Amazon’s ad revenue growth held steady in Q1: What it means for advertisers now

Company says COVID-19 impact on advertising revenue "wasn't as noticeable," though ad prices continue to be lower.

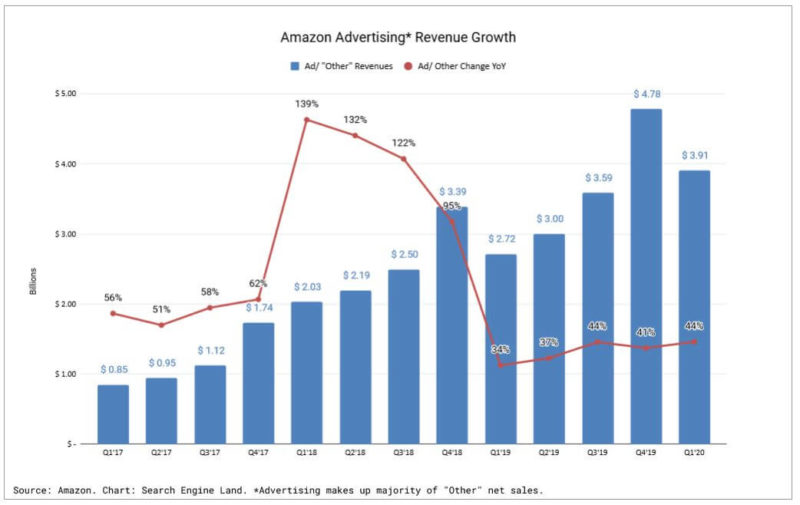

Amazon still keeps its ad business in an “Other” line item in its earning statements. Advertising comprises the bulk of that account, but we can’t precisely speak about ad revenue and growth because there are other things in that line item.

On the earnings call Thursday, Amazon CFO Dave Fildes did say the company had a strong quarter in terms of ad revenue and that the revenue growth rate of advertising held steady from the prior quarter.

Download our Guide to Digital Commerce Marketing

Amazon did, of course, see some impact from COVID-19 in March with “some pullback from advertisers and downward pressure on price.” He added, “It wasn’t as noticeable as maybe with what some others are seeing, and it’s probably offset a bit by the continued strong traffic we have to the site.”

Going into April, “now advertisers continue to advertise at a high clip,” said Fildes, though ad prices continue to be lower.

Why we care. Amazon’s heavy focus on performance-based advertising helped insulate it from the effects of COVID-19. Google, Facebook and Snap all pointed to the relative strength of direct response advertising compared to brand campaigns during this time.

With massive shifts in consumer demand, shipping delays and fulfillment challenges, the past month and a half has been a roller coaster for Amazon sellers. Amazon advertisers who have continued to have inventory available and keep campaigns running have largely been able to enjoy low CPCs and high impressions during this time. But not without the volatility that has underscored this crisis.

“The biggest lesson from Q1 and the early weeks of Q2 is that conditions can and do change rapidly, as evidenced by the rapid rise of sales attributed to Sponsored Products in mid-April shortly after stimulus deposits,” said Andy Taylor, Tinuiti’s director of research in the agencies’ first-quarter Amazon Ads Benchmark report.

Contributing authors are invited to create content for Search Engine Land and are chosen for their expertise and contribution to the search community. Our contributors work under the oversight of the editorial staff and contributions are checked for quality and relevance to our readers. Search Engine Land is owned by Semrush. Contributor was not asked to make any direct or indirect mentions of Semrush. The opinions they express are their own.