With So Much Money Is A Facebook Search Engine Inevitable?

The news broke yesterday that Facebook was getting a whopping $500 million from Goldman Sachs and existing investor Digital Sky Technologies at a valuation of $50 billion. None of this has been confirmed by the company but it’s being very widely reported. Apparently the Goldman investment will enable the company’s most wealthy clients to “get […]

The news broke yesterday that Facebook was getting a whopping $500 million from Goldman Sachs and existing investor Digital Sky Technologies at a valuation of $50 billion. None of this has been confirmed by the company but it’s being very widely reported. Apparently the Goldman investment will enable the company’s most wealthy clients to “get in” before an IPO and virtually guarantee that Goldman is the firm (or the lead firm) that takes Facebook public when that eventually happens.

Groupon also just raised a gigantic funding round, between $500 million and $950 million according to reports. Within the past 12 months there have been other massive rounds of more than $100 million at companies such as Zynga and Yelp.

Part of what’s going on in these cases is early investors selling shares, as well as founders and early employees “taking money off the table.” This relieves some of the pressure to go public. However, once the number of shareholders of a company reaches 500 or more Securities & Exchange Commission (SEC) rules apparently force companies to start reporting financial information as though they were public. It’s not clear how close Facebook is to the “500” number officially or clear to me how that number is calculated precisely. (Clearly Facebook has more than 500 employees who have stock options, which are classified differently.)

As an aside, SEC has begun an investigation into the trading of private company shares. I suspect that we’ll see some new regulations down the road, though not in this Congressional term, that alter the ability of companies to do this kind of private fund raising and trading at this level of scale without going public.

On to the fun stuff: what might Facebook do, beyond making more people rich, with all the money? More headcount and more acquisitions are obvious moves. In addition the company is reportedly going to move to a new, larger home in Menlo Park that was a former Sun Microsystems campus — sometimes referred to as “Sun Quentin” after the California prison in nearby Marin County.

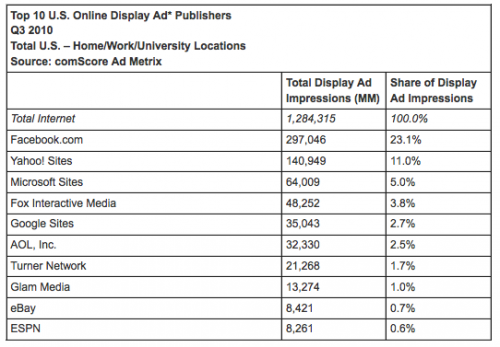

Facebook is reportedly making about $2 billion annually (run-rate) on advertising. But it’s serving almost 25% of all US display ads according to comScore. So I would expect its display revenues to increase accordingly. Yet where might Facebook look for more revenue growth when it does go public eventually?

Mobile advertising is one obvious place, e-commerce is another (shopping is a big opportunity for Facebook) and local is a third opportunity. But search might also be another place that Facebook inevitably turns.

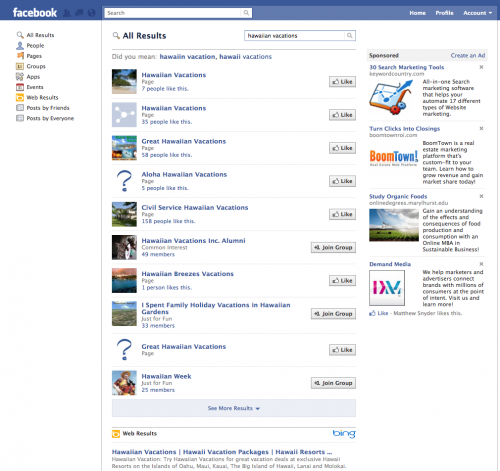

Given the Microsoft relationship and Facebook’s lack of core competency in search it would not seem logical that the company would go there. But the “gravitational pull” of search may ultimately prove too great. As you know, after email search is the web’s “killer app.”

Imagine that Facebook were to become convinced that having its own search engine was a key to delivering a better user experience overall, as well as generating new ad revenue. One obvious and immediate possibility would be to buy Blekko, which has pushed social integration with Facebook Likes further than Microsoft itself.

Blekko has raised just over $24 million and could probably be acquired for some multiple of that figure below $200 million. Presto: just ad search. Other more unlikely possibilities would be to buy someone like Infospace or even Ask, though in both cases it would cost more than $200 million and potentially much more in the case of Ask.

For its part Blekko is very innovative but faces a long uphill climb against Google and Bing. Under the hood at Facebook, with 500 million users, it would be quite a different matter. In my view the thing that today separates the Facebook experience from being “truly useful” is a strong search offering, notwithstanding the Bing integration.

I’m speculating and I don’t know what the Microsoft-Facebook deal terms look like. They might contractually preclude Facebook from developing or introducing its own web search engine for some period of time.

Formerly I would have argued that it would be very difficult and almost pointless for Facebook to develop its own search engine given the Bing relationship. But with all this new money flowing and not that many revenue opportunities like paid search out there, the push and the pull of search may just be too strong for Facebook to resist.

Postscript: Clint Boulton at eWeek has an interesting post arguing that Facebook might buy the Chrome-based social browser RockMelt. He suggests this is another way to compete with Google, although Google is the default search option on RockMelt.

- Blekko, Bing & How Facebook Likes Are Changing Search

- What Social Signals Do Google & Bing Really Count?

- Bing, Now With Extra Facebook: See What Your Friends Like & People Search Results

- Bing Expands Use Of Facebook ‘Likes’ In Search Results

- Facebook 101: A Simple Guide To Understanding When & How To Use Basic Features

Contributing authors are invited to create content for Search Engine Land and are chosen for their expertise and contribution to the search community. Our contributors work under the oversight of the editorial staff and contributions are checked for quality and relevance to our readers. The opinions they express are their own.

Related stories

New on Search Engine Land