Google Product Search To Become Google Shopping, Use Pay-To-Play Model

Google Product Search is getting a new name, Google Shopping, and a new business model where only merchants that pay will be listed. It’s the first time Google will decommission a search product that previously listed companies for free. The company says the change will improve the searcher experience, but it will also likely raise […]

Google Product Search is getting a new name, Google Shopping, and a new business model where only merchants that pay will be listed. It’s the first time Google will decommission a search product that previously listed companies for free. The company says the change will improve the searcher experience, but it will also likely raise new worries that Google may further cut free listings elsewhere.

“This is about delivering the best answers for people searching for products and helping connect merchants with the right customers,” said Sameer Samat, vice president of product management for Google Shopping, when explaining that by moving to an all-paid model, Google believes it will have better and more trustworthy data that will improve the shopping search experience for its users.

Perhaps this will be so; perhaps not. We’ll only have a better idea when the transformation is complete. The process begins now with experiments, launches more fully in the summer and will take through the fall to finish in the United States, when the service should be formally renamed from Google Product Search to Google Shopping.

Next year, the change to paid inclusion will happen outside the US, Google says. In some countries, Google Product Search has already been called Google Shopping but without the paid listings model.

Starting Now: Experiments

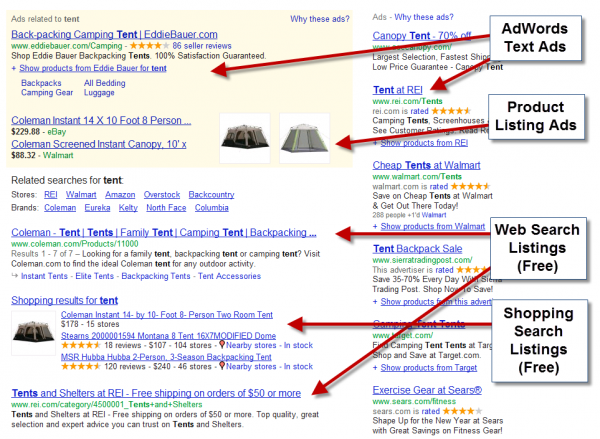

Beginning today, Google will run a variety of experiments on Google.com, for a small percentage of searchers at first, that merge listings from Google Product Listing Ads and Google Product Search together. To understand better, consider this “before” example:

You can see that Google has its traditional AdWords text ads above and to the right of the main results. Also above are Product Listing Ads, which were launched at the end of 2010 and allow advertisers to show small images next to their ads, as well as purchase on a CPA (cost per action/sale) basis, rather than the more common CPC (cost per click) basis. Product Listing Ads sometimes appear to the right of the main results, as well.

The screenshot also shows the “free” listings that Google provides, those that come from Google crawling the web, as well as those from Google Product Search. The listings from Google Product Search come from Google’s web crawl as well as from data feeds that merchants send to Google.

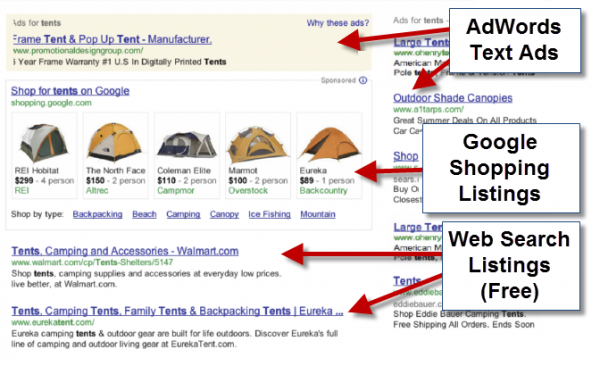

In contrast, below is an example of how one of the new experiments may look:

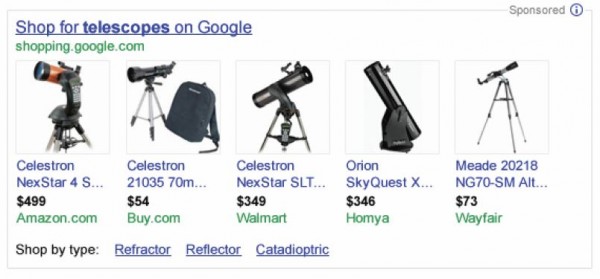

Rather than the Product Listing Ads and Google Product Search results being separate, both will be combined into a single Google Shopping box. Here’s another example, with a close-up on the Google Shopping box:

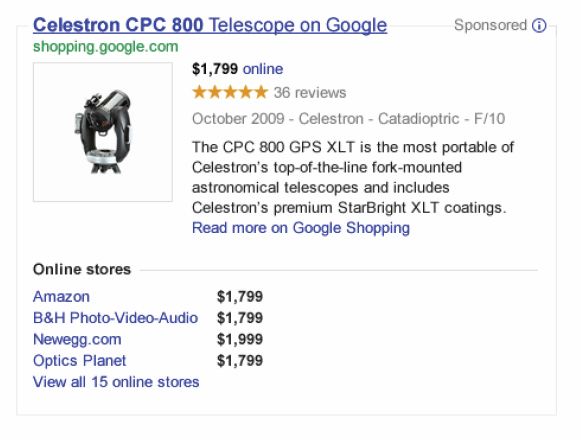

The example below shows how, at times, only one product might appear to the side of the main results:

Again, here’s a different example, with a close-up on the box:

Goodbye Google Product Search & Free Listings

Goodbye Google Product Search & Free Listings

As said earlier, Google Product Search currently gets its listings from Google crawling the web or by retailers submitting product data and feeds through the Google Merchant Center. There has been no charge for either. Indeed, Google has never charged for being in its shopping search engine since it began back in December 2002 and was called Froogle.

That’s ending. There’s no firm date on exactly when the free ride will be over, other than it should happen by the fall of this year.

Merchants may continue to be listed within Google’s free web search results. That’s not changing. But those wanting to appear in a dedicated shopping search engine — and in the Google Shopping boxes that will appear as part of Google’s regular results — will need to pay.

Hello Google Shopping & Paid Inclusion

The forthcoming Google Shopping will operate on what’s been known in the search industry as a paid inclusion model. That’s where companies pay to be listed but payment doesn’t guarantee that they’ll rank well for any particular terms.

In particular, Google says advertisers will provide data feeds or create product listings through Google AdWords, in campaigns that are set to run on Google Shopping. It will work very similarly to how Product Listing Ads work now. Merchants won’t bid on particular keywords but rather bid how much they’re willing to pay, if their listings appear and get clicks or produce sales. Getting a top ranking will depend on a combination of perceived relevance and bid price.

As part of the changes, Google Shopping will incorporate Google Trusted Stores badges into the listings, for those merchants who participate in the program. Google has already been testing the use of these within AdWords.

Google also says the new Google Shopping listings will be able to show if merchants have any special deals or offers — these can also be sent within the merchant’s data feed.

Product Listing Ads as a product will be phased out when Google Shopping takes over, but Google says using the PLA system now is the best way for merchants to prepare for the Google Shopping change. That’s why Google is offering two incentives to get merchants going with them now, if they’re not already:

- All merchants that create Product Listings Ads by August 15 will receive 10% credit for their total PLA spend through the end of the year

- Existing Google Product Search merchants will get a $100 AdWords credit if they fill out a form before August 15

Google provides more details about this and the forthcoming transition here. We’ll also be following-up with more transition advice and details as they become known.

Didn’t Google Hate Paid Inclusion?

The paid inclusion model will be familiar to many merchants, who know it’s commonly used with other shopping search engines. But it’s new to Google. In fact, it’s a model that Google once fought against, even to the degree of characterizing it as evil. Those days are over. Google Shopping will becomes the fourth “vertical” or topically-focused search engine from Google to use paid inclusion.

Once Deemed Evil, Google Now Embraces “Paid Inclusion” is my column from yesterday at our sister site Marketing Land. It explains the history of Google’s past opposition to paid inclusion and its reversal over the past year. Of that history, I’ll highlight this part of Google’s 2004 IPO filing, which specifically talked about paid inclusion being bad in terms of shopping search:

Froogle [what’s now called Google Product Search and will be called Google Shopping] enables people to easily find products for sale online. By focusing entirely on product search, Froogle applies the power of our search technology to a very specific task—locating stores that sell the items users seek and pointing them directly to the web sites where they can shop. Froogle users can sort results by price, specify a desired price range and view product photos.

Froogle accepts data feeds directly from merchants to ensure that product information is up-to-date and accurate. Most online merchants are also automatically included in Froogle’s index of shopping sites. Because we do not charge merchants for inclusion in Froogle, our users can browse product categories or conduct product searches with confidence that the results we provide are relevant and unbiased.

I bolded the key part. Eight years ago, Google viewed paid inclusion in general as some type of evil the company should avoid and in particular something that could cause shopping search to have poor relevancy or be biased.

What happened to cause such a change?

Reversing Its Stance

For one, Google’s official line seems to be that it hasn’t changed its mind about anything. That’s because it’s changing the definition of what paid inclusion is, to effectively claim that it’s not doing it. This is the statement I was sent after my column appeared yesterday:

Paid inclusion has historically been used to describe results that the website owner paid to place, but which were not labelled differently from organic search results. We are making it very clear to users that there is a difference between these results for which Google may be compensated by the providers, and our organic search results.

As I did yesterday, I’ll disagree again. Paid inclusion has been historically used to describe when people pay to appear in a search engine’s results but without any guarantee of prominent placement. What’s happening with Google Shopping is classic, textbook paid inclusion. It matches up precisely with the US Federal Trade Commission’s own definition of paid inclusion:

Paid inclusion can take many forms. Examples of paid inclusion include programs where the only sites listed are those that have paid; where paid sites are intermingled among non-paid sites; and where companies pay to have their Web sites or URLs reviewed more quickly, or for more frequent spidering of their Web sites or URLs, or for the review or inclusion of deeper levels of their Web sites, than is the case with non-paid sites.

Again, I’ve bolded the key part, a part that defines exactly what’s going to happen with Google Shopping.

The fact Google considered paid inclusion evil in the past is an embarrassment that some will have a good chuckle about. But companies do change stances. The bigger issue in all this is whether the shift is good for searchers and publishers.

Paid Relationships Can Be Good

When it comes to searchers, Google’s view is that by having a paid relationship, it can better ensure the quality of what it lists in Google Shopping.

“We believe a commercial relationship with partners is critical to ensuring we receive high quality product data, and with better data we can build better products,” Samat told me.

Today’s blog post from Google reflects the same view:

We believe that having a commercial relationship with merchants will encourage them to keep their product information fresh and up to date. Higher quality data—whether it’s accurate prices, the latest offers or product availability—should mean better shopping results for users, which in turn should create higher quality traffic for merchants.

A good example of the potential here is something we covered last November. Google had warned merchants in Google Product Search to include tax and shipping costs in their feeds. But well past Google’s deadline, merchants were still flouting those rules.

Potentially, those merchants risked being kicked out of Google Product Search. But being a free service, it possible the merchants might come back in another way. There was a low barrier to entry. That low barrier also means much more has to be policed.

When payment is involved, it’s harder to be abusive. Merchants risk losing their accounts, along with any trust built up to those accounts. In addition, when they’re paying by the click or by the sale, there’s more incentive to ensure listings are relevant.

But There Was No Other Way?

Still, this is an unprecedented move by Google. The company has never eliminated a search product that had free listings and shifted to an all-paid model.

I couldn’t think of any examples of this in the past, and Google confirmed this was a first. At best, it offered that Boutiques.com — purchased in 2010 and integrated into Google Product Search in 2011 — had a similar pay-to-play model. But Boutiques.com wasn’t an existing service that was shifted from free to fee.

For a company with such a long history of trying to be inclusive, it’s shocking. It’s more so when Bing Shopping accepts free listings. Google couldn’t find a way to do what Microsoft does?

“We’ve looked at a number of different aspects to approach this, but we have to evolve our experience. We believe consumers have a higher expectation of shopping online,” Samat said.

Will It Stay Comprehensive?

One thing I’ve generally loved about Google Product Search is that if I couldn’t find some odd product on Amazon (which tends to be a pseudo-shopping search engine for me), Google seemed able to ferret it out. But with the change to a paid inclusion model, will the ability to get into the nooks and crannies of the retail web be lost?

Google told me that it currently has tens of thousands of merchants listed in Google Product Search for free. I asked if the company had any idea how that might change when payment is required or if there would be an impact on comprehensiveness?

“We really want all kinds of merchants to participate,” Samat said. But he also said, “It’s hard to speculate on how this will play out. Our objective here is to deliver a better experience. We are doing a number of things to help the users’ experience get better.”

Going Forward

In the end, Google is shifting to what’s been the industry standard when it comes to shopping search, to have a paid inclusion program. The curious can take a look here at SingleFeed for a rundown on who offers paid plans or here at CPC Strategy. Most shopping search engines do. Even Bing, which is listed as being free, also does paid inclusion through a partnership with Shopping.com, saying that doing this will increase visibility.

One thing about the change is that it will probably cause all the shopping search engines out there to better disclose the paid relationships they have. As I covered in my column yesterday, the FTC has seemed to ignore that some don’t have any disclosure at all, as required. Google’s move has the potential to raise the bar here, and that’s sorely needed.

For searchers, Google’s trying to find the balance between having incredibly comprehensive results and the noise that can harm relevancy when there’s too much junk and not enough signal, it seems. As I said, it remains to see if they’ll get that balance right.

For publishers, there’s a whole lot of worry here. If Google can turn one search product to an all-paid basis, nothing really prevents it from doing the same for others. Could Google News only carry listings from publishers that want to pay? Will Google Places, already just transformed into a part of the Google+ social network, be changed to a pay-or-don’t play yellow pages-style model?

Even web search could be threatened. All the arguments about wanting to get better data and filter out noise are just as applicable to web search. The main reassuring thing here is that there’s little likelihood that Google could get hundreds of millions of web sites to do paid inclusion at the risk of not being listed. Pure paid inclusion works better in the world of vertical search, where there are only thousands of companies you’re dealing with.

Meanwhile, with Google Play selling content, will Google eventually decide that Google Shopping should make the next logical step and provide transactions, the way that Amazon does? At some point, Google the search engine that is supposed to point to destinations may turn into too much of a destination itself.

Related Articles

- Goodbye Froogle, Hello Google Product Search!

- Google Product Listing Ads Available To All Advertisers

- Google Partner Brings Big Data To Product Search

- Getting Started With Google Shopping Feeds

- Despite New Rules, Google Product Search Merchants Not Providing Accurate Tax & Shipping Costs

- Google Gets Into Ratings Game With Trusted Stores

- Google Testing “Trusted Stores” Badges On Search AdWords

- Official: Google Offers Goes Live, First Portland Offer Arrives

- Google Expands Offers To Five New Markets

- Once Deemed Evil, Google Now Embraces “Paid Inclusion”

Contributing authors are invited to create content for Search Engine Land and are chosen for their expertise and contribution to the search community. Our contributors work under the oversight of the editorial staff and contributions are checked for quality and relevance to our readers. The opinions they express are their own.

Related stories