With Google Wallet Mobile Payments Era Is Finally Here

For more than a decade people have prophesied the end of cash and credit cards. And for the past two years the drumbeat around mobile payments has grown steadily louder with the adoption of smartphones. Now numerous companies are jockeying to participate in what expected to be a huge market that will eventually generate billions […]

For more than a decade people have prophesied the end of cash and credit cards. And for the past two years the drumbeat around mobile payments has grown steadily louder with the adoption of smartphones. Now numerous companies are jockeying to participate in what expected to be a huge market that will eventually generate billions in fees and revenue.

For more than a decade people have prophesied the end of cash and credit cards. And for the past two years the drumbeat around mobile payments has grown steadily louder with the adoption of smartphones. Now numerous companies are jockeying to participate in what expected to be a huge market that will eventually generate billions in fees and revenue.

In the same way that Apple redefined and accelerated the development of the smartphone market with the iPhone in 2007, Google Wallet marks the beginning of the mobile payments era. Google is certainly not the first company operating in the sector, and it might not turn out to be the leader. But with last week’s announcement, Google has helped to bring new coherence and focus to the otherwise Darwinian and chaotic landscape of mobile payments.

Let’s Review the Google Wallet Announcement

What do we know about Google Wallet so far?

- Phones: Google Wallet will work with the Android Nexus S (via Sprint in the US) — and, through a NFC-enabled sticker, on potentially all smartphones (more on that below).

- Cards: The program will work with Citi MasterCard, a pre-loaded Google Prepaid Card (which can be “refilled” from any source of funds) and gift cards from various participating merchants. Google wants all payment, gift and loyalty cards to work with the system

- Markets: For the immediate future the program will only be available in San Francisco and New York

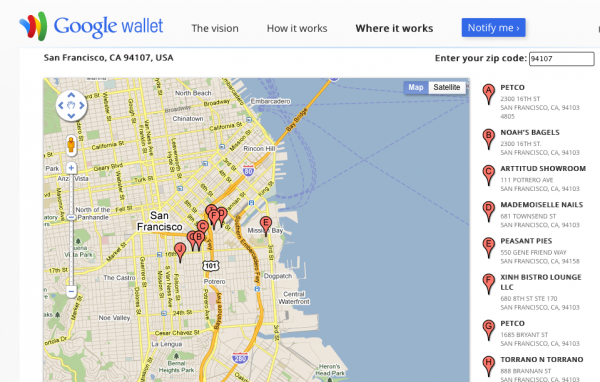

- Participating merchants: The first and fairly diverse group of merchants announced include American Eagle Outfitters, Bloomingdale’s, Champs Sports, The Container Store, Duane Reade, Einstein Bros. Bagels, Foot Locker, Guess, Jamba Juice, Macy’s, Noah’s Bagels, Peet’s Coffee & Tea, RadioShack, Subway, Toys”R”Us and Walgreens. However because Google Wallet relies on the MasterCard PayPass infrastructure it will work “at more than 124,000 PayPass-enabled merchants nationally and more than 311,000 globally.” (Google has an interactive map to find PayPass merchants.)

- Google Offers linked to Wallet: Offers are directly integrated into Google Wallet. Consumers will be able to send offers they encounter to Wallet with a single click (if you’re signed in). Redemption will be accomplished with a “SingleTap” at the point of sale or via scanning or keying in a code if the POS system doesn’t support SingleTap.

- Future uses: Google envisions that “receipts, boarding passes and tickets will all be seamlessly synced to your Google Wallet.”

An “Open Commerce Ecosystem”

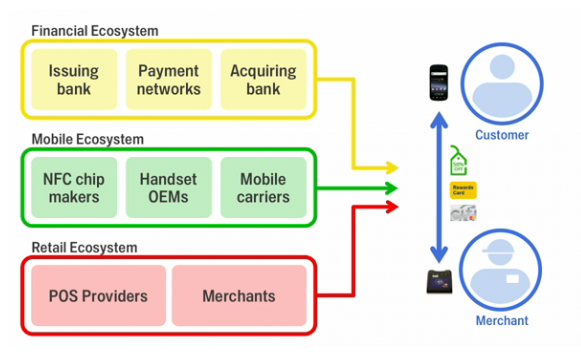

Google Wallet is modeled on Android. The company hopes it can build a payments “ecosystem” around Wallet in the same way it has built an enormously successful one around Android. Accordingly the company is trying to create an open standard that will be adopted by all interested parties:

Google Wallet will work best if it’s an open commerce ecosystem so you will be able to carry all the credit cards, offers, loyalty and gift cards you choose—and eventually much more. To this end, Google Wallet will make it possible to integrate numerous types of partners, and Google, Citi, MasterCard, First Data and Sprint invite the banking community, mobile carriers, handset manufacturers, merchants and others to work with Google Wallet.

By getting Citi, MasterCard, First Data on board at launch, Google may have created enough of an argument to persuade other banks and payment entities to participate even if they are hedging with other mobile payments efforts. However the Google Wallet ecosystem may all but doom the still nascent ISIS initiative from the three other major US wireless carriers: AT&T, T-Mobile, Verizon.

Offers and Wallet Reinforce Each Other

For Google Wallet to “work” it needs to generate consumer interest and adoption. This will probably be the most challenging part of the effort — at least in the beginning.

One of the ways Google hopes to gain consumer interest and attention is by connecting its fledgling deals service, Google Offers, to Wallet. The two are distinct but closely related programs. Wallet helps differentiate Offers from the myriad other deals programs in the market — though presumably Groupon, LivingSocial and other deal vendors could develop for Google Wallet — and Offers helps create additional consumer incentives to try Wallet.

There’s a potential analogy here to Google Places (the app) and Maps on Android phones. Google Places, Maps and Google Navigation are all very tightly integrated on Android phones. This helps reinforce usage of all of them vs. other available alternatives. Offers and Wallet could develop in a similar way mutually reinforcing one another.

Google Offers needs to gain widespread merchant participation, however, or become a coupon/deals aggregator (like Dealmap or Facebook) to provide consumers with sufficient deals “inventory” to make the service interesting.

NFC-Enabled Stickers

Although the focus at the press event was on the Nexus S as the exclusive Google Wallet-enabled handset few people have the Nexus S. This shuts out the majority of people who might otherwise be interested in Google Wallet. However, any smarpthone user will potentially be able to use Google Wallet with the aid of an NFC-enabled sticker.

These are physical stickers, though sometimes bulky, that users affix to their phones. Below is an image of one used in France for mobile check-ins and boarding in a test campaign last year:

While the sticker is clumsy in some respects it makes Google Wallet accessible to people who would otherwise have to buy a new handset to participate. This is a critical option that Google needs to market aggressively — it needs to give away these stickers — if it wants to develop the kind of consumer momentum necessary to make the program successful. In the absence of early consumer interest and adoption the program could languish.

Advertising and Data: The “Hidden Agenda”

There are secondary or “hidden” benefits for Google and marketers if Wallet becomes mainstream. As was demonstrated at the launch event, users can simply tap any NFC-enabled piece of media (or signage) to get more information or an offer. In this way, NFC is like a simpler version of QR codes, now increasingly used on traditional media and product packaging to deliver more information and incentives to consumers.

(QR codes can be read from a distance on outdoor ads and public transit for example. NFC requires the handset to be physically very close to the reader to transact.)

Google not long ago abandoned use of QR codes on its merchant Places stickers. It now makes them NFC-capable instead (Portland is the first city to get these new decals).

With a single tap on the sticker a user could obtain special offers, menus or other information about the business. And every interaction with NFC-enabled media, coupon redemption or payment transaction at the point of sale will provide Google and its partners with valuable data about consumer shopping and purchase behavior.

The “closed loop” now becomes much more possible than in the past. Search marketers could serve up offers in AdWords (PC and mobile) that are “saved to Wallet” and later redeemed in stores. This will enable search marketers to optimize ads and offers based on actual purchase behavior. That’s never really been possible before.

Having access to consumer payments data could also enable marketers to see the campaigns online that are generating sales offline even when there are no coupons or deals involved. There will simply be much more data made available to advertisers and that will extend to purchases.

Of course privacy is a potential stumbling block here and so Google and its partners will need to be cautious in their use of consumer data that become available through use of Google Wallet.

In general Google will have to give consumers reliable assurances about security and privacy to drive mainstream adoption. However there are already a substantial number of younger smartphone owners eager to start using mobile payments. According to a study from Kelton Research for Mastercard, 63 percent of 18 to 34-year-olds said they were “at ease” with the idea of mobile payments.

The Competitive Landscape

Where does Google Wallet leave others? As I wrote previously it could potentially boost competitors by creating interest and heat around the segment. But it could also shut some companies out if consumers flock to Wallet instead of alternatives. The next two years will probably be determinative of the landscape going forward.

As mentioned the “ISIS” mobile carrier initiative could die quickly in the face of “sexier” programs such as Google Wallet. Similarly PayPal is now under pressure to accelerate everything it’s doing in mobile. It could see a near-term bump or benefit from the publicity around mobile payments and Wallet.

Startup Square is trying to create payment solutions for consumers and merchants that are simple and don’t rely on any next-generation technology. Yet older mobile payments startups such as Boku, Zong and Obopay may find themselves in a new, more precarious situation. With thoughtful management they may be able to survive or leverage general uncertainty and anxiety in the payments space to successfully find buyers.

Apple and Amazon are wild cards and haven’t declared their intentions regarding payments. It’s widely believed that Apple is working on NFC enabled payments; however the next iPhone won’t have that capability according to various published reports.

With the introduction of Google Wallet, the company has thrown down the gauntlet to existing and future competitors in the payments arena. Furthermore a viable, mainstream mobile payments platform in the US is no longer an abstraction or matter of future speculation. It’s now a real, near-term opportunity.

Contributing authors are invited to create content for Search Engine Land and are chosen for their expertise and contribution to the search community. Our contributors work under the oversight of the editorial staff and contributions are checked for quality and relevance to our readers. The opinions they express are their own.

Related stories

New on Search Engine Land