own.

Related stories

New on Search Engine Land