Paid Search Roundup Q3 2014: From Performance Trends To Key Product Updates, What You Need To Know

The quarterly reports and earning statements are in. Overall, all signs point to continued global growth for paid search advertising in Q3. Here’s a look at performance results and the biggest announcements and changes to come from Google AdWords and Bing Ads in the third quarter 2014. What The Search Engines Reported Google reported third […]

The quarterly reports and earning statements are in. Overall, all signs point to continued global growth for paid search advertising in Q3. Here’s a look at performance results and the biggest announcements and changes to come from Google AdWords and Bing Ads in the third quarter 2014.

The quarterly reports and earning statements are in. Overall, all signs point to continued global growth for paid search advertising in Q3. Here’s a look at performance results and the biggest announcements and changes to come from Google AdWords and Bing Ads in the third quarter 2014.

What The Search Engines Reported

Google reported third quarter revenue rose 20 percent and click volume was up 17 percent from the previous year. While still robust, growth rates were slower than in recent quarters. The cost-per-click metric that has had analysts on edge as it has continued to decline was off again. However a CPC decline of just 2 percent from the previous year marked a considerably smaller discrepancy than we’ve seen in recent quarters.

Microsoft reported that Bing search advertising revenue increased by 40 percent from Q3 2013.

Yahoo, part of the Yahoo Bing Network, said it earned $450 million from search in Q3, reporting flat click volume but a 17 percent rise in CPCs.

What The PPC Providers Reported

In their own reports, Adobe, RKG and Covario showed paid search ad spend increases that ranged between 22 percent and 28 percent among their customer bases.

RKG and Adobe each reported CPC increases across Google campaigns — of 8 percent and 5 percent, respectively. RKG’s client base runs campaigns primarily in the U.S. market and is concentrated among large retail clients. Non-brand spend on Google rose 30 percent, and click-through rates improved 8 percent from the previous year. Non-brand spend on Bing Ads rose 29 percent as click volume increased by 33 percent year-over-year. Bing Ads CPCs remained flat among RKG clients, held down by increases in mobile ad click volume where CPCs remain lower.

Adobe’s report encompasses global ad campaigns with industry concentrations in retail, travel, finance and automotive. It saw worldwide PPC ad spend on Google rise 13 percent year-over-year, and overall spend on Bing Ads grew 39 percent.

Covario, also measuring global campaign performance, recorded an 8 percent decline in CPCs as a full third of paid search media spend went to mobile in Q3.

The Biggest Product Changes In Q3

Mobile and product ads were shown to be key drivers in rising click-through rates and revenue. Q3 saw several updates in these areas.

Google Shopping Campaigns Took Over: By far the biggest change for retailers was the transition to the new campaign format for Google product listing ads called Google Shopping Campaigns, at the end of August.

Close Variants Became The Rule: The biggest bombshell of the quarter was dropped on August 14. Google announced it would be removing the choice to not show ads on queries that are variations of exact match keywords — such as misspellings and plurals — at the end of September. Bing Ads, which had never had close variants, then added close variants, now permanent on exact match in the U.S. Bing Ads, however, did add the option to turn off close variants.

PLAs Kept Evolving: Google continued to test the way product listing ads are displayed, including grouping items by price and by brand. At the end of July, ratings with stars rolled out in the U.S.

Local Inventory & Store-Only Ads Expanded: In late September, Google took local inventory and store-only product listing ads beyond the U.S., where they launched last fall, to the UK, France, Germany and Japan. The store-exclusive ads also began showing on desktop, not just mobile devices, in August. These ads are powered by a separate local product feed uploaded to Google Merchant Center. (Remember that Rangespan acquisition which doubled as an acqui-hire of former Amazon veterans earlier this year?)

PLAs Went On Third-Party Sites: Google AdSense for Shopping was announced in early September. A small set of sites — Walmart being one — are participating. Shopping ads are displayed on relevant product search pages. The program is very similar to Amazon’s product ads program with ads that link off of the e-commerce site to the advertisers’ own sites.

Dynamic Sitelinks Rolled Out: Sitelinks keep proving their worth in increasing click-through rates. On July 24, Google announced that dynamic sitelinks were rolling out globally. This means Google is likely to serve a sitelink derived from relevant content on advertisers’ sites when advertisers haven’t set up sitelinks themselves. Bing Ads followed suit and introduced dynamic sitelinks in the U.S. in September.

Callout Extensions Debuted: September brought several new text ad updates. Callout extensions are the link-less siblings of sitelinks. They enable advertiser to add another line of copy in their ads and spotlight features such as free shipping and price matching.

More Extensions, Less Copy On Mobile: Speaking of extensions, the following week, Google announced it would start showing an extension in place of the second line of ad copy on smartphones. The change, which took effect mid-October, underscores the growing importance of ad extensions and annotations in driving higher click-through rates.

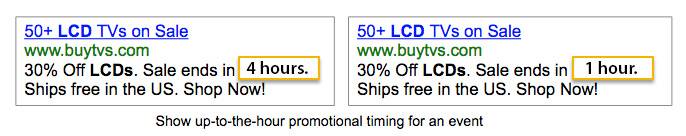

Ad Customizers Took Dynamic Insertion To The Next Level: In late September, Google started rolling out ad customizers which enable advertisers to customize ad copy at scale with variables. Ad customizers are the first in what Google is calling Tools for the Power User. A new Business Data section was added in the Shared library in AdWords is where advertisers upload the ad customizer data template with targeting attributes and information on device preference, scheduling, product detail, price, event timing or any custom text that you define to pull into the ads.

Google App Promotion Ads Come Out: Google, coming in behind Facebook and Twitter in offering ads for app marketers, launched app install and app re-engagement ads in June and made them available on Google search and YouTube globally at the end of August.

Website Call Conversions Tracking Arrived: On August 18, Google announced the ability to track conversions from phone numbers on advertisers’ websites. Call forwarding numbers are served dynamically post ad click. Bidding strategies can assigned based on website call conversions. The tracking can be used in conjunction with other third-party call tracking services that provide more robust tracking and recording options.

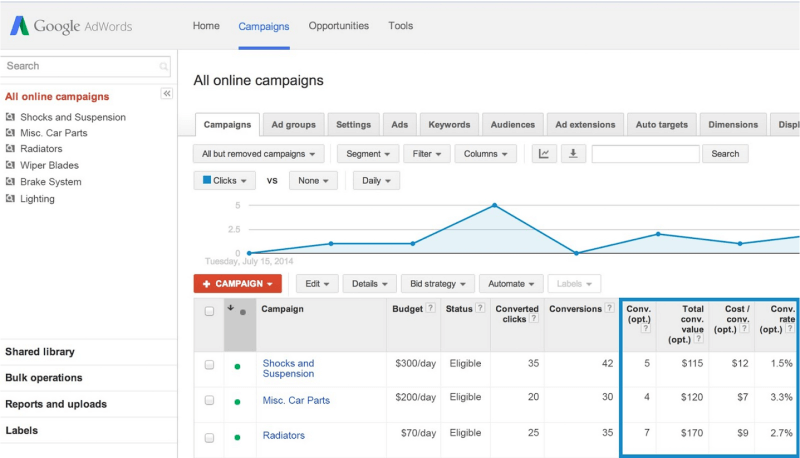

“Conversions for Optimization” Setting Brought More Control: OK, so this crosses over to Analytics, but it bears calling out. This new setting, announced in August, lets advertisers choose what’s most valuable for reporting and bidding strategies among the goals and conversions imported from Google Analytics. For example, an education advertiser tracking both catalog downloads and course sign-ups, can set up bid strategies to optimize only for the higher value course sign-up conversions.

Bing Ads Auto-Tagging Arrived: In June, Bing Ads finally released the ability to automatically add UTM tags to ad destination URLs in order to capture performance data in Analytics.

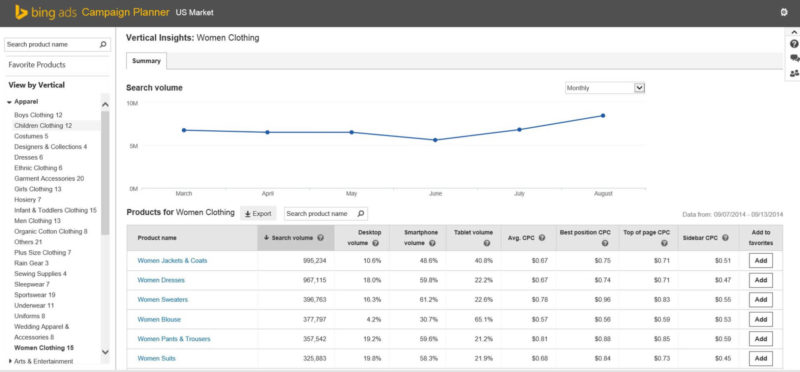

Bing Ads Campaign Planner Launched: The new tool in the Bing Ads web UI, Campaign Planner, offers marketplace insights including search traffic trending and forecasting data, industry benchmarks, competitor performance and keyword suggestions.

Other updates from Bing Ads in Q3 included expanding the Bid Landscape tool to ad groups and beyond the U.S., a refreshed Change History report, and a more robust Web UI that is faster with new bulk editing features and the ability to review up to 1 million keywords.

In June, Bing Ads announced it would begin combining tablet and desktop traffic á la enhanced campaigns. The difference from AdWords being that Bing Ads has provided a bid modifier on tablet. The bid modifier ranges from -20 percent to +300 percent on bids against desktop. The combination took effect in September.

And that’s a wrap for Q3. The National Retail Federation is already projecting a record 56 percent of shoppers will make purchases online this holiday season. Shop.org, a division of the NRF, has estimated that holiday e-commerce sales will rise 8-11 percent this year.

Contributing authors are invited to create content for Search Engine Land and are chosen for their expertise and contribution to the search community. Our contributors work under the oversight of the editorial staff and contributions are checked for quality and relevance to our readers. The opinions they express are their own.

Related stories

New on Search Engine Land