Global PPC Spending Up 23%, Mobile PPC Jumped 132% YOY In Q2 [Covario Report]

Covario reports overall pay-per-click (PPC) spend accelerated, rising 22 percent from Q1 and 23 percent year-over-year. Mobile PPC spending outpaced overall growth, increasing 39 percent from Q1 and 132 percent year-over-year. Mobile accounted for 16 percent of global search spend. Smartphones claimed 40 percent of the mobile spend allocations, tablets 60 percent. Smartphone CPCs remained […]

Covario reports overall pay-per-click (PPC) spend accelerated, rising 22 percent from Q1 and 23 percent year-over-year.

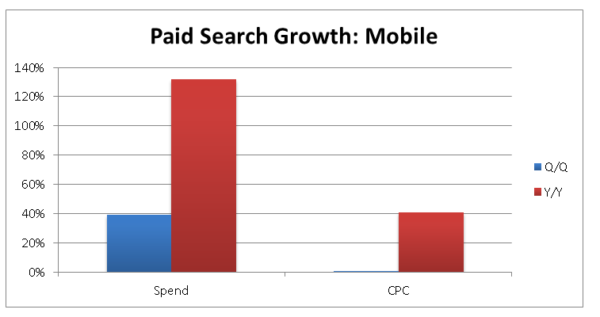

Mobile PPC spending outpaced overall growth, increasing 39 percent from Q1 and 132 percent year-over-year. Mobile accounted for 16 percent of global search spend. Smartphones claimed 40 percent of the mobile spend allocations, tablets 60 percent.

Smartphone CPCs remained 40% lower than desktop CPCs, but have been rising nearly each of the past five quarters, the exception being Q4 2012. Interestingly, Covario saw tablet CPCs decline below desktop for the first time in several quarters, coming in 12% below desktop CPCs.

Global CPCs Rise Across Major Platforms

Global CPCs rose 10 percent for the quarter. Report author, Alex Funk, attributes the uptick in CPCs in part to increased competition among the company’s consumer electronics and enterprise technology clients. In addition, Funk said, “There have also been several platform changes over the past three quarters, including Google’s Product Listing Ads and the new Enhanced Campaigns, but it’s too early to tell if the latter has really affected CPCs yet since much of the market is taking a wait-and-see attitude.” This conclusion that the market hasn’t seen a real impact from enhanced campaigns yet is shared by others.

Baidu saw a 27 percent increase in CPCs quarter-over-quarter. Google CPCs rose 16 percent quarter-over-quarter. Yandex and Yahoo-Bing CPCs are both down compared to last year, but rose 10 percent and 4 percent respectively for the quarter. South Korea’s Naver saw CPCs shoot up 32 percent quarter-over-quarter.

Google’s Domination Remains Unchallenged, Yahoo-Bing Keeps Growing

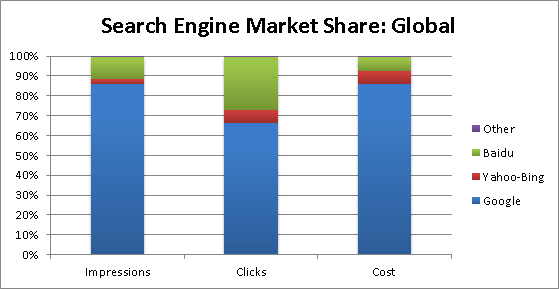

Google’s global PPC market share domination continues. The search giant has 86 percent share of spend and impressions and 62 percent of click share. Spending on Google rose 13 percent from the previous year.

Growth hasn’t slowed for the Yahoo-Bing Network (Bing Ads). Spending rose 23 percent year-over-year and 7 percent from Q1. The network has 6 percent market share in spend and clicks.

Baidu still has a stronghold in China, and saw media spend increase 22 percent year-over-year and rise an impressive 70 percent from Q1. Baidu has greater global market share than Yahoo-Bing, with roughly 7 percent of global spend share, 11 percent of impressions and 27 percent of clicks.

While Covario says it’s too soon to see an impact from enhanced campaigns on Q2 results, the company does expect to see CPCs for tablets and smartphones increases accelerate more than they have in the past few quarters as mobile advertising gets more competitive.

Contributing authors are invited to create content for Search Engine Land and are chosen for their expertise and contribution to the search community. Our contributors work under the oversight of the editorial staff and contributions are checked for quality and relevance to our readers. The opinions they express are their own.

Related stories