An SEM Christmas Carol: Q4 Past, Present & Yet To Come

SEM no longer lives in a vacuum, Columnist Susan Waldes argues. Do you have the resources to thrive in an increasingly complex future?

At its inception — and for years afterward — paid search could exist in a vacuum. You could send clicks and drive profitable return, staying inside your AdWords and other UIs, analyzing your keywords and executing your optimizations.

Over time, to remain competitive, it became more important to collaborate with other teams in order to ensure search engine marketing (SEM) success. Landing page optimization is now an integral part of paid search that requires creative and development resources. Conversion pixels and remarketing pixels need placement and QA by dev teams, as well.

We need banners to be developed by a creative team. We align our sitelinks and messaging with the offers on the promotional calendar, which are handled by the broadcast advertising or branding team.

Ideally, the paid search team also has visibility into the lifetime value of the users and can adjust bids based not just on the single “conversion point,” but the actual revenue being driven (even if it takes 90 days or 2 years for that user to mature to his or her full value).

There are still many paid search departments operating in a silo. The industry has reached a tipping point where this is very dangerous.

Desktop impressions that have last-click attribution possibilities hit their peak and are now declining. The competition for impressions continues to increase. The engines have shifted their algorithms such that the undiscovered long-tail does not exist anymore.

SEM In Q4s Past

It’s January 2010 and you, the SEM head at a women’s dress retailer, are high-fiving the CEO after winning Q4 2009. You spent $1,000,000 and drove $3,000,000 of attributable revenue. You are giving a presentation showing how you did it.

By savvy execution, you gained the competitive edge. You were an early adopter of sitelinks and did frequent ad text testing, driving your click-through rate (CTR) to 5%.

You segmented your campaigns by device earlier in the year, and by Q4, you eliminated mobile searches that showed negative ROI, focusing your spend on the high-ROI desktop searches.

You were on top of your match types, adding your best keywords as exact match and responsively adding negatives to eliminate poor performing spend. You got your conversion rate to 10%.

With your installation of Marin software earlier in 2009, the software was adjusting your bids daily at a granular level with all your campaign segmentation to hit that 300% return on ad spend (ROAS) target that you plugged into the program as a goal. Marin was also capturing the revenue you drove based on the cookies and the conversion pixel you placed on your landing page.

This 300% ROAS target you hit means you were profitable on the company’s 30% margins. Though you only squeaked out a bit of profit within Q4, the customers you drove will buy more down the road. Company-wide, your average customer orders increase 2.3 times.

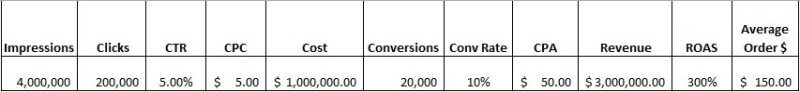

Here are your Q4 2009 metrics:

Fast-Forward To Q4 Present

Demand has grown in the online women’s dress space, and you’ve discovered some new keywords. There are now 6 million PPC impressions in Q4 on your keywords.

However, half of them have moved to mobile, leaving only 3 million to work with on your desktop-only strategy (25% fewer desktop impressions than 2009).

More of your competitors have moved into paid search by now, and some of the largest have shifted their brand advertising dollars away from TV and into their Q4 paid search budgets. Many are willing to invest the branding dollars into driving awareness without directly attributable ROI.

The more ROI-focused competitors have evolved to stay competitive by factoring the full customer lifetime value into their bidding. With organizational focus on lifetime value, they’ve been able to drive their average number of orders per user up to 3 via email and remarketing programs.

They’ve been tracking cohorts and determined a customer is worth $450. They will pay up to $300 for a customer acquisition, knowing that acquisition will mature to profitability in two years.

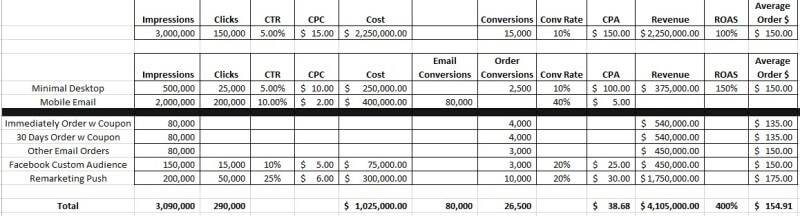

These competitive factors have increased the average cost-per-click (CPC) on your core keywords in Q4 to $15 (up from $5 in 2009). With the lower impressions and higher CPCs, your winning 2009 strategy — if executed in 2014 — looks something like this:

Your ROAS is one-third of what it was five years ago. You need more than double the budget to get to break-even gross revenue on cost.

Even if you factor in your average lifetime order number of 2.3, you still don’t get to your directly attributed 2009 SEM numbers. This kind of performance change is not one that typically elicits a high-five from your CEO.

If this is what your Q4 2014 produces, your future Q4s have little to no PPC budget. Perhaps the company has no PPC department or agency in the future. Perhaps you’ve moved to another job after getting canned. “He used to be so good,” they’ll say. “I don’t know what happened.”

It doesn’t have to be so bleak.

Q4 Present, An Alternative

Let’s examine another way Q4 might play out. You’ve been given your $1 million budget, and we’ve established the marketplace conditions. Aware of these challenges, you make a plan.

You frontload your spend, spending the majority in October and November when CPCs haven’t heated all the way up yet. The desktops CPCs are a more moderate $10 during this period, and you keep desktop sales as a minimal part of your spend.

The mobile conversion problems in your industry mean early-November mobile CPCs are even lower at $2. You create mobile-preferred ads and a new landing page with a gated mobile experience, using a pop-up (or modal, or lightbox, if you prefer the terminology) at the right moment which asks for an email address — offering a 10% coupon to be emailed.

With less competition in mobile search, and this very shallow conversion point collecting simply an email addresses, your CTRs are 10% — and 40% of those clicks (your conversion rate) are happy to give you their email address in exchange for a coupon.

You collect 80,000 email addresses via mobile. These people have indicated a strong interest in shopping with you. 4,000 (5%) users order right away when they get back to their desktop with the added incentive of the coupon they were emailed.

Another 4,000 order with the coupon over the next 30 days as the holidays get closer. After their initial coupon email, you put these people in your normal email campaigns, and another 3,000 order during Q4 without ever using the coupon.

Many of the emailed users haven’t ordered, but they’ve clicked through to the site from an email and gotten cookied on their desktop computer with your AdWords remarketing pixel.

In the meantime, you use $75,000 of your budget for a Facebook custom audience campaign comprised of your email addresses and are thus nurturing these 80,000 people via Facebook ads.

Ultimately, 3,000 of them order, and 25,000 come through those ads to browse your site again and get cookied with your AdWords remarketing pixel on their desktop.

Black Friday hits, and you’ve turned down your search spend to a trickle of high performance keywords.

You use the remainder of your budget to push remarketing in late November and through December. You target all site visitors, including the original desktop clicks and the mobile users that you’ve now cookied on their desktop, too.

When the competitors drop out on December 26, you push even harder on remarketing and take advantage of a surge of cheap available impressions on Facebook and GDN to drive a New Year’s Eve dresses campaigns, knowing NYE has a higher average order size than any other time of year.

Here’s how the numbers end up:

You’re looking at $4 million in revenue and 400% ROAS. Queue the high-fives!

In January 2015, you’ll be celebrating with the CEO who will recognize that you’ve found the secret sauce in a cross-device, cross-channel world with ever-increasing complexity and competition.

Wait, Could You Pull This Off?

Before we get ahead of ourselves, take a step back and do a thought exercise. Could something like the strategy described above be executed in your organization? Would it be bathing suit season before the New Year’s Eve banners were completed?

Execution on the sort of strategy described requires cohesive project management through several teams.

Development is needed to create the mobile landing page and email collecting funnel. They’ll also need to place a new conversion pixel for this email entry conversion. I still see paid search campaign kick-offs delayed by months simply waiting for a single AdWords conversion pixel placement.

Somebody will need to design and create the email that contains the coupon. Somebody else will need to make sure there are rules to send this email when the user originates from your mobile landing page pop-up.

This initiative will require atypical attribution that is neither first- or last-click but tied to the entry of the user’s email address, yet is also capable of factoring additional spend such as remarketing spend on both Facebook and AdWords.

There is likely some complex database work to achieve this. How will you stitch together the spend, multiple touch points and eventual revenue from this effort?

Can you get approval from higher-ups to move to a 90-day multi-channel strategy? Even if spend looks high and results low for October in isolation? Could you even get (the much simpler) approval to use a coupon/offer code on an already expensive channel?

What If You Can’t Execute A Complex Strategy?

My campaign example might be a bit over-the-top in terms of complexity.

Still, in our multi-channel, multi-device world, the SEM team cannot deliver maximum results without agile teams, multi-channel approaches and significant resources to draw from (other than just budgets). This access needs high-level support to ensure work and resources are properly prioritized.

Soon, it won’t be a matter of thriving or driving “maximum results.” The easy last-click attribution will get more and more lost and rely on more complex tracking. The desktop impressions will continue to plateau or decrease. The competition and CPCs will continue to go up.

Before long, the ability to work with these complexities will determine if PPC is viable at all for many businesses.

How will you compete? This is the world we are in now. If you are clinging to the dwindling batch of desktop paid search impressions that drive directly last-click attributable sales and ROAS that is profitable on the first interaction, your future Q4s look very bleak compared to the past.

If you can’t catapult your SEM program to being a fundamental part of a complex, agile, multi-departmental machine driving acquisitions based on lifetime customer value this Q4, then you need to make this your primary focus in 2015 while there is still time to have great Q4s yet to come.

Contributing authors are invited to create content for Search Engine Land and are chosen for their expertise and contribution to the search community. Our contributors work under the oversight of the editorial staff and contributions are checked for quality and relevance to our readers. The opinions they express are their own.

Related stories

New on Search Engine Land