Report: US Search Ad Spend Rises 12 Percent YoY In Q4 2013; Smartphone CPCs Drop

IgnitionOne released its fourth quarter Digital Marketing Report today, showing that the paid search market in the US continues to grow. Search ad spend rose 12 percent year-over-year in the fourth quarter of 2013. In part as a result of the later kick-off to the holiday shopping season this year, December ad spending was up […]

IgnitionOne released its fourth quarter Digital Marketing Report today, showing that the paid search market in the US continues to grow. Search ad spend rose 12 percent year-over-year in the fourth quarter of 2013. In part as a result of the later kick-off to the holiday shopping season this year, December ad spending was up a significant 27 percent over 2012.

Though overall ad impressions fell 16 percent year-over-year, clicks rose 5 percent and click-through rates jumped 25 percent in Q4. IgnitionOne posits lower impressions are a result of “top of page innovations” including new ad extensions and image ads that “leave less room for ads”. Roger Barnette, IgnitionOne president, added by email, that extensions are “decreasing the overall number of ads that are showing up for any given search and thus lowering overall impression volume. It’s actually one of the advantages of utilizing these tools, not only do CTRs improve but it pushes the competition further down or off the first page.” Barnette also noted, “One thing I’ve noticed a lot is for exact brand searches there is often times only one ad that shows up on the page, which is a recent change.”

Advertisers Placed Lower Premium On Smartphone Ad Inventory: CPCs Fall YoY

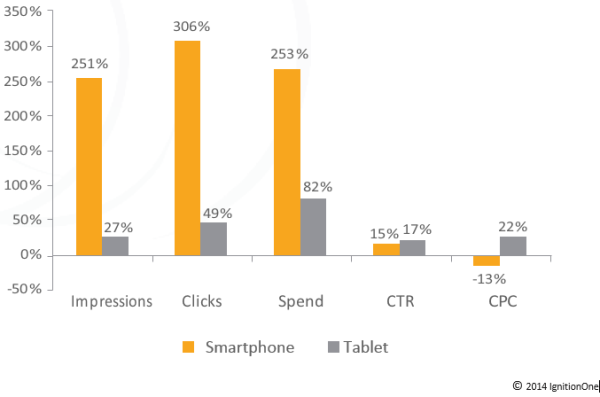

Despite a 251 percent increase in impressions and 306 percent increase in clicks, smartphone CPCs actually fell by 13 percent in Q4 compared to 2012 among advertisers in this data set. Tablet CPCs rose 22 percent year-over-year on the more modest gains of 27 percent in impressions and a 49 percent increase in clicks year-over-year. Here again, the CPC increase for tablets is likely a result of the tethered tablet and desktop bidding instituted with Enhanced Campaigns. In contrast, while advertiser participation on mobile has increased with the roll out of Enhanced Campaigns, advertisers have actively discounted their mobile bids in relation to desktop/tablet.

Ad spending growth for tablets remained strong with a year-over-year increase of 82 percent. Smartphones spend saw exponential growth of 253 percent. The mobile share of spend in Q4 was 63 percent tablet, 37 percent smartphone.

Google Product Listing Ads Perform Strongly In The Holiday Shopping Season

As other reports have also shown, advertiser investment in Google Product Listing Ads (PLAs) increased substantially in Q4 compared to 2012, when Google converted to Google Shopping to a paid platform. Spending on PLAs increased 618 percent, impressions grew by 380 percent and clicks were up 312 percent year-over-year.

Still, PLA adoption has grown substantially, but traditional text ads still account for the bulk of advertiser account activity. For advertisers running PLAs, the ads accounted for 10 percent of impressions, 13 percent of the clicks and 16 percent of the total spend.

“It has been over a year since PLAs were introduced to digital marketers and this quarter has proved that the ad product has come into its own,” said Roger Barnette, President of IgnitionOne. “Both marketers and consumers have found value in these ads, shown by the increase in spend as well as the increase in click-throughs compared to standard search ads.”

PLAs by their nature, appeal to consumers deep in the purchasing funnel. The ad units were particularly effective during the holiday shopping season, according to the report, with click-through rates 74 percent higher than text ads during the week of Thanksgiving and 95 percent higher on Cyber Monday. On smartphones, however, IgnitionOne found that PLA click-through rates were 38 percent lower than smartphone text ads.

Yahoo Bing Network Held Steady

The Yahoo! Bing Network maintained share in Q4, up a tick from last quarter’s 22.6 percent to 22.7 percent of spend versus Google’s 77.3 percent share.

Contributing authors are invited to create content for Search Engine Land and are chosen for their expertise and contribution to the search community. Our contributors work under the oversight of the editorial staff and contributions are checked for quality and relevance to our readers. The opinions they express are their own.

Related stories

New on Search Engine Land