Mid-market, enterprise retailers had different Google Ads holiday weekend strategies, data indicates

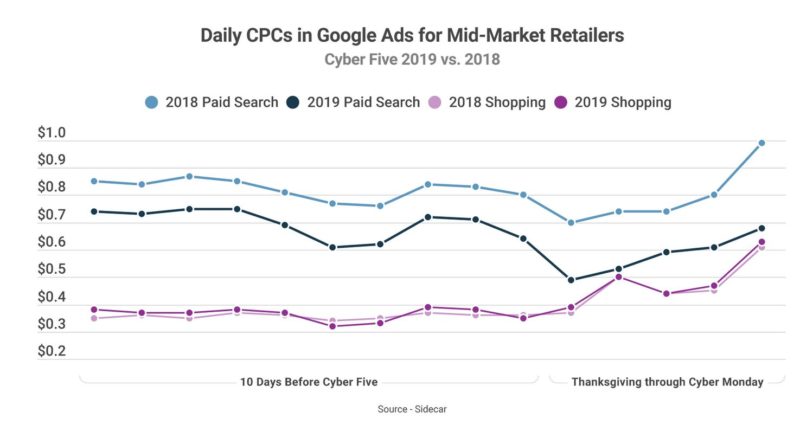

Daily text ad CPCs were significantly lower among mid-market retailers this year as they focused spend on Shopping ads, Sidecar found.

Mid-market retailers threw their marketing dollars into Google Shopping, pulling back from Google text ads over the five days between Thanksgiving and Cyber Monday compared to the same period last year. Enterprise retailers, meanwhile, increased spend across both Shopping and text ads.

The findings are based on a representative sample of U.S. retailers running Google Ads accounts with e-commerce marketing firm Sidecar during the period in both 2018 and 2019.

Why we should care

Sidecar reported enterprise retailers in its sample spent 24% more on average daily on Google Shopping and 96% more on Google text ads year-over-year. The company said bigger budgets and the ability to maintain ROAS goals drove those higher investments. Mid-market merchants focused their likely more limited budgets on Shopping ads for higher returns.

Daily CPCs among those enterprise retailers rose compared to last year in both Shopping and text ads. Mid-market merchants, on the other hand, saw just slightly elevated Shopping CPCs while text ad CPCs were significantly lower than last year as they pulled back in those campaigns.

As the holiday data comes in, agencies and platforms will share different segmentations of data that can help give us insights into spend and performance trends. Yesterday, for example, we reported on data from performance agency Tinuiti that showed merchants’ aggregate CPCs remained flat over the holiday shopping period known as “Cyber Five” for both Shopping and text ads. However, looking at a device level-data, desktop CPCs increased by 18% for Shopping and 11% for text ads this year among that client set.

More on the news

- Sidecar reported overall Google Shopping CPCs averaged $1.12 across the five-day period in 2019, compared to $0.98 last year among its retailer set.

- Text ad CPCs fell slightly to an average of $0.62 in 2019 from $0.65 in 2018.

- Sunday turned out to have the biggest jump in Google Shopping CPCs among the five days, rising from $0.80 in 2018 to $0.96 in 2019. “This is an indication that retailers started taking greater advantage of the historically less competitive day of Sunday to bolster sales via Google Shopping, which wasn’t witnessed last year,” Sidecar said.

Contributing authors are invited to create content for Search Engine Land and are chosen for their expertise and contribution to the search community. Our contributors work under the oversight of the editorial staff and contributions are checked for quality and relevance to our readers. The opinions they express are their own.

Related stories

New on Search Engine Land