How To Manage Bids For AdWords Shopping Ads

Last month, I covered the basics of how Shopping campaigns in AdWords differ from Search campaigns. The key finding I had was that, with Search, you have to add keywords to target more queries. In Shopping, all queries that match your products are targeted by default, and one of the main reasons to divide products […]

Last month, I covered the basics of how Shopping campaigns in AdWords differ from Search campaigns.

The key finding I had was that, with Search, you have to add keywords to target more queries.

In Shopping, all queries that match your products are targeted by default, and one of the main reasons to divide products into Product Groups is to get more control over bids.

This month, I’d like to share what I’ve learned about managing bids for AdWords Shopping ads.

Bidding In Shopping Campaigns

All bidding in Shopping Campaigns is done at the lowest Product Group level — so while ad groups in Shopping campaigns have a default bid, those serve no useful purpose. I’m not sure why Google kept ad group bids in Shopping campaigns… perhaps simply because they wanted to leverage the existing AdWords infrastructure.

Default ad group bids in Shopping campaigns don’t do anything other than provide a starting CPC value for new product groups created in the ad group. As soon as a product group is created, it loses its connection to the ad group’s bid.

This is a really critical point to understand, because bids work very differently than in regular Search campaigns. In a Search campaign, keywords inherit the bid of their ad group unless they have their own bid. Thus, if you change the bid for an ad group, you are changing all bids for any keywords in that ad group that do not have their own bids. Any time you change the ad group bid, all keywords without their own bid will inherit the most recent ad group bid.

In Shopping campaigns, it’s different because bids exist only at the lowest product group level, and there are no inherited bids. To compare that to Search campaigns, it’d be like saying that we have to place bids for every keyword and cannot set ad group bids.

Managing Bids Can Be A Big Hassle

Maybe that doesn’t sound so bad, until you try to manage bids for a Shopping campaign with thousands of products.

Say you have already set bids for product groups with lots of conversion data before you figure out that your bids for all the other product groups are 10% too high. If this was a Search campaign, you’d simply lower ad group bids and those would then apply to everything that didn’t have its own bid yet. Not so in Shopping campaigns, since changing the ad group’s bid doesn’t change any of the bids for product groups.

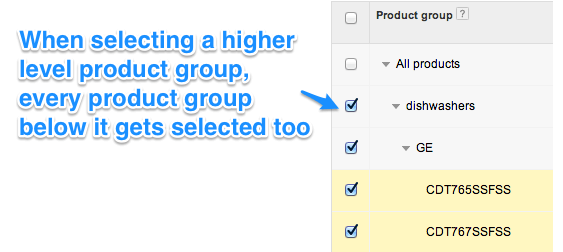

So then you might consider changing bids for a parent level of product groupings (any level above the lowest level of product groups). This, too, is not a clean solution, as you are changing bids for every single product group below it; hence, overwriting your carefully set bids for the high-conversion product groups.

Determining The Right Bids For Product Groups

Shopping campaigns suffer from the same shortcoming AdWords had before their big interface redesign in 2005 when you had to use one set of pages to get reports and another to make account changes. When insights are separated from the pages where you can act on them, account management becomes less efficient.

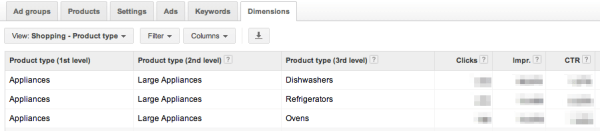

Here’s the problem: the way to see the most granular data about Shopping performance is in the Dimensions tab, where an entirely new set of reports was added related to Shopping campaigns. You get your insights in one place, but they’re not always easy to translate into actions.

For example, one of the Dimensions reports is “Shopping – Product Type” and it shows stats for up to three of the five levels of product type (by default it only includes 1 level of product type, so be sure to add the others with the “Columns” button). Here’s what that might look like:

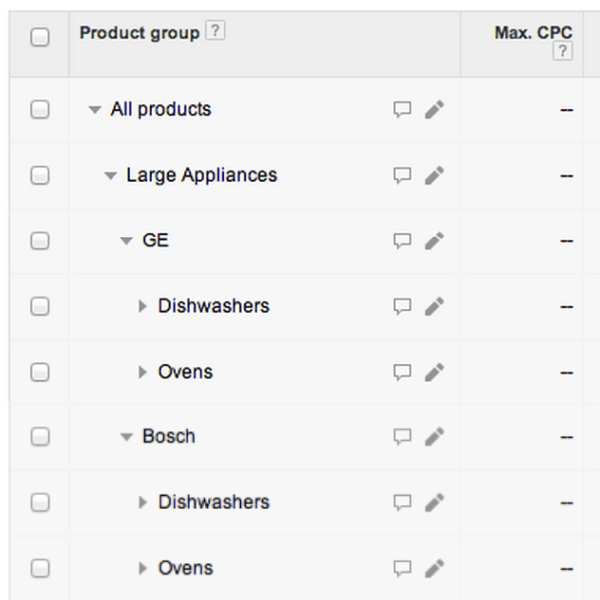

So say that you determine Appliances > Large Appliances > Dishwashers has a bad CPA. How do you take action on that? You go to your management page and here’s what you see:

Because your Product Groups don’t map cleanly to data in the dimension reports, you could find yourself having to hunt for where to set bids based on an insight you got from a report. It’d be better if the reports mirrored how you set up your product groups.

Alternatively, to get really granular data to act on, you can subdivide your product groups all the way down to the item ID on the management pages so that you won’t need to use the Dimensions reports; but then, you have to manage many more bids (which is not easy given the current AdWords interface).

The other problem is that many of your narrowly-defined Product Groups will have very sparse data, so you may have to calculate the bids based on a higher level aggregation. And unlike with keywords that inherit the bid from their ad group if they don’t have their own bid, product groups don’t work that way — you have to place a bid for every Product Group.

That means setting lots and lots of bids manually. Even worse, if you decide to set all bids manually from the highest level, all product groups underneath get their bids changed — even the ones you had so carefully calculated before.

Using Benchmark Data To Set Shopping Bids

Shopping Campaigns include a few new interesting competitive metrics that we don’t get in Search Campaigns: benchmark CTR and benchmark max CPC. According to Google, this includes data for similar products from an anonymized set of advertisers.

It’s available one to two days after the auctions take place, and only when there is enough data so that it can be anonymized — so, just like with a search query report, if you don’t get data, try a longer date range for your report. Unfortunately, the data is only available for product groups that are not at the item ID level; so, you can’t see benchmark data for individual products.

Google’s advice is to raise bids or try to improve relevance by modifying the feed if you’re below the benchmark CTR, and to set a higher bid if you’re below the benchmark max CPC.

I decided to test this out and here’s what happened: when I increased my bids to be closer to the benchmark, my campaign results completely tanked. In several cases, my clicks doubled — but my daily cost went up 600 to 1000% and conversions dropped in half!

What happened is that changing bids for product groups is a bit like changing bids on broad match keywords: you just can’t predict what will happen because the query mix completely changes. When you are competing for different queries, predicting results is nearly impossible.

Hence, my advice is to change bids very cautiously, and work toward refining your product groups as you change bids so that your bid changes are limited to a more tightly defined set of products.

Here’s an example of the issue with changing bids for Product Groups with lots of products. If you double the bid for a product group like “everything else in GE,” you may all of a sudden go from participating in just the auctions for less-expensive products like microwaves to also competing on queries for high-end ranges.

Conversion rates for these may be different, and your entire budget could get spent on lower converting, more expensive items — leaving the campaign out of budget before it’s come anywhere near driving the number of sales it normally drives.

Can Benchmark CPC & CTR Be Used To Calculate A Benchmark Ad Rank?

I tried using benchmark data to calculate a benchmark ad rank so I could determine the lowest bid required for me to keep the same volume. Here’s the idea: ad rank in its simplest form on AdWords used to be calculated as max CPC * CTR. Assuming that Shopping ads employ a similar ranking formula, we get:

benchmark ad rank = benchmark max CPC * benchmark CTR

Then, if you know the benchmark ad rank, it’s simple to calculate the max CPC needed to maintain rank:

min CPC required to maintain rank = benchmark ad rank / actual CTR

I tested this theory on some product groups and once again found rather disappointing results. In cases where I lowered my bids, I lost clicks and impressions; in cases where I raised my bids, the incremental CPC (the cost required to buy an additional click) was exorbitantly expensive compared to my current average CPC.

While I was hoping to find a great bid formula, for now I’m finding it best to set bids manually and adjust them slowly based on the main KPIs like CPA or ROAS.

Next month, I will wrap up my first look at Shopping campaigns with some thoughts on how to ensure your ads are showing for the right products and how to optimize your Merchant Feed.

Contributing authors are invited to create content for Search Engine Land and are chosen for their expertise and contribution to the search community. Our contributors work under the oversight of the editorial staff and contributions are checked for quality and relevance to our readers. The opinions they express are their own.

Related stories

New on Search Engine Land