Google’s Product Listing Ads: The Aftermath

Back in September, I wrote about the Product Listing Ads transition from free to paid clicks in Google Shopping. The PLA transition is now complete, and with holiday shopping in full effect, it’s worth taking a look at the evolution of the PLA transition, and more importantly, the impact of PLAs on the bottom line […]

Back in September, I wrote about the Product Listing Ads transition from free to paid clicks in Google Shopping. The PLA transition is now complete, and with holiday shopping in full effect, it’s worth taking a look at the evolution of the PLA transition, and more importantly, the impact of PLAs on the bottom line of big and small businesses alike.

Before getting into some results and the impact on marketing efficiency, I received several comments in response to my last post surrounding how consumers behave within PLAs. Personally, I do not think of PLAs as ad placements like paid search because, unlike the ads in paid search, shopping results are not clearly labeled as ads.

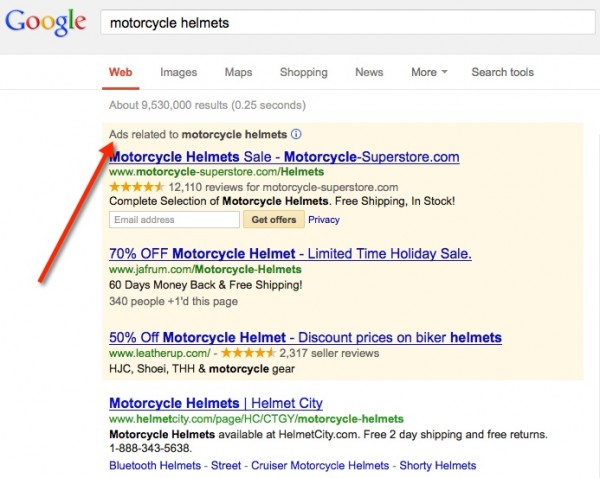

On a normal Google search engine results page, ads are clearly labeled as ads.

But, within Shopping, there is no clear notification that results are paid placements.

Unless you click on the ‘Why these products?’ link in the upper right, in which case you will see:

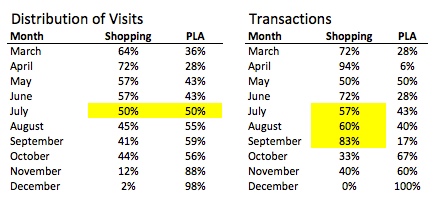

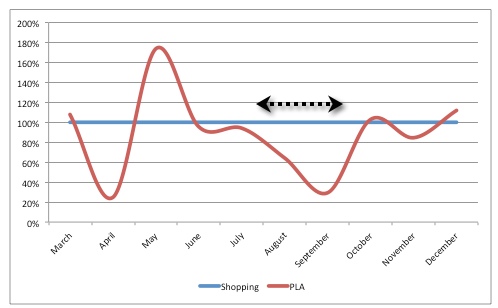

If there has been no significant visible transition to users, we can assume that user behavior within Shopping / PLAs has not changed, either. After all, the nature of the product, comparison shopping, remains the same. However, looking at the distribution of traffic and transactions over time for a composite of several long-time PLA/Shopping e-tailers suggests there have been some interesting things going on:

Both tables provide insights, and I’ve highlighted the most significant metrics. Distribution of traffic tells us that the visitor inflection point occurred in July — meaning that August was the first month that Google pushed the majority of traffic into PLAs.

However, distribution of transactions shows that traffic driven by PLAs in Q3 was highly unqualified, resulting in very few relative transactions despite more volume being pushed via PLAs.

The disruptive switch could be due to a multitude of reasons, including extensive testing in the layout or the evolution of auction settings such as bid floors, both of which could have significant ramifications as the market settled into place.

Whatever the cause, it had a massively negative impact on PLA conversion rates relative to Google Shopping in Q3:

That said, by October, things appeared to settle down as PLAs steadily took over nearly 100% of traffic.

So, if we ignore the rocky Q3 and look at the aggregate shift from beginning to end of 2012, general user experience within Google Shopping has not changed too much. So what has changed?

To get some answers I reached back out to my good friend, Erick Barney, VP of Marketing at Motorcycle Superstore (MCSS) to get his thoughts and insights on the last few months of PLAs and their underlying market currents. The following is a summary of our conversation along with some quotes from Erick.

It’s worth noting that MCSS has been in the Google Shopping space for many years and had a highly optimized merchant center feed prior to the PLA switch. Since the completion of the paid click transition, they have observed a ROI via Shopping that exceeds paid search.

Despite all of the product-level details in the merchant center feed not being present in the new placement formats, Erick believes that as a category leader with an optimized feed, MCSS is benefitting from the new auction based model.

“PLAs represent Google’s effort to reduce the clutter in the Shopping experience. By charging for clicks, companies need to have a strategy surrounding product submission, feed optimization, and bid management,” says Barney.

Even with the new associated costs, PLAs have been good to MCSS. “There’s no point in getting hung up on the cost of PLAs. It is what it is. We should be grateful we got all those free clicks for so many years,” says Barney.

Category leaders and price competitive e-tailers stand to benefit the most from the paid shopping experience as consumers purchase either from trustworthy or cheap stores. In response, Google has also recently introduced the Google Trusted Store guarantee, which highlights category leaders and incentivizes users to purchase from trusted retailers.

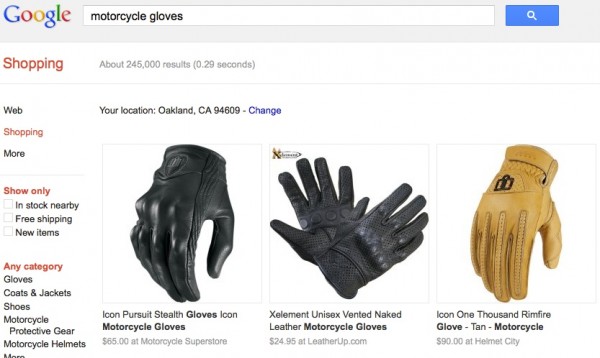

All said and done, the biggest change in PLAs remains to be the absence of Amazon from the listings. If you search long and hard enough you will find some Amazon listings in the results but only at a fraction of the company’s former visibility.

Just a few months ago, Amazon dominated Google Shopping. They ranked #1 for virtually all results. Now, other brands can take up those top positions. But, is that a good thing? It depends.

“Amazon used to drive huge volume but you don’t own the customer from an Amazon transaction so lifetime value is relatively low. Removing Amazon from Shopping has freed up the top spot on most product searches but has also led to reduced overall conversion volume,” says Barney.

While category leaders have picked up traffic through increased exposure and increased lifetime value through ownership of the customer, they have lost net revenue. As a result, smaller retailers who were not previously subsidized by Amazon stand to benefit the most from increased exposure.

“Amazon faces a very interesting predicament. It was historically easy for them to submit their entire catalog to Google Merchant Center and rest on their laurels as the unrivaled e-commerce leader to generate massive amounts of traffic. Now they need to worry about bidding and margins like the rest of us, which appears to have taken them out of the shopping results,” says Barney.

Maybe it’s temporary, but the results have impacted businesses in a big way.

The Bottom Line

The process of shifting traffic from fee to paid clicks was by no means smooth, but it appears to have normalized leaving opportunity for price-competitive businesses to stake a claim to placements that have previously been reserved for Amazon.

That said, because there is now a cost of engagement, businesses need to be strategic in which products are submitted to the Google merchant center, continue to focus on feed optimization, and consider margins in determining an ROI goal for PLAs.

If you gave PLAs a shot back in Q3 2012, it’s worth going back to see if you may have been victimized by the rocky transition. Compare relative conversion rates and distribution of traffic to get a better picture of the impact of the transition and you might find it’s worthwhile to put together a test budget for Q1 2013.

Contributing authors are invited to create content for Search Engine Land and are chosen for their expertise and contribution to the search community. Our contributors work under the oversight of the editorial staff and contributions are checked for quality and relevance to our readers. The opinions they express are their own.

Related stories

New on Search Engine Land