Strong Start: Paid Search Grew 25 Percent In Q1, Mobile Shot Up 135 Percent YoY [Covario]

Covario released its Global Paid Search Spend Analysis for the first quarter of 2014 today. Its client set — made up of enterprise technology, consumer electronics, and retail advertisers –increased paid search spend on mobile devices by 135 percent year-over-year and 35 percent over the previous quarter. Mobile now accounts for 25 percent of paid […]

Covario released its Global Paid Search Spend Analysis for the first quarter of 2014 today. Its client set — made up of enterprise technology, consumer electronics, and retail advertisers –increased paid search spend on mobile devices by 135 percent year-over-year and 35 percent over the previous quarter.

Mobile now accounts for 25 percent of paid search spending, with 60 percent of that spend going to tablets, 40 percent to smartphones. Cost-per-click (CPC) on smartphones rose 9 percent compared to the previous quarter, while tablet CPCs remained flat.

Surprisingly, however, Covario has seen the discount from desktop widening with the smartphone discount increasing by 3 percent to clock in at 44 percent lower than desktop. Tablets came in 20 percent below desktop, an 8 percent discount increase from the previous quarter.

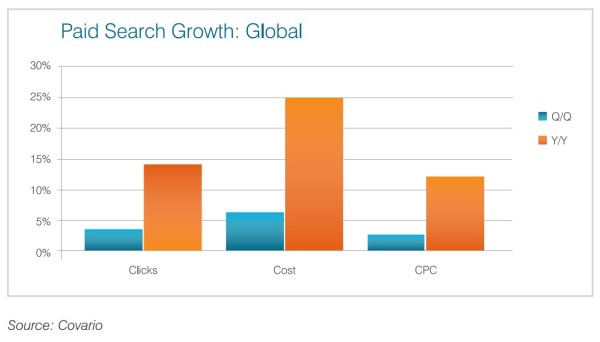

Overall, Covario advertisers spent 25 percent more on paid search advertising in Q1 of this year than the previous year and 7 percent more than in Q4 2013.

Overall, Covario advertisers spent 25 percent more on paid search advertising in Q1 of this year than the previous year and 7 percent more than in Q4 2013.

Globally, CPCs rose 12 percent compared to a year ago and 3 percent over Q4. Alex Funk, the study’s author and director of global paid media strategy at Covario, cites mobile maturation for the CPC increases, a conclusion also drawn in IgnitionOne’s latest quarterly report on paid search.

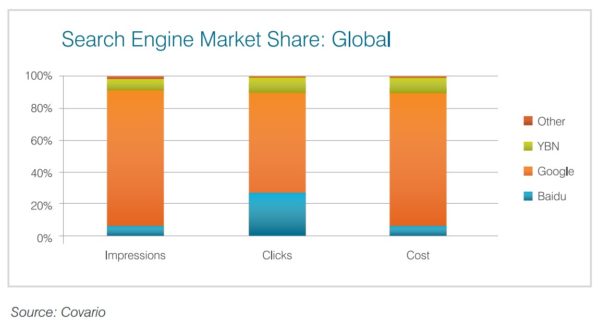

For budget planning, Funk is recommending advertisers plan for a 15 percent increase in search spend through 2014, with 80 percent allocated to Google. The budget increase is suggested for product listing ads, mobile search and in anticipation of higher click-through rates.

Regionally, his recommendations vary. Europe, the Middle East and Africa (EMEA) have begun recovering from a sluggish 201, with paid search spend up 6 percent year-over-year and a healthy 13 percent from Q4. The UK, Germany, France, the Nordics and the Netharlands saw the biggest growth in the region. Funk suggests advertisers plan to spend 10 percent more in the region, with the bulk of the increase going to the growth markets in Europe and emerging markets in the Middle East and Africa. While Google should account for 95 percent of budgets in these regions, in Russia and Eastern Europe, that should go to Yandex.

The Asia/Pacific region saw more double-digit growth — up 26 percent year-over-year, with clicks up 21 percent and 12 percent increase in click-through rates. Advertisers should plan for a 15 percent increase in spending. In China, Baidu should account for 80 percent of paid search spend, and Naver should garner about 65 percent of spend in South Korea. Spend should be split 80 percent Google and 20 percent Yahoo in the remaining Asia/Pacific markets, says Funk.

The complete report is available for download here.

Contributing authors are invited to create content for Search Engine Land and are chosen for their expertise and contribution to the search community. Our contributors work under the oversight of the editorial staff and contributions are checked for quality and relevance to our readers. The opinions they express are their own.

Related stories