Merkle: Google ad growth slowed, Microsoft gained with Yahoo in Q2

The Verizon Media transition helped propel Microsoft Advertising shopping ad growth among Merkle’s client base last quarter.

Ad spend growth on Google search ads slowed while desktop spend on Microsoft Advertising had its strongest quarter in more than three years in the second quarter of 2019, according to performance agency Merkle.

Verizon Media inventory bump. Microsoft Advertising’s gain came in large part from its deal with Verizon Media to handle all search ad inventory across its properties, including Yahoo, Merkle reported. That meant a loss for Google, which had been serving Yahoo shopping ads since 2016. The transition to Microsoft Advertising (formerly Bing Ads), announced in January, was largely completed by the end of March.

U.S. spending on Microsoft Advertising shopping ads grew by 54% year-over-year. Overall, Microsoft Advertising spend grew 8% year-over-year compared to the combined results of Bing Ads and Yahoo Gemini the prior year, reversing two consecutive quarters of negative growth.

Slower Google Shopping spend growth. Google Shopping spend grew 38%, a deceleration from 41% in the first quarter of 2019. “Yahoo dropping Google’s ads in favor of Bing Product Ads at the end of Q1 appears to have had a meaningful impact,” said Merkle.

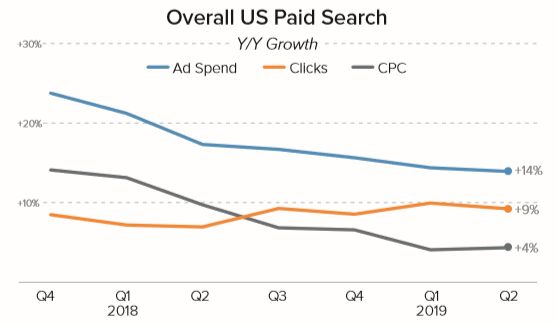

Overall search spend growth steady at 14%. Among Merkle’s client base, which skews large retailer, US search spend increased by 14% year-over-year in the second quarter of 2019. Microsoft Advertising spend grew by 16%, and Google Ads search spend rose by 15% year-over year. Google click volume increased by 10% and CPCs rose by 4.5% from the previous year.

Why we should care. This is a high-level look at the data encompassed in Merkle’s Digital Marketing Report (registration required), but it reflects the slower growth the engines have been reporting. (Microsoft reported slower ad revenue growth last quarter. Google reports earnings for the second quarter of 2019 on Thursday.) However, there are areas of growth for advertisers (and more nuanced stories to tell), with Microsoft Advertising shopping ads being one example.

Merkle also noted that click share for RLSAs

Contributing authors are invited to create content for Search Engine Land and are chosen for their expertise and contribution to the search community. Our contributors work under the oversight of the editorial staff and contributions are checked for quality and relevance to our readers. The opinions they express are their own.

Related stories