Google Grows Revenues 24% From Last Year, Plans New Class Of Stock

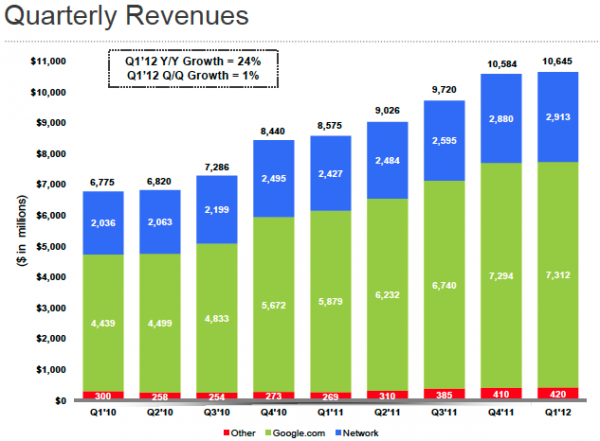

Google’s revenues rose to $10.65 billion in the first quarter of 2012, resulting in net income of $2.89 billion, or $8.75 per share, the company announced after market close today. The revenue number represents a 24% increase over the year-ago period. Additionally, the board of directors proposed the creation of a new class of non-voting […]

Google’s revenues rose to $10.65 billion in the first quarter of 2012, resulting in net income of $2.89 billion, or $8.75 per share, the company announced after market close today. The revenue number represents a 24% increase over the year-ago period. Additionally, the board of directors proposed the creation of a new class of non-voting shares — to be distributed as a dividend to all current shareholders — effectively resulting in an two for one stock split.

“We had a very strong quarter,” said CEO Larry Page on a conference call with press and analysts, “Since becoming CEO again, I have pushed hard to focus on the big bets.”

Page described the creation of a new class of stock as enabling the founders to keep corporate decision-making amongst a small group, allowing the company to continue to take a longer-term view on the business.

Though Page and Sergey Brin, in a 2012 founders’ letter, say they know some won’t be happy about the decision, “…after careful consideration with our board of directors, we have decided that maintaining this founder-led approach is in the best interests of Google, our shareholders and our users. Having the flexibility to use stock without diluting our structure will help ensure we are set up for success for decades to come.”

Page pointed to projects like Google Chrome, Android, and YouTube as examples of initiatives that have benefited from a long-term approach, because they have taken years to develop into especially strong products.

The decision begs speculation about what Google may be planning to do with its stock — acquisitions, perhaps? — that it wants to do without granting voting rights. But, in the letter, the founders address this, saying: “we don’t have an unusually big acquisition planned, in case you were wondering.”

Although the creation of a new class of stock is currently only a proposal, it’s expected to have no problem being adopted at the next shareholder’s meeting, given that Page and Brin back it.

CPCs Continue To Dive, While Clicks Rise

Some of the most interesting numbers have to do with trends in cost-per-click and overall clicks. The company’s average CPCs decreased 12% over the first quarter of last year, and they were down 6% over the fourth quarter of 2011, as well. But the company was able to keep revenues rising by increasing the number of clicks — they grew around 39% over the first quarter of 2011 and approximately 7% over the fourth quarter. The trends confirm reports from major search marketing agencies released earlier this week.

Asked about what was driving these trends — especially the decline in CPCs — SVP and chief business officer Nikesh Arora attributed it to a mix of complex factors including the growth of mobile and tablet activity versus desktop, the interplay between emerging and more developed markets, foreign exchange effects, the dynamic between network and Google properties, and ad quality changes.

“The dynamics are very complicated,” said Arora. “If anything, the recent lower CPCs present a bigger opportunity to attract advertisers.” Arora also stressed that “the most important thing for you to know is that the business is healthy.”

The Mobile Opportunity

As Arora noted, the growth of mobile is generally acknowledged to be behind some of the CPC drop, because mobile doesn’t yet monetize as well as desktop. But this also confirms that mobile is one of the largest areas of opportunity for Google. Tablets, in particular, are proving to be well-known as shopping devices, and the Google executives said the company is putting the pieces in place to take advantage of the trends.

“People always spend the most money on whatever the major source of traffic or revenue is,” said Page, acknowledging that desktop clicks and impressions are still garnering the largest spend by advertisers. “I think over time it will reverse….We’re very bullish in that area and we’re making a lot of investments.”

Investments discussed include global efforts to bring small local businesses online, to help advertisers build mobile sites, and to improve mobile advertising capabilities to better serve these needs.(A better click-to-download capability for mobile ads promoting apps was mentioned as an example of improvements in ad formats.) Additionally, Page said he foresees improvements in the ability to make local transactions via a smartphone to work in Google’s favor in the long term.

Where Is Google Making Its Money?

Google’s owned-and-operated properties accounted for the majority (69%) of its total revenues in the quarter. It brought in $7.31 billion from its own sites, or 24% more than last year’s revenues for the same period.

Partner sites that carry Google advertising generated revenues of $2.91 billion, or 27% of the company’s revenues. This network revenue grew 20% from the first quarter of 2011.

Google continues to make slightly less than half of its money in the United States. Revenues from outside the U.S. totalled $5.77 billion, or 54% of all revenues. The company was particularly strong in the United Kingdom, where it brought in $1.15 billion, or 11% of total revenues.

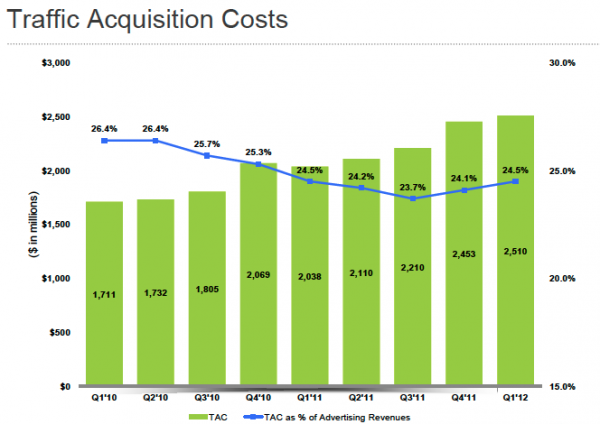

Those advertising distribution partners and other sources of traffic received $2.51 billion in all in the first quarter, meaning that traffic acquisition costs (TAC) rose from $2.05 billion in the same period in 2011. However, TAC remained steady (at 25%) when looked at as a percentage of advertising revenues.

Where Does Google+ Fit In?

Though Google+ has become something of a whipping boy in social media circles, Page indicated that he was very happy with the progress of the initiative. He said to think of Google+ as having two different parts.

First, and most highly developed currently, is what Page called the “social spine” — this is the social element that Google+ brings to all of the other services the company provides, when users “upgrade” to using it.

“170 million people have now upgraded to Google+,” Page said.

As for the other part — that is the “social destination”. Page said this should be judged as the new product it is. By that measure, he said, it is showing “very healthy growth.”

Maturation As A Marketing Medium?

It’s an indication of how Google has “grown up” that the company will be hosting its first upfront for YouTube in May in New York. Arora says the video service has “gone from being an interesting place for brands to be, to being a must-buy. Now they [advertisers and agencies] are seeing the benefits of using the web for branding.”

The company is also working on packaging YouTube with its display ad inventory and developing better methods of cross-media measurement.

“We’re seeing a big breakthrough with brands,” Arora said.

But Google will bring its own performance-oriented perspective, of course.

“Advertisers are interested in ROI,” noted Page. “They don’t care [whether it’s mobile or desktop or TV]. We have immense amounts of inventory, even inventory through our network. What we should do is dynamically allocate throughout these products to allow them to get the maximum ROI.”

Related stories

New on Search Engine Land