Paid Search Spend Rises 8 Percent In Q1, Mobile Shows Signs Of Maturing [Report]

In the first quarter this year, U.S. search advertising spend rose 8 percent when compared both quarter-over-quarter (QoQ) and year-over-year (YoY) according to IgnitionOne’s latest report which looks at the campaigns run through its digital marketing platform. In Q1 2014, paid search clicks increased 5 percent and click-through-rates (CTR) were up 23 percent YoY while […]

In the first quarter this year, U.S. search advertising spend rose 8 percent when compared both quarter-over-quarter (QoQ) and year-over-year (YoY) according to IgnitionOne’s latest report which looks at the campaigns run through its digital marketing platform.

In Q1 2014, paid search clicks increased 5 percent and click-through-rates (CTR) were up 23 percent YoY while impressions fell again, by 15 percent. IgnitionOne cautions that the drop in impressions does not imply that search queries are down but that the decrease is due to the rise in mobile searches where there is less real estate for ads.

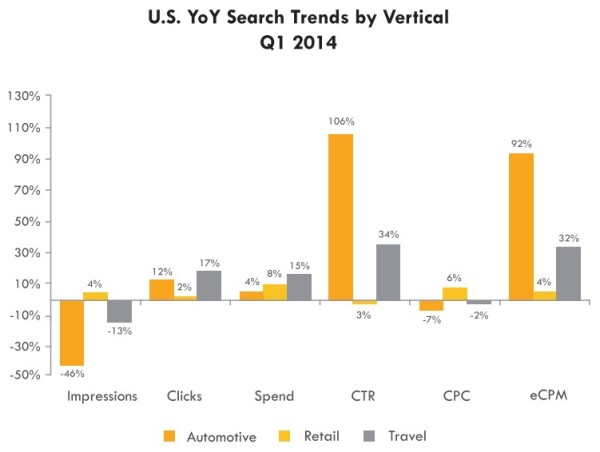

Looking at three industry verticals — automotive, travel and retail — the highest YoY growth in spend came in the travel sector at 15 percent, compared to 4 percent for automotive and 8 percent for retail. All impression metrics were down with the exception of a 10 percent rise from Google in the retail sector. High eCPMs in the automotive and travel sectors reflect the upward trajectory of CTRs in both verticals.

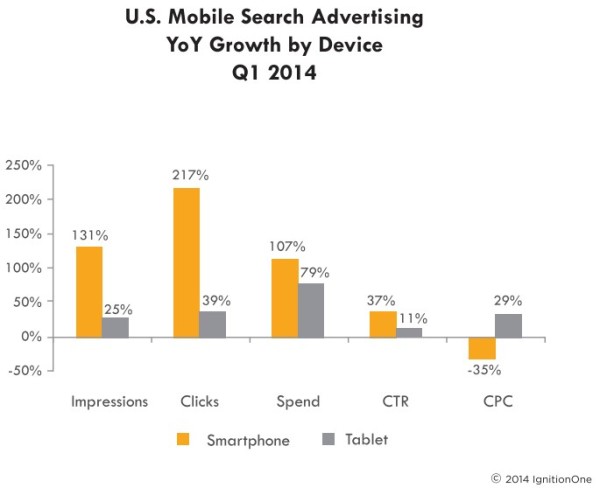

Mobile spend continues to climb, though not at previous triple-rate growth. Tablets spend is up 79 percent while smartphone spend rose 107 percent. Cost-per-click (CPC) on smartphones fell 35 percent, which IgnitionOne suspects is “due to marketers becoming more sophisticated with bidding and getting more efficient traffic on these devices”.

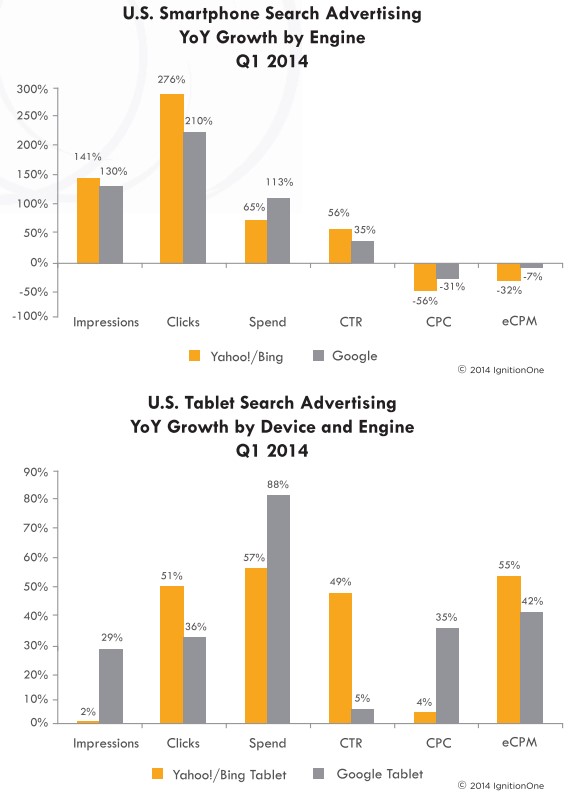

Smartphones accounted for 42 percent of paid search spend on mobile devices. Interestingly, IgnitionOne highlights that marketers are seeing greater efficiencies on the Yahoo Bing Network, where they still have control over device targeting through Bing Ads.

Nearly across the board we are seeing greater efficiencies in both smartphone and tablet advertising for Yahoo!/Bing when compared to Google. This is reflected in either greater reductions in CPCs in smartphones or reduced growth in CPCs for tablet, as well as higher growth CTR for both devices.

This efficiency is due to the higher level of control allowed in Yahoo!/Bing as compared to post-Enhanced Campaign Google. An example of this control is how marketers are able to manage bidding at the keyword level by device in Yahoo!/Bing where in Google that is no longer possible.

Search Market Share Holds Steady

The Yahoo Bing Network also held on to its U.S. search market share in Q1, with 22.9 percent of spend vs. Google’s 77.1 percent, up just slightly from last quarter’s 22.7 percent.

IgnitionOne powers paid search for large brands as well as advertising agencies such as 360i, GroupM and iProspect.

Contributing authors are invited to create content for Search Engine Land and are chosen for their expertise and contribution to the search community. Our contributors work under the oversight of the editorial staff and contributions are checked for quality and relevance to our readers. The opinions they express are their own.

Related stories

New on Search Engine Land