Google EU shopping rivals complain antitrust remedies aren’t working

They're demanding more changes, saying their problems have intensified rather than improved since the EC ruling in June, 2017.

In the wake of the European Commission’s $2.7 billion antitrust fine against Google last year, the company opened up product listing ads (PLAs) to rival comparison shopping services. It also pledged to operate Google Shopping as though it were a stand-alone entity and to provide “equal treatment” for rivals.

Implementing that program resulted in a number of changes to the auction and shopping ads in search results. However, rivals such as Kelkoo, among others, have been complaining these measures haven’t worked and that their competitive positions have deteriorated.

Google’s shopping comparison rivals now formally seek additional concessions and have complained to the European Commission, which is reviewing their complaints and seeking information from Google to assess the efficacy of its remedies.

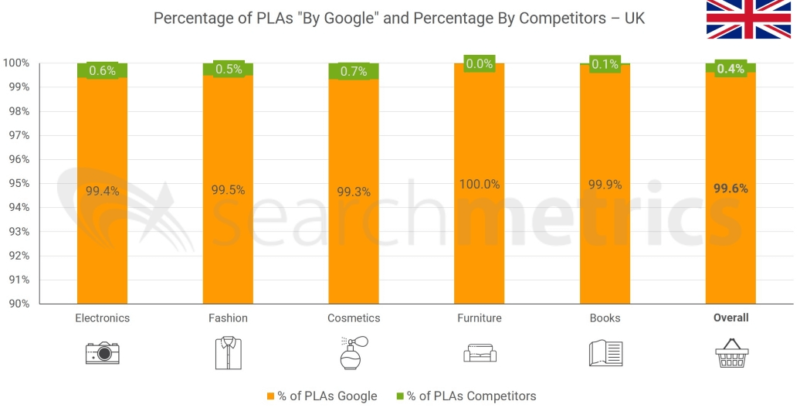

Data and analysis released earlier this week by Searchmetrics appear to support the rivals’ cause. Searchmetrics’ analysis found that Google still overwhelmingly dominates shopping ads in the UK and Germany in five key retail segments. More than 99 percent of PLAs across the examined categories in the UK were still “by Google.” The German market is reportedly somewhat more competitive.

Searchmetrics also found that organic visibility had declined for Google’s shopping competitors since the end of June 2017. This is mirrored in some of the complaints and allegations from Google competitors in Europe. According to The Wall Street Journal:

Some rivals also allege Google has continued to demote their websites in its general search results since the EU decision, which also alleged such demotions. Kelkoo CEO Richard Stables says the firm’s revenue from general search traffic dropped by 62 percent last year, to €2.3 million. In 2018, he projects a two-thirds drop to €800,000.

Google has taken the position that its changes to shopping ads and the auction in Europe comply with the European Commission’s order and that rival shopping services are treated equally. Google’s competitors disagree.

Should the Commission find that Google’s measures are inadequate or don’t comply with its antitrust order, the company could receive additional fines equivalent to 5 percent of its global daily revenue until compliance. Indeed, the European Commission is likely sympathetic to Google’s competitors and will be inclined to demand further action with the threat of additional penalties.

It’s not entirely clear what should happen or what would indicate compliance. The simple answer might be a substantially higher percentage of rival ads in PLAs and rival sites in organic slots. But that implies a high degree of regulatory involvement and potential intervention in the SERP itself.

Google maintains it has leveled the playing field for PLAs in Europe. Its competitors see something quite the opposite. Are those competitors right, partly right or not entirely competent and blaming their failures on Google?

Google is in the process of appealing the EC antitrust ruling and fine, but that could take several years.

Contributing authors are invited to create content for Search Engine Land and are chosen for their expertise and contribution to the search community. Our contributors work under the oversight of the editorial staff and contributions are checked for quality and relevance to our readers. The opinions they express are their own.

Related stories