Shopping Campaign Click And Ad Spend Growth Far Outpaced Text Ads Across Engines In Q3 [Study]

Merkle RKG's Q3 Digital Marketing Report finds clicks share from Shopping campaigns on Bing Ads and Google AdWords on the rise.

Merkle RKG released its digital marketing report for the third quarter this week. In all, paid search spend rose 19 percent in the US among its client set. Here we are going to focus on what Merkle RKG is seeing in Shopping campaigns on Bing and Google. For point of reference, the agency’s client base skews big retailer and the data focuses on US campaign traffic only. Let’s dive in.

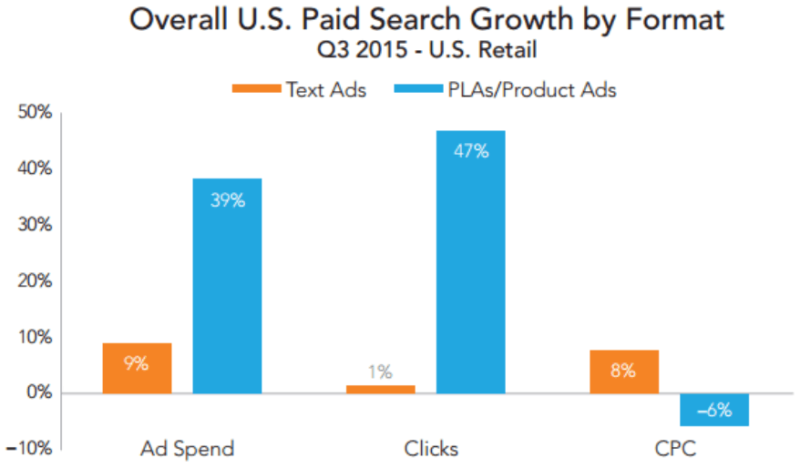

Overall, Google AdWords and Bing Ads Shopping campaign ad clicks increased by 47 percent, and ad spend increased by 39 percent year over year across all devices. CPCs on Shopping campaigns dipped six percent overall, largely as a result of more mobile PLA clicks on Google.

Comparing these stats against text ads among the advertiser set running both campaign types, text ad spend increased just nine percent, clicks rose one percent and CPCs saw an eight percent increase year over year in Q3.

Bing Product Ad Performance

Bing product ad clicks more than tripled, with 332 percent year-over-year increase. That sizable increase isn’t particularly surprising, given Bing Product ads only came out of beta on desktops and launched in beta on mobile in the US in March 2014.

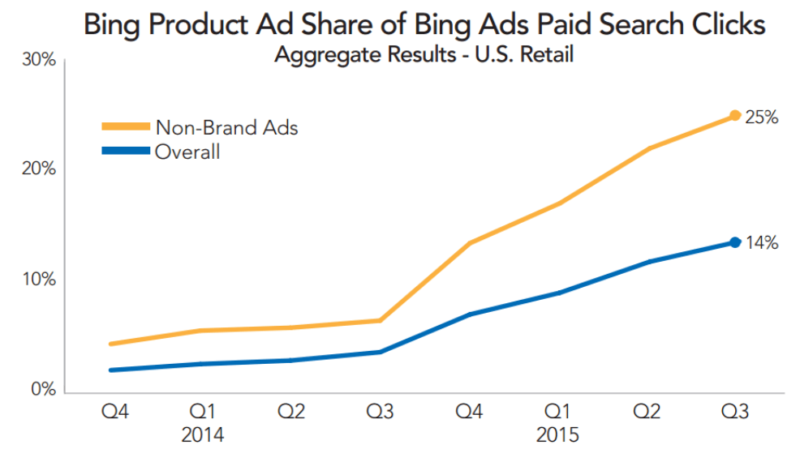

However, the share of clicks coming from product ads on Bing and Yahoo has increased quickly, reaching 25 percent of share among non-brand clicks and 14 percent of overall clicks.

Google PLA Performance

On smartphones, Google product listing ads (PLAs) clicks increased 166 percent year over year. Tablet PLA clicks increased 30 percent, even as text ads clicks on tablets fell six percent.

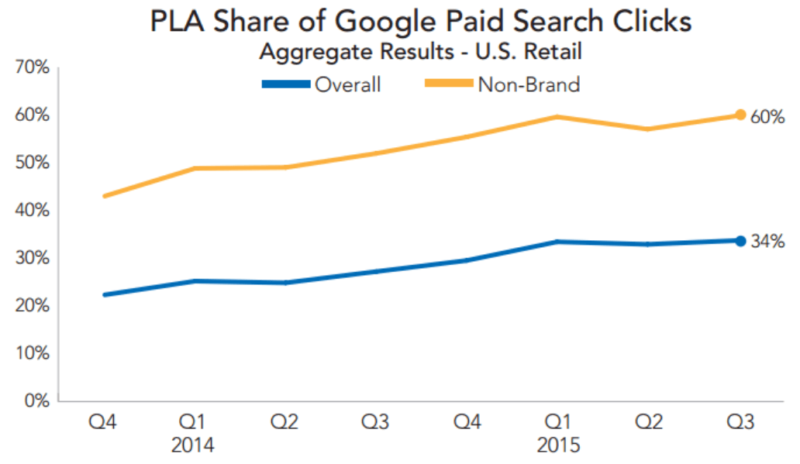

In terms of click share, PLAs accounted for 34 percent of retailer clicks in Q3, which is flat from the past couple of quarters but up from 27 percent the prior year. For non-brand queries, PLAs had 60 percent click share in Q3 — back in line with the high point reached in Q1, after dipping slightly in Q2.

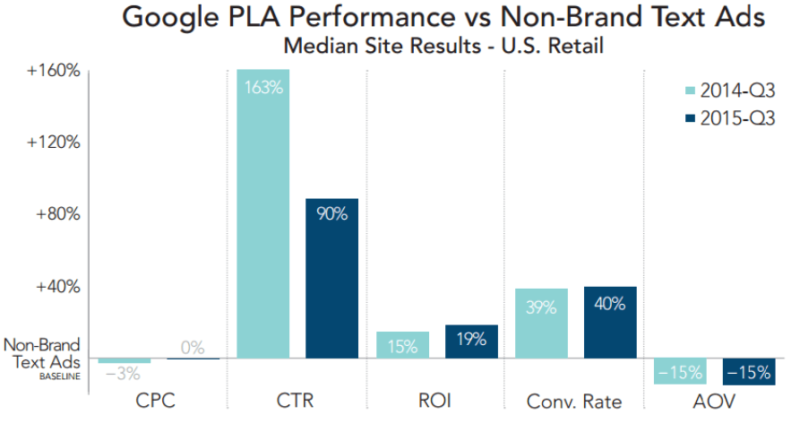

Comparing Google PLA ads to text ads, the CTR advantage of PLAs over text ads has declined over the past year for two primary reasons, according to the report. One is the impression mix shifting to phones, where the relative CTR for text ads is higher. The second is that overall CTR has improved as impressions have fallen, which Merkle RKG believes is due to Google showing fewer text ads per query.

PLA CPCs reached parity relative to text ads in Q3. Charting this metric out over the past couple of years, the report finds a trend in PLA CPCs dipping below text ad CPCs in the second quarter, only to rebound in Q3 and peak relative to text ads with the holiday shopping competition in Q4.

PLAs By Vertical

Looking at performance by vertical over the past three quarters of 2015, PLA click share varies quite a bit. While Flowers & Gifts and Consumer Electronics saw PLA click share decline in Q3, Home & Garden click share rebounded back to Q1 levels after dipping in Q2, and Cars & Auto and Sporting Goods saw slight increases over Q2. Apparel is a category, though, that has seen steady and significant PLA click share growth each quarter of 2015, increasing 13 points since Q1.

The full report is available for download. The report’s author, Mark Ballard, also covered the agency’s findings on Yahoo Gemini campaign performance in his most recent Search Engine Land column. I highly recommend reading that.

Contributing authors are invited to create content for Search Engine Land and are chosen for their expertise and contribution to the search community. Our contributors work under the oversight of the editorial staff and contributions are checked for quality and relevance to our readers. The opinions they express are their own.

Related stories