Yahoo Down YoY, Flat From Q2, Search Ad Revs Down 19 Percent

Yahoo just announced quarterly revenues of $1.575 million, which represents a 12 percent decline from the third quarter of 2008 and is basically flat vs last quarter. However the company saw a 19 percent decline in search ad revenue YoY but flat sequentially. Yahoo CEO Carol Bartz characterized Q3 as “solid” in the press release […]

Yahoo just announced quarterly revenues of $1.575 million, which represents a 12 percent decline from the third quarter of 2008 and is basically flat vs last quarter. However the company saw a 19 percent decline in search ad revenue YoY but flat sequentially.

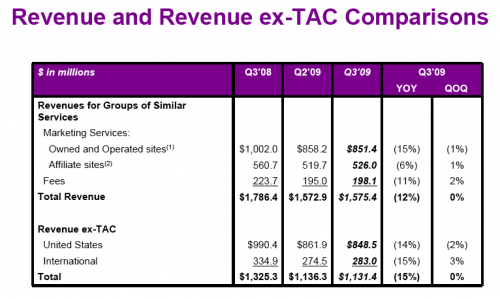

Yahoo CEO Carol Bartz characterized Q3 as “solid” in the press release and said that the business had “stabilized.” Here are the top-level financials:

Other revenue information from the release:

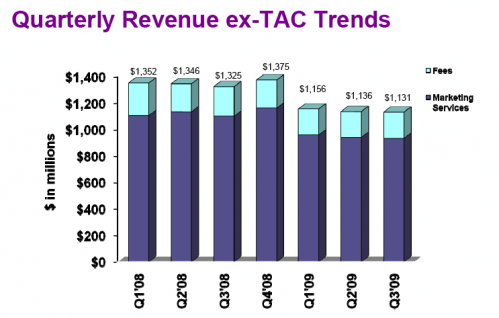

- Marketing services revenues were flat and fees revenues increased 2 percent,compared to the second quarter of 2009.

- Marketing services revenues from Owned and Operated sites were $851 million for the third quarter of 2009, a 15 percent decrease compared to $1,002 million for the same period of 2008. The decrease was primarily driven by a 19 percent decline in search advertising revenue and an 8 percent decline in display advertising revenue.

- Marketing services revenues from Affiliate sites were $526 million for the third quarter of 2009, a 6 percent decrease compared to $561 million for the same period in 2008.

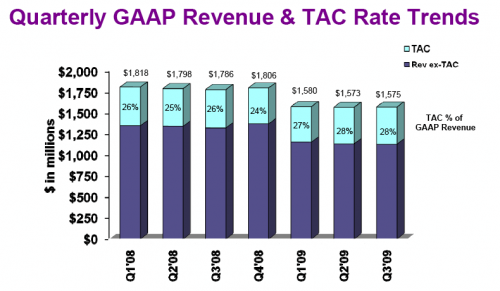

Here are some of the slides from the associated presentation:

And now the call, with prepared remarks (by CFO Tim Morse):

CEO Carol Bartz “came down with something, nothing serious” but she’s not on the call. I’m disappointed.

Morse is going through his remarks in a monotone that is just washing over me. He made statements about search revenues being basically flat sequentially, though they’re down 19 percent vs. last year. He said queries are up slightly (I believe) vs. Q2. I wish Carol were on the call . . .

Quick update on Microsoft:

We’re not out of search; we’ll continue to innovate and create a “better more personally relevant search experience” without spending on the “arms race.” Search is like an “Intel chip.” The differentiation isn’t at the chip level it’s in the user experience. (Not all that persuasive.)

We expect the deal to close/be approved in early 2010. He cites the letter of support from the American Association of Advertising Agencies from yesterday.

Assuming the deal closes . . . Morse talks about the transition to the new platform for advertisers (non-substantive remarks). We have experience with Panama, etc., etc.

Q&A session:

Question re display revenues and trends and why is Google doing so much better in search?

Morse stumbles: “It’s tough to compare to Google.” This quarter’s only “down 1 percent, that feels like stabilization.” Queries are up.

Question re vulnerability of affiliate business and increasing TAC rates:

Morse: We know that Google monetizes better so we have to pay more. There’s a “make whole” provision if affiliates defect to Microsoft but not to Google.

There were a range of questions about Yahoo’s display business and future outlook.

Guaranteed placement was strong in the second and third quarters.

Question re margins and cost containment

Morse says that internal teams will control costs and will be rewarded by Yahoo for doing so.

Questions about ad quality on the Yahoo homepage

Among other things, Morse cites the Yahoo homepage relaunch and “acceptance” and “positive reviews.” Homepage growth was in the “double digits.”

Questions re the conclusion of paid inclusion

Morse said shutting down paid inclusion will improve “overall marketplace” and wouldn’t speculate on direct impact on future revenues.

Question re metrics surrounding the new Yahoo homepage

Up strong “teens” in terms of page views. Not all the US users have switched yet. In eight countries total; fully rolled out in seven of them. Avoids talking about anything more specific. It’s still “early on.” All the metrics I’ve seen are “quite favorable.”

Question on mobile monetization

Morse: mobile is a focus for our future growth. Reach is really improving. Huge leader in mobile with 35 million users in the US.

Question on search monetization: query growth up but RPS down, why?

All of search was down 1 percent QoQ. Flat sequentially. An awful lot that we’re doing to “invest in these businesses and make them better.” He rattles off search improvements (awkwardly). We’re not “falling down, we’re not falling down at all.”

Question re the branding campaign, why?

It’s very early to assess success of campaign. We definitely expect this to translate into more users over time. About “revitalizing the company.” About getting us to back to where we were. Over the last few years we’d underspent on the brand. We’re also using it as an internal catalyst too. It’s about us and our corporate identity. In the future it will become more product focused. It will become a more or less permanent part of our cost structure.

Bottom line:

Overall the mood on this call was in fairly stark contrast with the mood and outlook on the Google call. In contrast, to the “we’re back” tone there, Yahoo seems to be tentative, uncertain and struggling to maintain its position in display and search (notwithstanding some good news in display). All the talk about innovating in search around the user experience felt unconvincing.

Bartz would have been a somewhat more buoyant presence and been able to inspire more confidence.

Contributing authors are invited to create content for Search Engine Land and are chosen for their expertise and contribution to the search community. Our contributors work under the oversight of the editorial staff and contributions are checked for quality and relevance to our readers. The opinions they express are their own.

Related stories

New on Search Engine Land