SMBs Divided On The Effectiveness Of Google My Business

Columnist Myles Anderson digs deeper into BrightLocal's 2014 SMB Internet Marketing Survey to learn more about the attitudes of small and medium sized businesses.

In January, we published the findings of the 2014 SMB Internet Marketing Survey.

In this post, I am going to share the result of further analysis from the same survey, this time comparing the data for certain Industries and their attitudes, spend and commitment to internet marketing.

The industries covered are selected based on the number of respondents within each industry. In total, we had 736 SMBs complete the survey from over 30 different industries.

We have only included analysis for 15 industries that had at least 20+ respondents. We felt that if an industry had below 20, we couldn’t trust the data; anomalies would have too great an impact on the averages and would skew the results.

The following 4 charts represent some of the key findings from this deeper analysis.

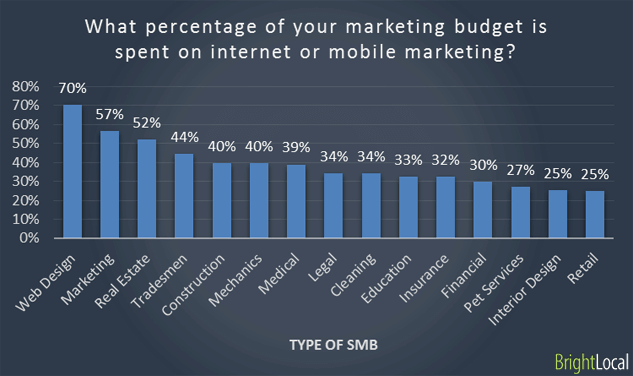

What % Of Your Marketing Budget Is Spent On Internet Or Mobile Marketing?

Analysis:

- Web Designers (70%) & Marketing Businesses (57%) allocate greatest percent of their budget to online.

- Retail (25%), Interior Design (25%) and Pet Services (27%) allocate the least.

We can see a broad distribution of marketing budget allocation to online across the industries studied, ranging from 25% to 70%.

It’s not surprising that Web Designers and Marketing Businesses spend the majority of their marketing budgets online — they understand the channels, they know how to get good ROI and so they invest in it.

At the other end of the spectrum are Pet Services, Interior Designers and Shops. These industries spend the smallest percent of their marketing budgets on digital marketing. Perhaps they see the low returns from their digital marketing, have low understanding of the channels and have low confidence in them.

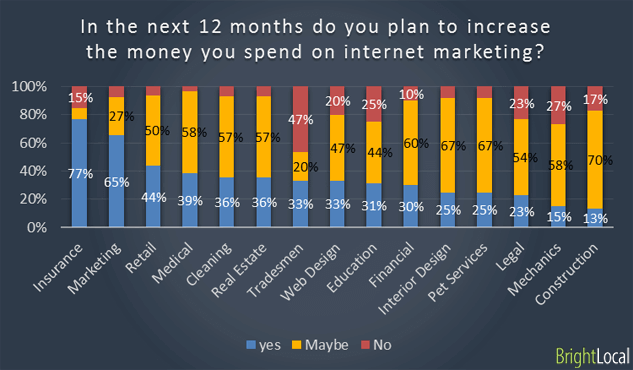

Will You Increase Spend On Internet Marketing In Next 12 Months?

Analysis:

It’s useful to compare results of this chart with the previous chart to get a complete picture of confidence that different industries have in internet marketing.

Some industries, such as Construction and Mechanics, spend over 40% of their budget online and don’t plan to increase this. Do they find that further investment won’t deliver more customers? Are they committed to spending the other 60% on other offline channels because those channels reach customers that online doesn’t — e.g. trade customers, contractors, etc.?

Conversely, some industries — Insurance and Retail — spend less online right now but are more likely to increase their spend to digital in 2015.

Marketing businesses already spend a larger percent of their marketing budget online, and 65% of respondents said they planned to increase this — further evidence that it works for them and their confidence is high.

Interestingly, Tradesmen currently spend 44% of their budget online but are the least likely to increase that in the next 12 months. So this industry may not be a great one for search consultants to target or up-sell digital services to in 2015.

How Effective Is Internet Marketing At Attracting Customers To Your Business?

Analysis:

- Positive

- 93% of Medical businesses say internet marketing is Effective or Very Effective.

- 93% of Real Estate businesses say it is Effective or Very Effective.

- 45% of Marketing businesses say it is Very Effective.

- Negative

- 40% of Financial businesses say it is not effective.

- 33% of Tradesmen say it is not effective.

- Just 15% of Insurance businesses say it is Very Effective.

In overview, the results are very positive for Internet Marketing. All these industries say that Internet Marketing is effective rather than not effective with each industry returning >60% Effective or Very Effective.

However, certain industries (Financial, Tradesmen and Legal) had a much higher % of respondents who said it was Not Effective.

Tradesmen are the least likely industry to increase spend in 2015 (see previous chart) which is not surprising when we see that 33% of them say online marketing is not effective at bringing in new customers.

There is a similar correlation for the Legal sector — low effectiveness = no increase in budget allocation. We found this result surprising result given how competitive online legal marketing is and how many specialist legal marketing firms there are. Is this a symptom of too much competition? Is it too difficult and expensive for many practitioners to invest in or to see decent returns from the budgets they have?

For us, the most confusing result here is for Insurance businesses. This sector is most likely to increase their spend in 2015, but returned the lowest score for “Very Effective” (just 15%).

Marketing businesses are again extremely positive, with 45% saying Internet marketing is Very Effective at bringing in new customers. This is a useful, if not surprising, insight for other marketing consultants and agencies who are analyzing their own spend.

How Do You Feel About Google+ Local/Google My Business?

Analysis:

- Positive:

- 64% of Cleaning businesses have a positive sentiment about Google +Local and Google My Business (GMB).

- 61% Medical businesses have a positive sentiment.

- 60% of Marketing and Web Design businesses have a positive sentiment.

- Negative:

- 31% of Insurance businesses have a negative sentiment about Google +Local and Google My Business.

- 29% of Real Estate businesses have a negative sentiment.

In this question, we asked SMBs to pick a statement which best summed up their feelings about Google+ Local/GMB. The statements covered the usability and importance of +Local/GMB, and we aggregated the answers into 3 “pots.”

Sentiments vary widely across different industries, with some businesses in each industry finding it confusing — so it’s clear that Google still has work to do to educate and convince some businesses of the benefits of +Local/GMB.

Cleaning, Medical and Marketing businesses are most positive (>60%) while Financial, Insurance and Interior Design are least positive (<40%).

Interestingly, 31% of Marketing professionals are confused by or frustrated with +Local/GMB. Given that it is their business to know digital channels inside and out, it is worrying that many still find it hard to work with.

Real Estate and Insurance businesses have the most negative sentiment. Real Estate agents have been the big losers since the Pigeon update with a huge drop in local pack results being served for real estate/realtor terms — so it isn’t surprising that these businesses would feel negatively about the service.

Full Findings

The full set of findings from this Industry analysis can be found on BrightLocal.

We publish data and analysis on 10 questions, including:

- Effectiveness of Offline vs. Online channels

- Mobile Marketing & Mobile Readiness

- Important Factors when Selecting a Marketing Agency

- Marketing Support (in-house vs. outsource)

Contributing authors are invited to create content for Search Engine Land and are chosen for their expertise and contribution to the search community. Our contributors work under the oversight of the editorial staff and contributions are checked for quality and relevance to our readers. The opinions they express are their own.

Related stories